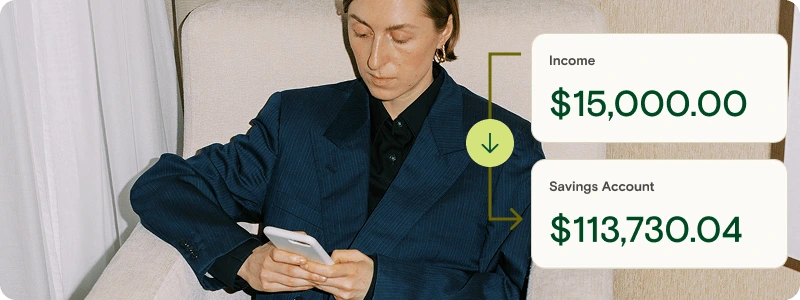

It takes grit to build a million-dollar business.

Long nights, big risks, and tough decisions—giving it your all is what got you here. But as every seven-figure business owner knows, scaling revenue doesn't guarantee profit.

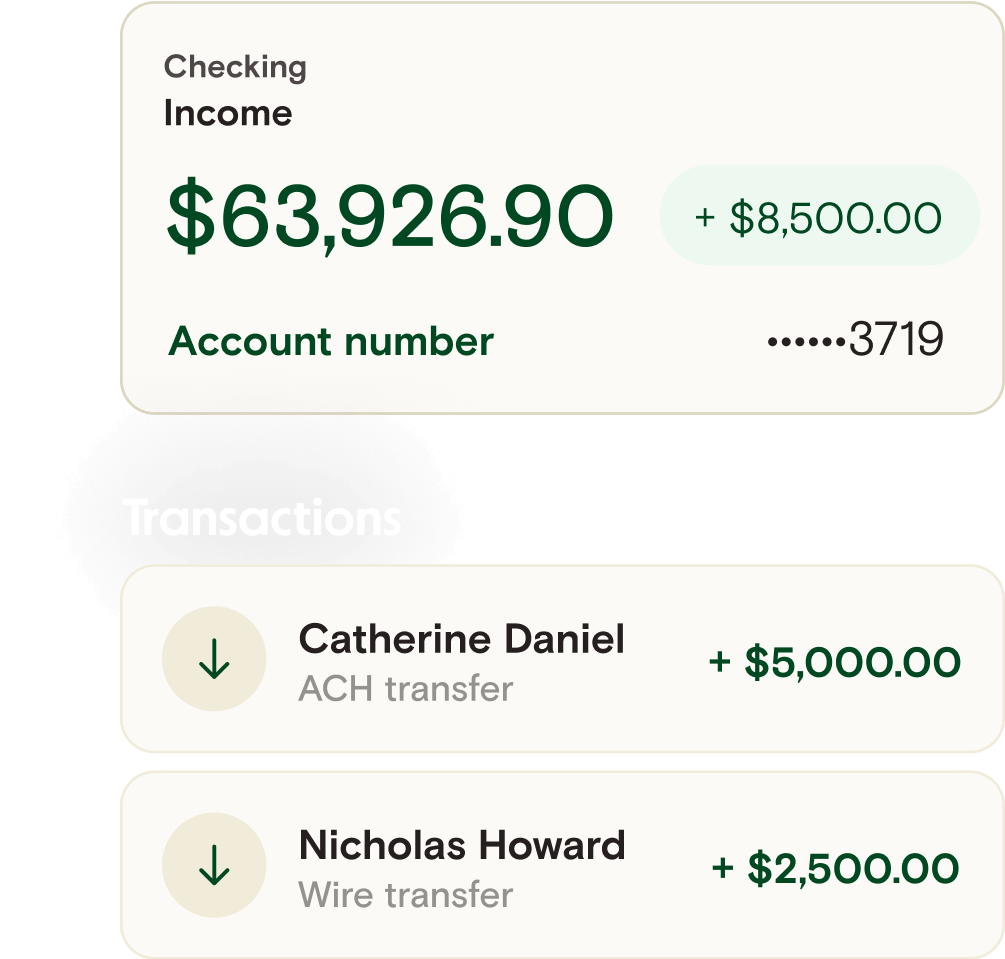

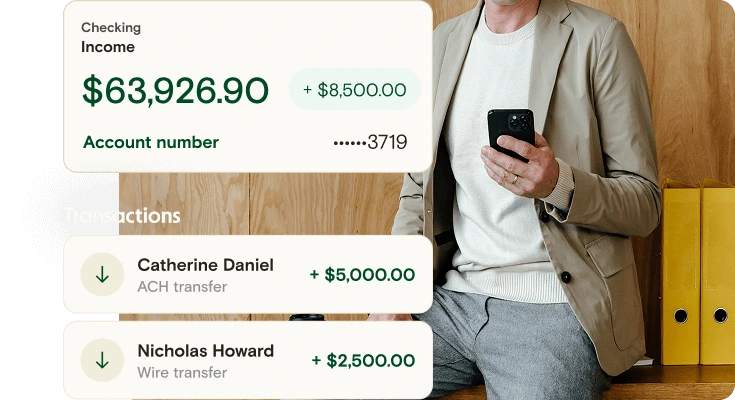

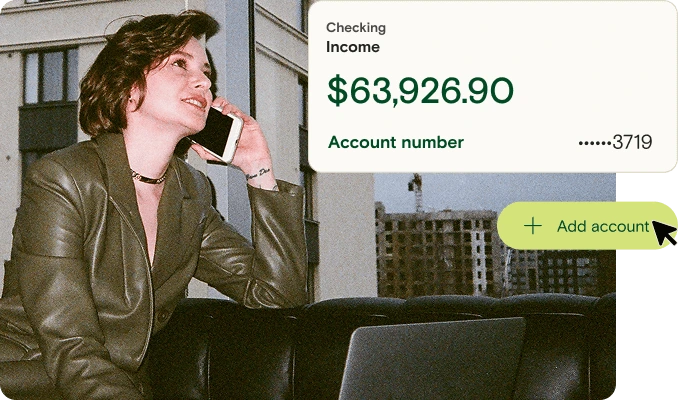

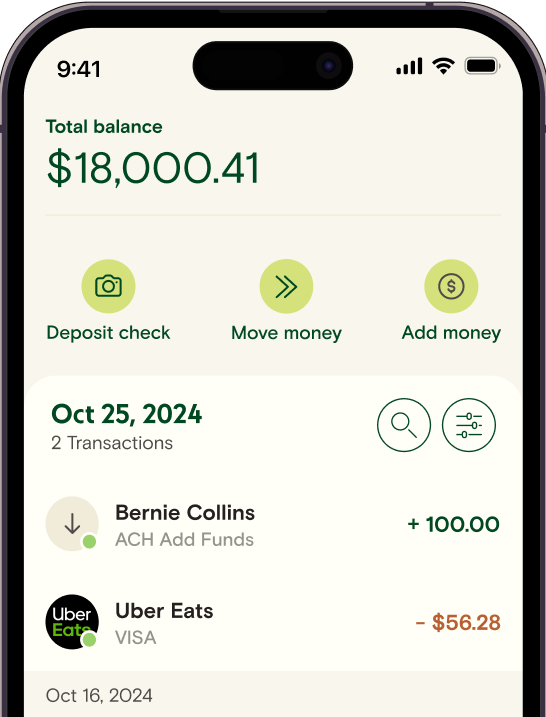

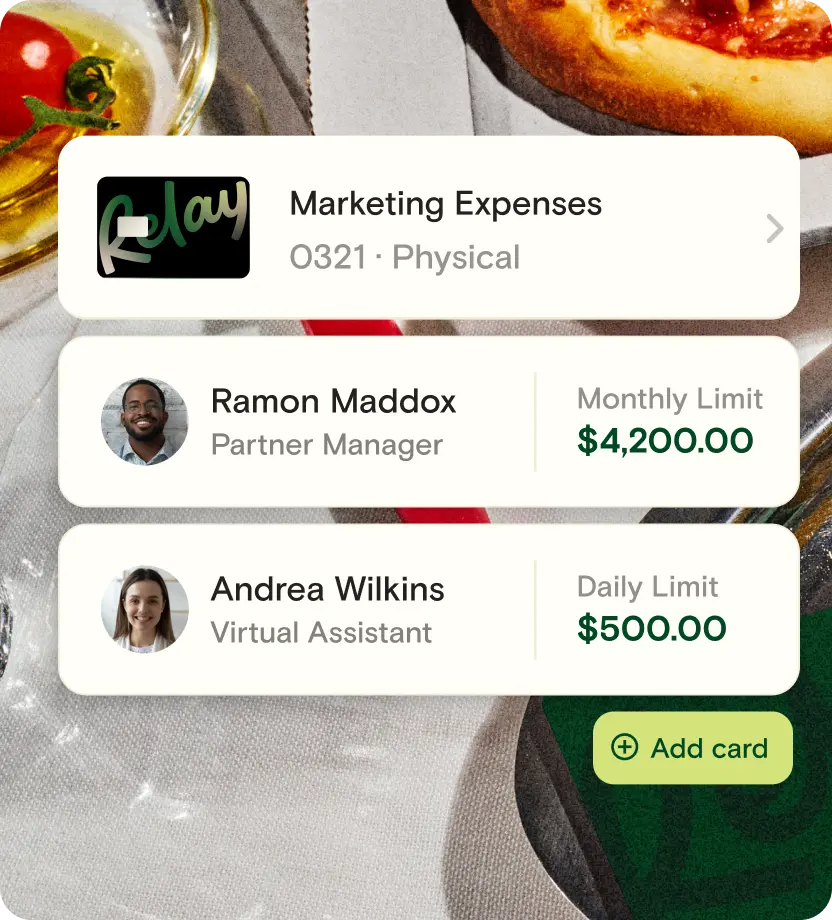

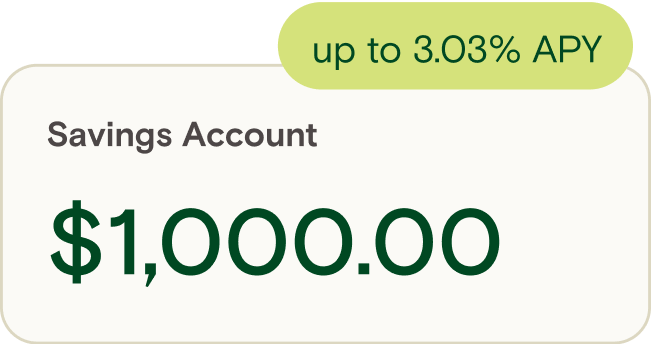

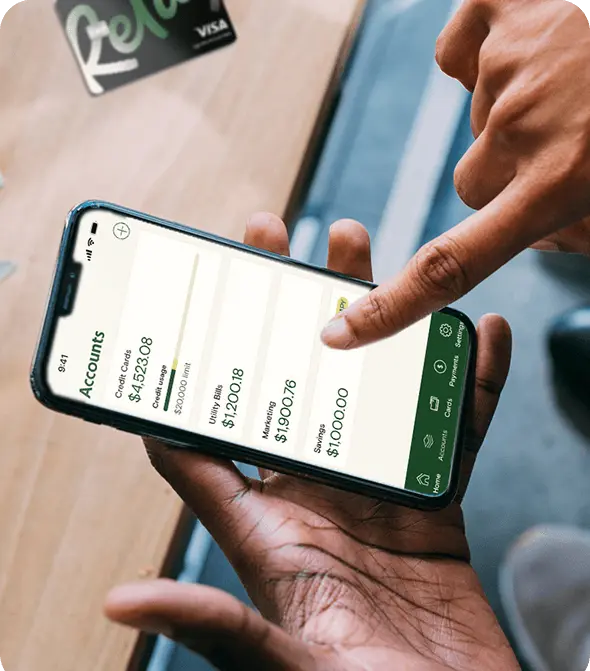

Relay is built for this stage of your journey. Get complete cash flow control with all-in-one banking and expense management that helps you spend smarter, save more, and stay profitable as you grow.