Put your money to work with automated savings

Relay moves idle cash out of operating accounts and into your savings. Earn up to 2.68% APY1 on every spare dollar.

Start saving- No hidden fees

- No minimum balances

- Interest paid monthly

Earn more

Each business can open up to two savings accounts. Your interest rate is determined by your monthly plan. Learn more about Relay’s plans and pricing.

| Monthly plan | Amount earned |

|---|---|

| Starter | 0.91% APY |

| Grow | 1.55% APY |

| Scale | 2.68% APY |

Built for first-time savers and seasoned stashers

Your business needs a cash cushion. To take more risks, expand and invest, and bounce back from setbacks. Relay’s savings accounts make it easy to get started.

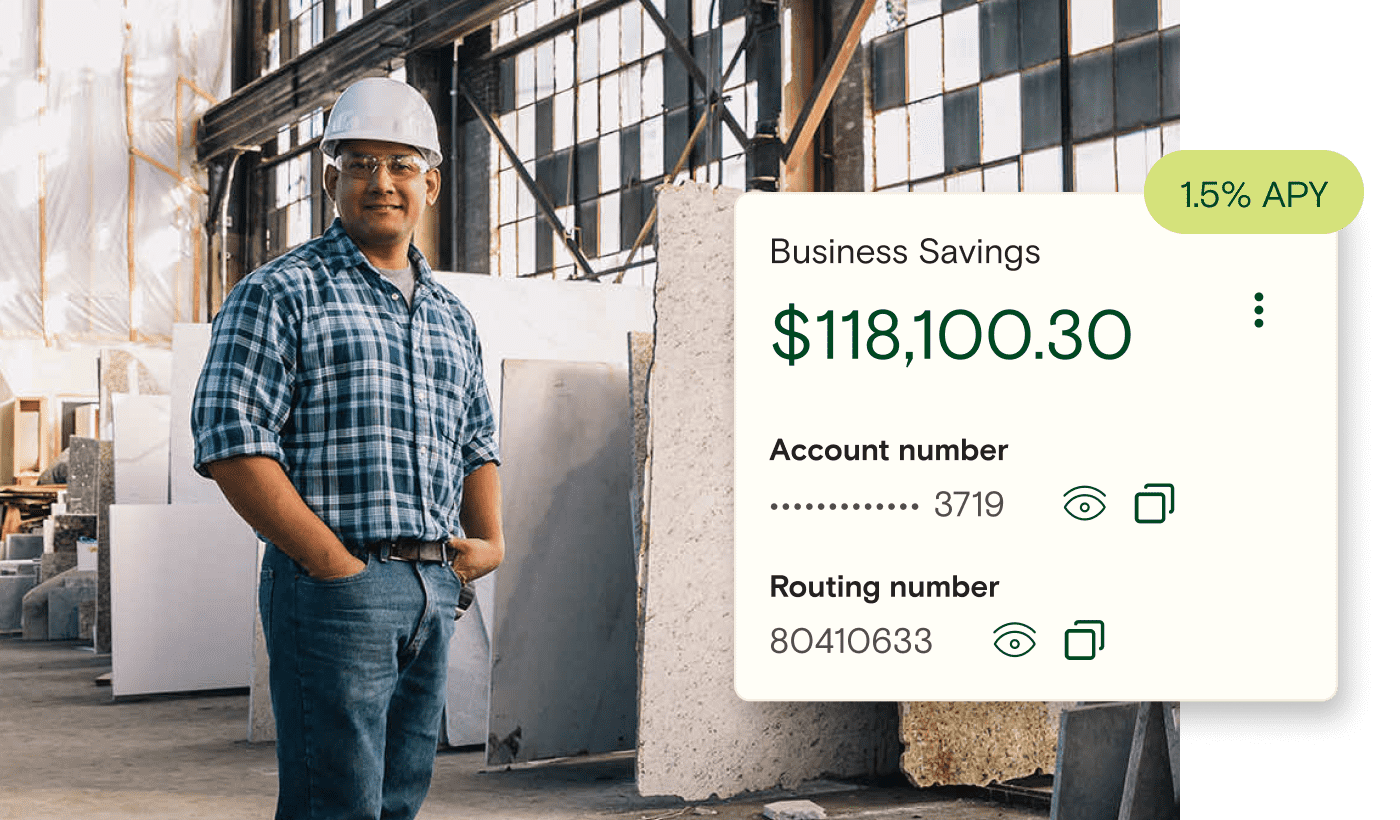

Earn up to 2.68% APY1 on your savings

Hard work should be rewarding from day one. That’s why you’ll earn interest on the very first dollar you deposit into a Relay savings account. As your cash reserves grow, so will the interest rate you earn.

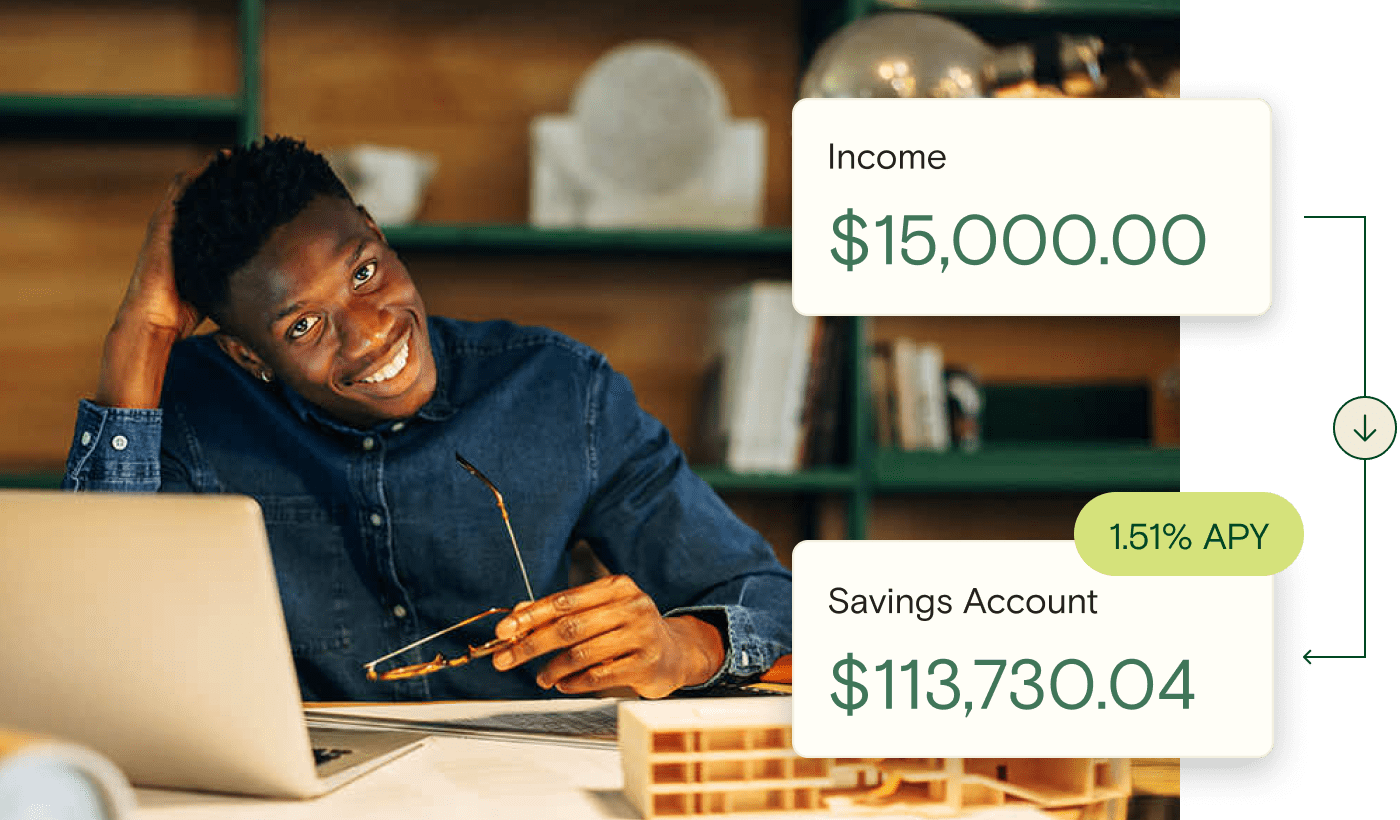

Don’t let dollars idle

Starting to save is tough. You have to hunt down idle cash and figure out how much you’re comfortable setting aside in savings every month. Relay’s auto-transfer rules make it easy by moving your excess cash out of operating accounts and into savings for you.

Reach savings goals faster

Automated savings steadily and consistently build up your reserves, moving you towards real goals quickly—whether you want to save up for 3 months of operating expenses, a new investment in your business, or a treat for your team.

Set it and

protect it

#1 rule of saving successfully: don't dip into reserves. To keep your cash growing, money in your Relay savings accounts can’t be used for card purchases or external payments.

Up to $3M in FDIC coverage

via Thread Bank2,3

Save safely. Every business qualifies FDIC Insurance up to $3M available for funds on deposit via Thread Bank, Member FDIC. FDIC deposit insurance covers the failure of an insured bank.

Perfect for Profit First

Make the most out of Profit First allocations. Relay savings accounts earn interest on the cash you set aside—think profit and tax reserves. Plus, create an auto-transfer rule to take care of the twice-a-month allocations for you.

Learn moreWhat our customers have to say

Keeping your business on the money

Relay’s online business banking platform makes it easy to fully understand what you’re earning, spending and saving.

Bank without worrying about hidden fees, overdraft fees or minimum balances

Collect payments via ACH transfers, international and domestic wires, checks and payment processors like Stripe and Square

Open up to 20 individual checking or savings accounts to organize cash and expenses

Make banking collaborative with role-based user permissions for team members, accountants and bookkeepers

Assign up to 50 physical or virtual Visa® Debit cards to your team members

Give your business a cash flow cushion with the Relay Visa® Credit Card

Get personalized customer support when you need it by email