She quickly learned that no access to a physical branch also meant no service from her traditional bank, even when she needed it most.

Salma’s drive to help small businesses

Salma’s decision to pursue accounting came early in life, while she was still in high school. She had witnessed her parents struggle financially as they tried to start and keep multiple small businesses afloat — only to run into cash flow challenges. Salma recalls walking into one of these businesses, a medical supply dealership, and coming into contact with an accountant for the first time in her life.

“I knew that my parents were struggling with their finances. One day I walked in and saw this guy with a stack of invoices and a calculator. My dad explained that this man was an accountant, that he was working on fixing our numbers. And immediately, I saw this accountant as a hero who was going to save my parents’ business. And that day, I swear, I decided that this was what I wanted to do, to be an accountant.”

Salma went on to become a CPA, working at PwC for seven years. The nature of her work directed her focus to enterprise clients, and eventually, Salma started to feel that she’d have a bigger impact helping small businesses.

A 100% remote, tech-enabled advisory firm

When Salma decided to start her business, she had two goals. First, find a way to operate in both of the countries she calls home: Morocco, where Salma spent her childhood, and The United States, where she earned her CPA and spent years working. And second, Salma wanted to work on something that would let her directly impact clients.

At first, Salma considered starting a traditional outsourcing business. But as she was exploring how to set up her operations, Salma discovered a world of accounting apps and tools that she had never been exposed to during her time at PwC.

“I started looking at what I needed to manage my business and to serve clients, and I realized that there were all of these tools that I didn’t know about. As I dug deeper reading, watching videos, and connecting with people on LinkedIn, I realized that there was this big opportunity to provide accounting and financial strategy services remotely.”

That’s how Salma landed on the idea behind PROKONECT: a 100% remote, tech-enabled accounting and advisory firm. The firm provides monthly accounting, advises clients on financial strategy, and streamlines financial operations.

No process with a single point of failure

One year in, PROKONECT has grown from a solo operation to a team of five. The firm works primarily with tech startups and eCommerce businesses, and much like the firm itself, many of PROKONECT’s clients are remote.

“We started right at the beginning of the Covid-19 era, so we basically didn't have to convince companies that working with a remote accounting firm was strategic, something that could add value to their business.”

At the core of Salma’s strategy is the idea that no process should have a single failure point or be reliant on a single team member. “A firm needs people, but it shouldn’t need a specific person,” says Salma. “At PROKONECT, this means everything is well-documented, and anyone can pick up a job and do it just as well as the next person.”

But no matter how well-documented your process is, it’s hard to stick to it when your tools actively work against you — especially when one of those tools is unreliable banking.

Salma learned this early on. “I wanted to work on my business, not in it. And our traditional bank made that a big challenge for us.”

Starting with a traditional bank account

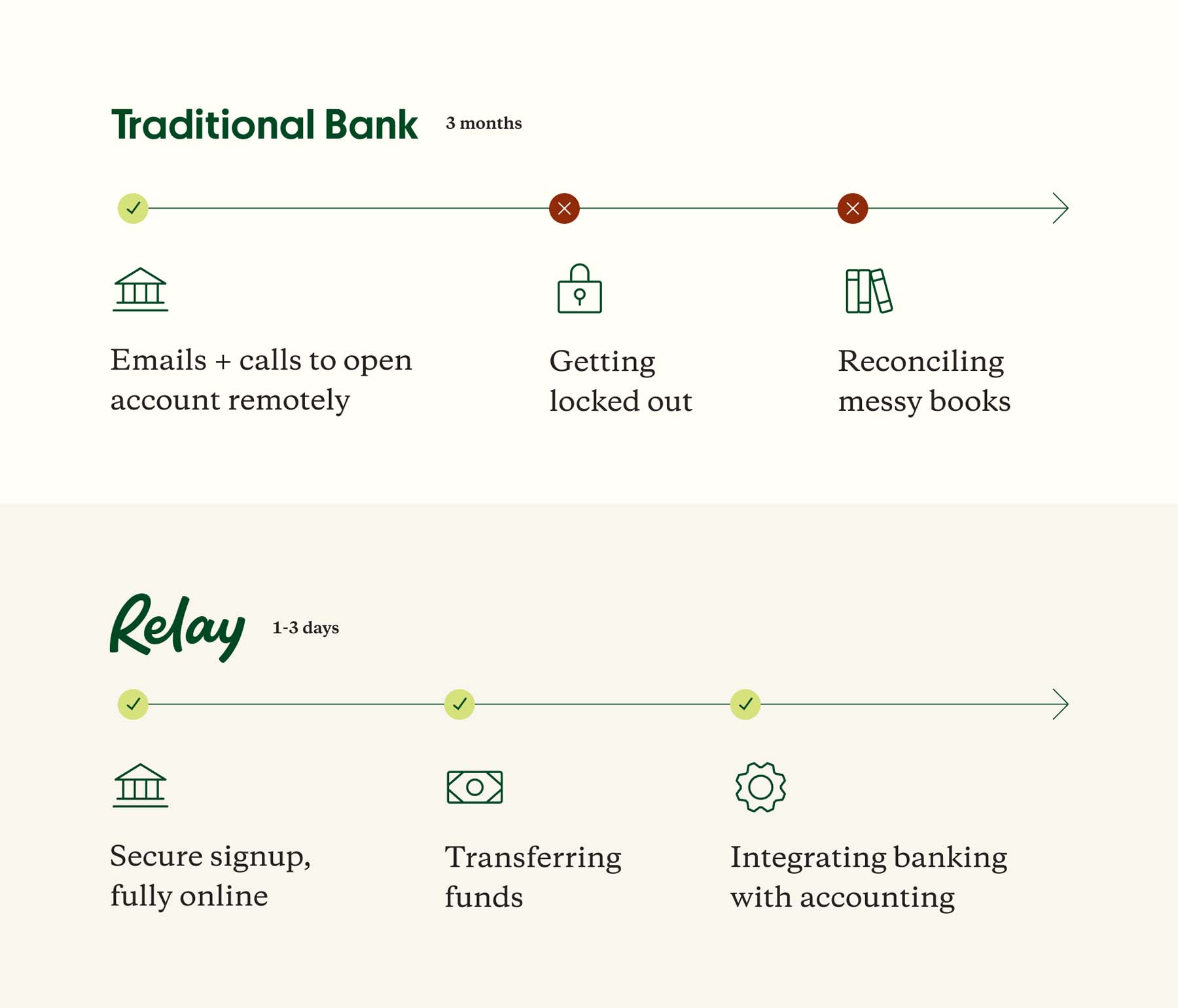

Salma spent six months preparing before signing her first client. She’s a Texas-licensed CPA but was starting her business remotely from Morocco. Registering PROKONECT in the US posed no problems, despite being remote. Issues began when Salma tried to open a bank account. She picked a traditional bank, expecting that it would welcome her business. Instead, she was met with delays.

“I was expecting to go to the bank, say, 'Hey, I want a bank account,' and that a bank would be happy to welcome me, and that's it! But it took a month of back-and-forths before my firm had an account.”

And once set up, Salma started running into day-to-day banking issues.

“There was always some sort of challenge. Whether I was sending an ACH or a wire transfer, I always had to pick up the phone and call the bank. And when you call a traditional bank, you wait for an hour on the phone, and then you don't even know if you’ll be lucky to get somebody on the other line.”

Getting locked out of banking completely

Soon after opening her account, Salma needed to change her phone number. Doing this, it turns out, would lock her out of her business account completely, with no options to unlock the account remotely.

“If you get locked out of a traditional bank — say you don't remember your password, or you change your phone number and can’t verify your account, the bank will not resolve this for you remotely. That’s what happened to me. I changed my phone number, wasn't able to verify my account, and wasn't able to log in and access my funds.”

Despite countless phone calls and emails to the bank, her account stayed locked. Now, she had to forego payments from her clients while also using her personal funds to cover invoices. “I ended up paying for invoices from my personal account," Salma explains. "We practice what we preach, and that's not something you're supposed to do as a business owner. But the bank put us in this situation where we had no other choice.”

All other options exhausted, Salma had to fly from Morocco to the United States to unlock her funds.

Salma was without a bank account for another month before it was unlocked. And even after the bank unlocked her account, fixing the mess created by mixing personal and business banking added another month to Salma’s timeline.

Switching to Relay for fast remote onboarding and personalized customer service

Realizing that a traditional bank would continue slowing her down, Salma wasted no time finding an alternative.

“I had heard about Relay from someone at a Xero networking event. We have a small Houston community — I recall someone mentioning it, and that's how it all started.”

She reached out to Relay's team. From there, Relay streamlined Salma’s onboarding process and she had a new account before getting back to the United States to close her old one.

“I was approved the same day at Relay. Then, I went to Houston and closed my traditional bank account. That was the first thing I did after my flight landed. I've been with Relay ever since, and it has been the best banking experience I could've asked for.”

Salma considered other digital banks as well but found them as unresponsive as their traditional counterparts. “I wasn't getting any responses from their customer support. In contrast, Relay was a complete lifesaver. I struggled with multiple different options, and Relay was the only one that delivered,” says Salma.

Having experienced banking challenges while starting PROKONECT, Salma has a more in-depth understanding of her client’s pain points and the potential risks they take with traditional banks.

“I'm glad I'm out of it, and I will never go back to a traditional banking system.”

Today, she helps her clients understand those risks and avoid banking pitfalls.

Taking clients from chaos to clarity and confidence

Salma designed her firm’s onboarding process to take clients from what is often a state of chaos toward clarity and confidence.

“We work with a lot of startups, which are often chaotic. One of our huge differentiators is how we optimize systems for our clients.”

Every client is unique, facing challenges specific to their industry and their business. Before pitching anything, PROKONECT takes the time to dive deep and build a complete picture of the client’s business.

“The first thing we do is understand the client’s pain points in terms of systems and processes. Once we get to know their business model and see their pain points, we craft an accounting process to fit their needs. We identify the right technology and how everything should integrate.”

For Salma, streamlining the client’s financial operations is always step one. The accounting work follows after. Not only does this simplify her team’s work — it also sets the client up for success.

“Only once this is done do we start thinking about accounting, bookkeeping, financial reporting, financial strategy, budgets, forecasts, KPI measurements, and everything else.”

Introducing Relay in the client's “apps map”

To present their recommendations to clients, PROKONECT puts together an applications map. “This ‘apps map’ shows the client what their accounting system will look like,” explains Salma.

Salma then connects the dots for her clients. “When we present the client their apps map, the typical response is, ‘Oh, I didn't know about that. That's interesting. Oh, wow. Oh, okay.’ Light bulb, light bulb, light bulb.”

Salma includes Relay in her apps map to address specific problems or risks. For PROKONECT, these typically include:

• Remote businesses with distributed teams or no access to a nearby branch

• Companies that require multiple checking accounts to manage cash flow

• Clients that want to outsource their AP management to PROKONECT

• Clients looking to equip their employees with business debit cards

As Salma presents the map to the client, she explains exactly how each application fits into the larger picture.

How Salma positions Relay when speaking to clients

In Salma’s view, you must always do what is best for your client. Because of this, Salma pitches solutions only when she knows that there’s a real need. “If you can articulate how something will save the client time and money, how it will make things stress-free, or why it’s a good foundation for growth,” Salma explains, “then clients are ecstatic to change to something more digital.”

Not everyone buys into the pitch right away. “Some people maybe have trust issues when they hear about an online bank,” says Salma. But what counts is advising clients correctly, even if they’re hesitant. Some may change their minds later, “We had a client message us saying that they want to move to Relay, that they’re tired of going to Houston to unlock their account.”

She’s explicit about the trade-offs with her clients. “When clients need banking, they have two choices: go with the hassle of a traditional bank and expect long wait times and a lot of back-and-forths to get an account — especially if you're not physically in the US — or go with Relay. I recommend Relay because it will take a day to get an account, and you will get outstanding customer support from day one.”

Beyond enabling PROKONECT and their clients to bank remotely, Salma sees Relay as a way to run a more efficient firm.

Putting advisors at the center of banking

As Salma sees it, the real value of Relay is working with a banking partner that understands the needs of accountants and bookkeepers.

“Relay has done something critical in building for accountants and financial advisors. We already do so many things manually with other banks — and Relay automates all that administrative work. And when you provide easy access to the accountant, you’re in effect saying to the business: accountants are the ones that you need to trust to handle these transactions.”

As her business grows, Salma is thinking long-term. And that means partnering with apps that share the same long-term vision and enable her firm’s growth. “Relay's long-term vision is perfectly aligned with a tech-driven accounting firm. You are going to grow alongside the tools you use, and with Relay, it's like working with a partner, not just an app.”