That's exactly what Accrew founder Anna Ready discovered when she was faced with a client's $200,000 monthly accounts payable problem.

At Relay, we simplify accounts payable by integrating AP directly into online banking. 🏦 We see first-hand how a manual AP process can cause additional administrative work for back offices. So when we sat down with Anna, she shared the story of how she helped her client overcome this issue using Relay.

Anna’s passion for remote work and family

When Anna Ready founded Accrew in 2008, she was looking for a way to stay home 🏡 with her kids and watch them grow up. She wanted to be able to run a business and live her life — and today, she’s able to do just that, while helping her clients achieve the same thing.

Based in California, Accrew is a fully remote, cloud-based firm that provides bookkeeping, accounting, and consulting services. Anna and her now 15-person team mostly focus on small businesses and nonprofits with a desire to grow. 🚀

“I like clients that are open to talking about better ways of doing things," says Anna. "If you've already got it all figured out, you're probably not going to get a ton of value from working with us because you already know everything. So, if you are looking for and open to input, we love that. We’re looking for a real partnership with our clients.”

Typically, Accrew’s clients don’t need a full-time team member. Even if the client is on the larger side, some prefer to work with a firm rather than hire and manage their own finance employees. In either case, Accrew provides all the support they need (except for filing taxes).

Creating remote opportunities for Accrew’s employees

Anna started moving towards cloud-based tools ☁️ back in 2012. Today, Accrew’s tech stack powers a team spread out across the United States.

“Everyone on our team works from home and has flexible schedules. As long as they're getting back to clients in a reasonable time and meeting their deadlines, they can kind of work when it works for them," says Anna. "It’s been really fun to be able to take that thing I wanted and provide it for other team members too.”

Thanks to QuickBooks Online, Slack, Melio, Dext, and Relay, of course, Accrew is also able to serve clients outside of where Anna lives in California. Going forward, Anna hopes to continue to expand the firm and her team.

“The more that we can continue to grow with companies that are a good fit for us, we’ll be able to provide opportunities to more team members who find [Accrew] is a good fit for them in their life too.”

Helping clients streamline the accounts payable process

Anna loves to work with clients that are looking for a real partner 🤝 in improving their processes. And as any business owner knows, one of the most frustrating financial processes can be accounts payable — especially if you’re juggling, for example, dozens of contractors that need to get paid weekly.

That’s exactly what Anna’s client, a company that does telecommunications consulting, was struggling with when she met them after a podcast interview. The client was working with another bookkeeping firm but wasn’t satisfied with how things were going.

When the client started discussions with Accrew, they shared their frustrations with their current accounts payable process. The company uses dozens of contractors and subcontractors to support the work they do. As a result, they typically need to send 10-15 different payments every single week.

A lack of accounts payable ownership

In the company, the process didn’t have clear ownership. That meant paying contractors often ended up on the CEO’s or vice president’s list, taking valuable time away from their other responsibilities.

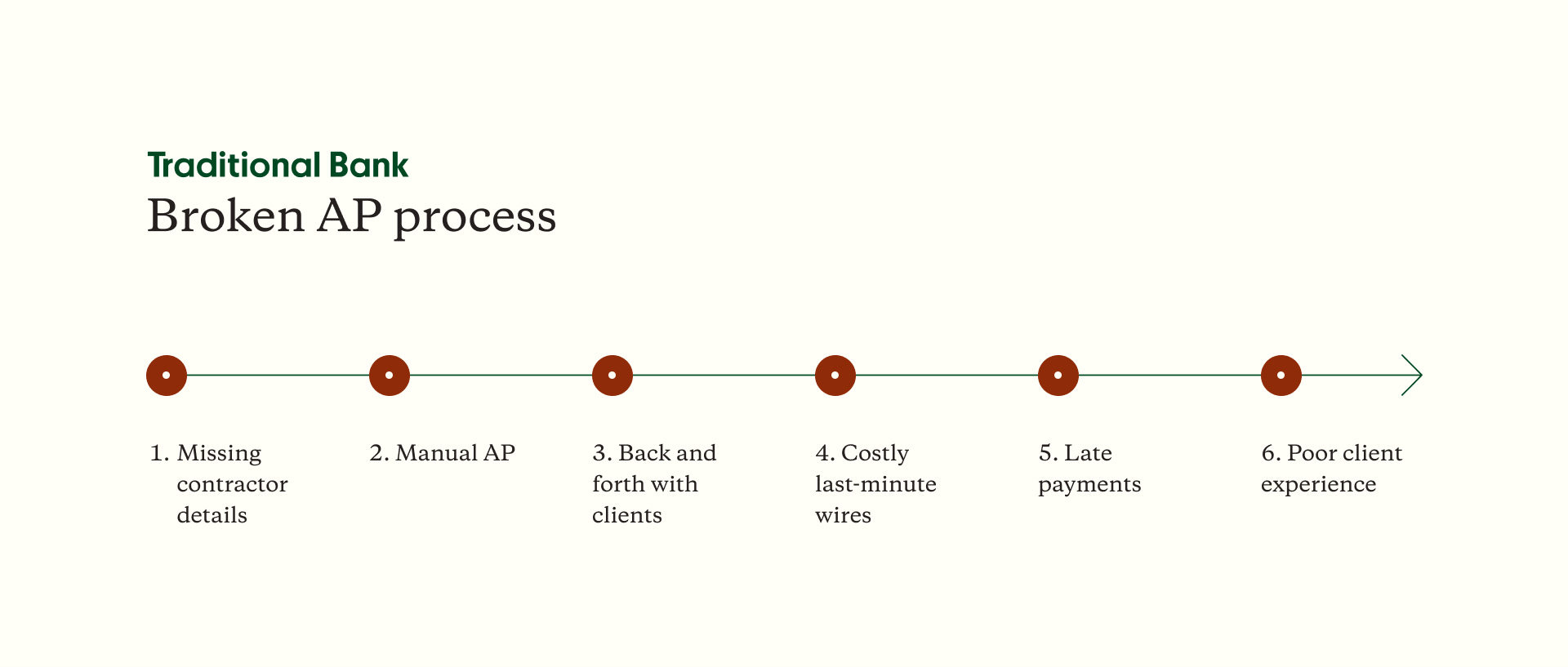

According to Anna: “When we started working together, the client said, ‘Hey, we'd love you to take this off our plate.’ [So we agreed], and as we dove into the way that they were doing it, which was just through their current bank, it was nothing but friction.”

Navigating the obstacles: fees and frustrating banking policies

When Anna’s team first took over accounts payable, she faced obstacle after obstacle: “We could process maybe half the payments and then half of them we couldn't because of system limitations — like what type of account it was or what bank they were banking with.”

There were a few different issues with the client’s bank, but one of the most difficult was that Anna's team wasn’t able to schedule ACH payments to people with accounts at the same bank.

“Anytime we got into paying someone at the same bank we would just get an error message," says Anna. "And when you just keep getting the same error message, it’s not clear whether it's user error, access error, or bank error.”

Whenever this issue happened, Anna's team would have no choice but to reach out to the client. Someone at the client’s company would then have to process the rest of the contractor payments via wire transfer or ACH, depending on how urgent the situation was.

And because the client needed to process between $50,000-$70,000 in payments per week, this was not a small problem. Wire transfers cost at least $25-$30 per transfer, and even a regular ACH costs $1 per transaction for the bank-to-bank movement. Those fees added up quickly for the client.

When banking limitations lead to negative client experiences

The fees were painful for the client, but as a large company, their main goal was getting such a large volume of payments fully off their plate. Unfortunately, Anna shared, “every week we could only do about half of the task, and then we'd have to email the client to say you need to do this other half. That’s not a great client experience — it's not really like we took it off their plate.”

“Either we could jump in and try to troubleshoot this, or [we could ask the client to] call their bank or schedule the payment themselves. We’d get to the point where this person needs to get paid and we can't do it. So, that did not feel awesome,” says Anna.

While navigating these obstacles, Anna soon recognized that many of the accounts payable issues could be traced back to the client’s bank. 🏦

Unfortunately, from the client’s perspective, “it wasn’t that obvious whether it was the bank's limitations or whether we just didn't know what we were doing. [As the client], your instinct would probably be to assume that the big bank who knows how to do banking is probably right and this brand new bookkeeper you're working with probably just doesn't know how to do it.”

Many accountants and bookkeepers are familiar with this exact situation. You might find yourself taking the blame when things go wrong with a client’s financial processes — and when that happens, it becomes your job to find a solution.

Moving to Relay and looking like a rockstar

Over time, the situation escalated, and Anna knew she needed a long-term fix for this client’s accounts payable problem. “I wanted to own that this was a problem. I also wanted to help provide a solution because I wanted to get us to the point where [the accounts payable process] was fully owned by Accrew and the client was just getting a notification.”

Anna originally thought of Relay as a solution because her firm has been a user since 2019. She knew that Relay Pro, specifically, would enable her client to pay contractors faster ⚡️ and at a lower cost than a traditional bank. Relay Pro also allows users to process same-day payments — an option that was difficult or impossible with the client’s bank.

From there, Anna had to pitch the idea to her client and get them on board. She hopped on a Zoom meeting with the client and laid the cards on the table, acknowledging that the current situation wasn’t making anyone happy. “I owned what the problem was, and I owned that we were not able to solve it with the current setup.”

Anna's proposal? Streamline the process with a better tool: Relay Pro. On top of the other benefits, Relay would simplify the accounts payable process by allowing contractors to input their payment information and W-9 forms, directly into Relay. The client would be able to skip all the back-and-forth with contractors over their payment details.

The best part? By using Relay for contractor payments, Anna's client would be able to give the Accrew team secure, hassle-free access to their bank accounts and totally hand off the AP process.

When the client saw how Relay could solve their pain points and create a solution, they agreed to move forward with Relay.

From there, Anna was able to work with Relay to send the client an invite to create an account. “Relay support was super helpful. I just emailed them to say, "Hey, is there a way I can get this process started for my clients?" And it was great, they replied back and said, ‘Yeah, we'll send an email to invite them to create an account.’” 📧

Managing the entire AP process with Relay

Since rolling out Relay to her client, Anna has helped streamline the accounts payable process — even better, she’s been able to turn her client’s AP frustrations into delight, creating a better experience for everyone involved.

Today, accounts payable is a simple, stress-free process for Accrew and the client.

One of Anna’s team members processes the payments each week. Then, Anna does a quick review to ensure the payment amounts are correct (based on information from the client). Finally, she checks Relay to make sure the person received the funds that were sent to them in the correct dollar amount.

No more back-office busywork

When the contractors are paid through Relay, Anna’s team will send them a confirmation email with a link to Relay. If they haven’t shared their payment information yet, they’re able to easily use that link to tell Relay where to send the money. No more back-and-forth with the contractors or the clients — and that’s good for everyone.

Anna says that thanks to Relay, “I don't have to feel lame every week asking the client to do half of the things that we ought to be doing. We are doing 100% of the things and just letting them know when it’s happened. So yeah, it's been pretty awesome.”

What was formerly a frustrating, difficult, and time-consuming experience can now be done in a few simple steps. Anna and Accrew can finally say that they have solved the client’s problem and eradicated the ongoing friction.

Anna’s advice to firms with accounts payable problems

If you’re a bookkeeper or an accountant and you’re struggling to improve a client’s processes, Anna recommends starting with their biggest pain points. Think about the biggest challenges you’re experiencing on a regular basis.

Then start with quick, easy wins so you can get the client on board with the changes you’re recommending. From there, you can start to optimize processes that are a little less urgent.

Anna also says that celebrating the positive changes you make is key. 🔑 “So much of change management is about clearly communicating why we're going to do it," says Anna. "But you also need to clearly communicate what's better now because the client put the effort into change — to say, we did it, hang a banner, mission accomplished, we all did it, let's celebrate.”

“If you just go, 'Okay, yeah, it's all good now you,' you're missing both the opportunity to acknowledge that all of this was worth it and to appreciate the client for participating in the change.”

Streamlining accounts payable = customer delight

“The best thing about going through this experience is knowing we were able to solve a real problem in a lasting way,” says Anna.

Relay’s all-in-one business banking and accounts payable solution has helped business owners like Anna transform their processes for the better. Instead of struggling with a traditional bank’s expensive fees and system limitations, Relay allows you to pay bills without leaving the platform, organize payees in one place, and set up automated approval rules.

Relay Pro also has all the payment types you need to support your clients. Whether it’s free, same-day ACH or free domestic and international wires (with built-in currency exchange), we’ve got you covered.

Want to try Relay? Sign up for a free account. Accountants and bookkeepers can book a demo with our team — you'll get a comprehensive walkthrough of how to get the most out of Relay's business banking when collaborating with clients.