Here at Relay, our vision is to increase the success rate of small business by fully automating financial management. Time and again, we’ve heard from business owners that their banks don’t actually do anything to enable their business. In fact, banks are often a limiter on business growth.

We’re changing that. From a product perspective, we’re building deep integrations into the tools business owners rely on, enhanced collaboration with both internal team members and external advisors, and robust banking functionality that takes the admin out of banking, saving teams time and money. And we’re offering this core banking functionality free of the account fees that can be so burdensome for business owners.

As we’ve learned more about our market and the needs of growing businesses, we’ve also encountered users who need more than core banking. Users at growing businesses who require deeper tooling to alleviate the administrative burden of their increasingly complex day-to-day operations.

<!-- EMBEDDED_ENTRY_INLINE:2ub48BYrxuYqnf0PJ8kMNa:inlineCta -->

That’s why today we’re launching Relay Pro, an enhanced feature set initially focused on automating accounts payable. Relay Pro was designed for growing businesses requiring more comprehensive functionality to streamline their back-office. Starting with accounts payable automation, this Pro plan will integrate key financial processes directly into banking — so you never have to switch tabs or tools.

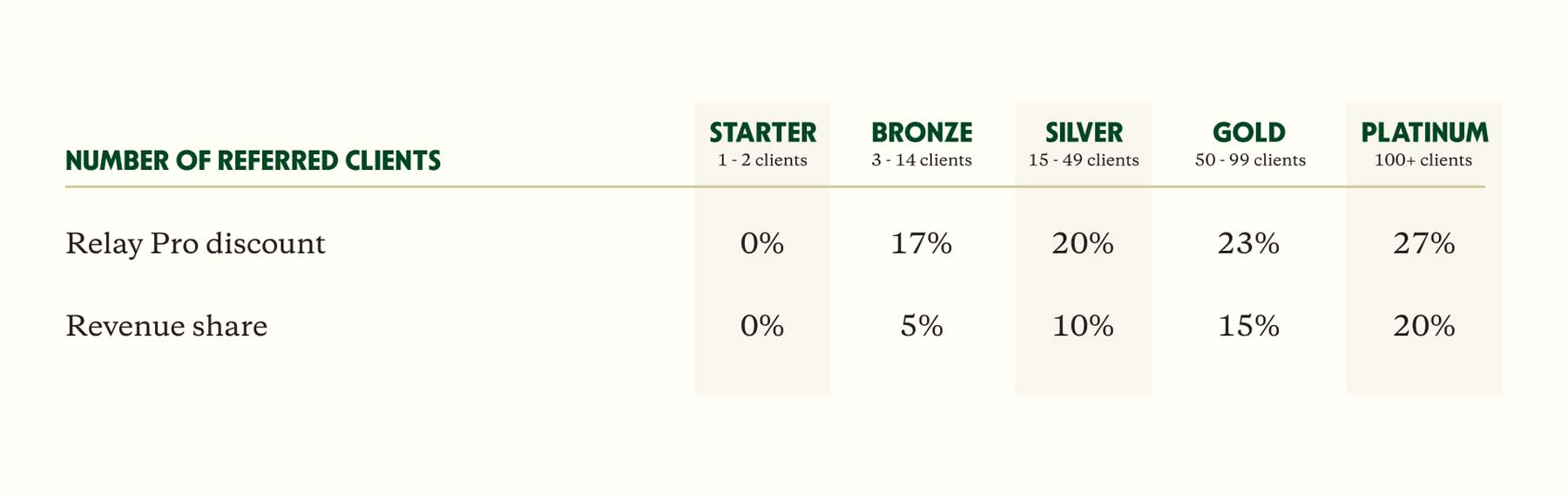

Relay Pro can be added to your Relay account at a cost of $30/business per month. (See our Pricing Page for full specs.) We’re also offering incremental discounts to advisors who want to use Relay Pro with their clients — see below for more details on advisor rates.

In an ecosystem where the average business owner relies on 30+ tools to run their business, we’re building banking that both centralizes back-office workflows and integrates directly into a team’s existing stack. Read on for more details on today’s Relay Pro launch.

Relay Pro: Accounts payable automation for SMBs

We’ve met many SMBs stuck in a “middle zone” when it comes to accounts payable. Growing businesses with enough complexity that paying bills — a seemingly simple task — has become a big pain. Tracking down invoices (physical and digital), chasing approvals, and even making the payments themselves (raise your hand if you’re still cutting paper checks...) can accumulate into a big time sink. (Not to mention the fact that average processing costs have been shown to reach $15 per invoice...) On the other hand, the AP solutions on the market are often too heavy or expensive to make sense for most SMBs.

Relay Pro includes powerful features designed for growing SMBs who feel this pain.

With Relay Pro, businesses can:

Automatically import bills from QuickBooks Online or Xero

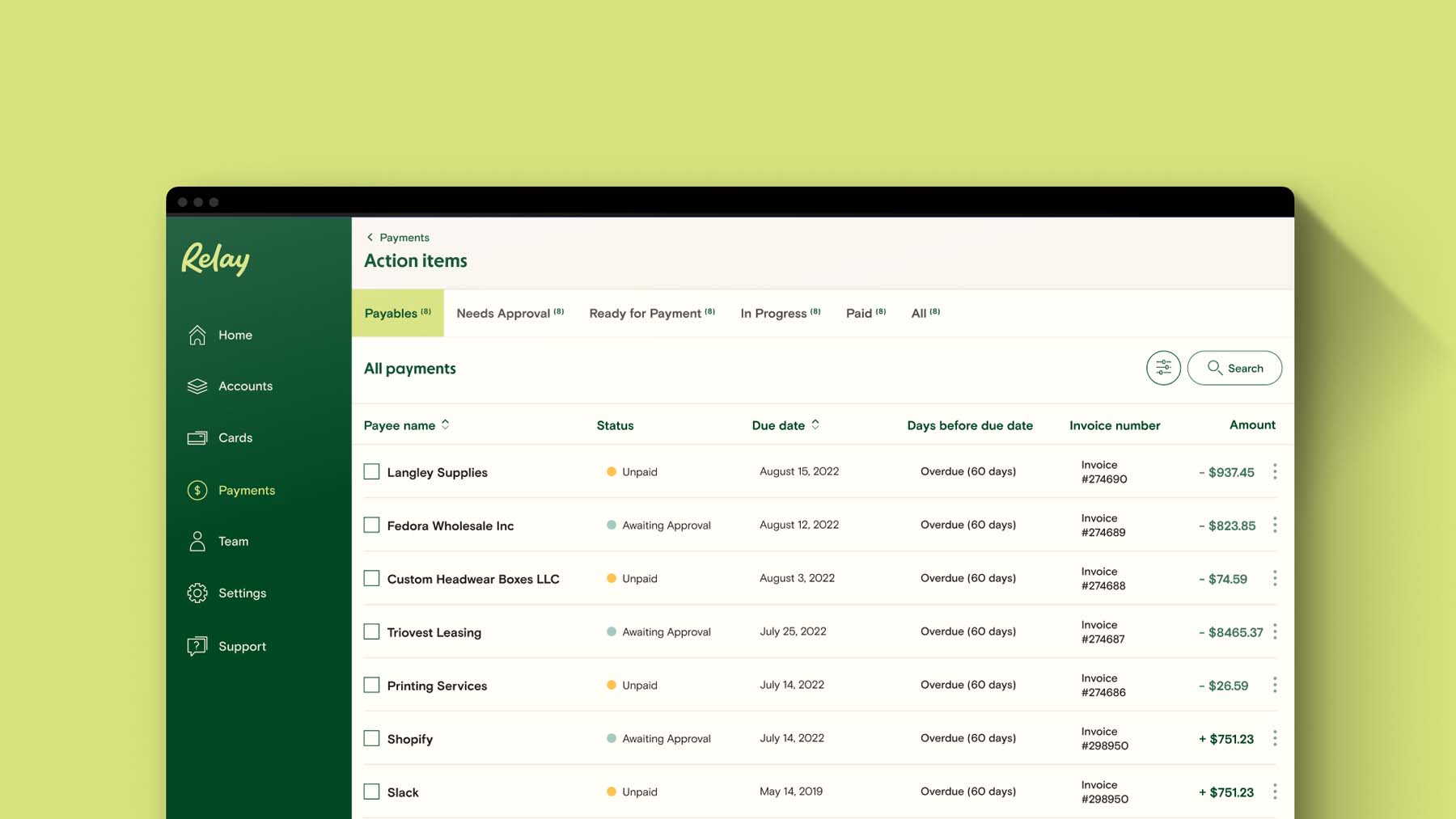

Review, approve, and pay all bills from one dashboard

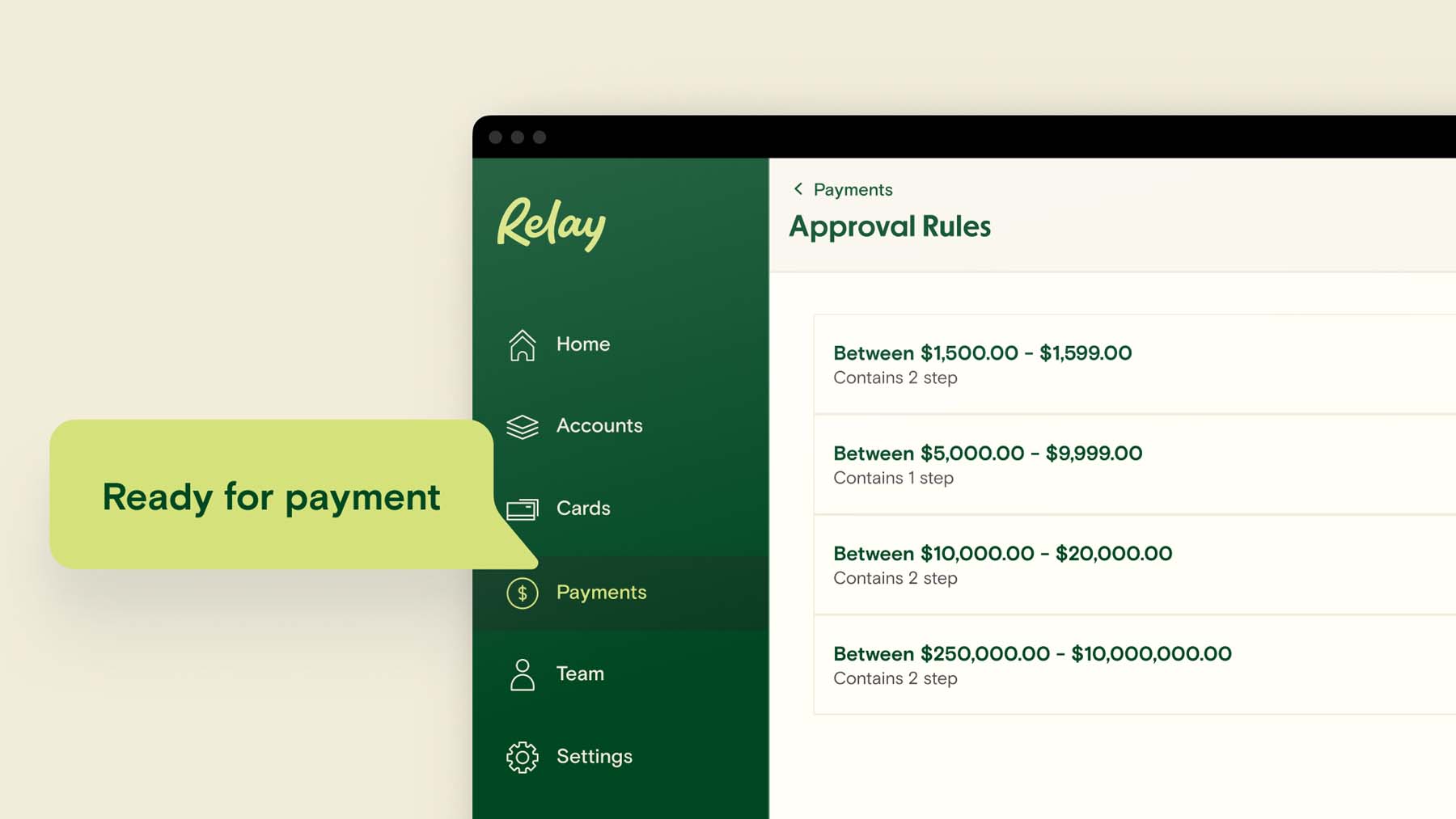

Automate single or multi-step approval rules for bill payments

Pay multiple bills to the same vendor in a single batch

Pay multiple bills to different vendors in one workflow

Auto-sync paid bills as “paid” back to your general ledger

Get 50 same-day ACH transfers per month (so long, late fees)

<!-- EMBEDDED_ENTRY_INLINE:5aN2V4kHU4Pz2HXZfN5Jz8:inlineCta -->

Why go Pro?

For businesses to be successful, they need to have visibility and control over their finances — ideally a bird’s-eye view of money coming in and money going out. Yet as any business owner knows, this simple status check is very challenging to achieve. With Relay Pro, you can not only streamline the accounts payable process, but also gain confidence and control over your financial situation.

Here are the most valuable reasons to upgrade to Pro:

Centralize your bills

We know how hard it is to get a clear picture of your business’ finances — including understanding what bills you have outstanding. We also know that you and your team have more impactful things to do than chase invoices and approvals for bill payments. With Relay Pro, you can centralize your bills in one place, view the status of each bill at glance, and complete all approvals and payments from one hub. This saves time and provides valuable insight into your financial status.

Automate bill approvals

Before bills can be paid, they need to be approved — and getting there can feel like running an obstacle course. Endless email threads, text messages at odd hours, the verbal OKs to “pay this bill, but not that other one yet” all add up to a lot of inefficient, expensive, error-prone admin work for the business. With Relay Pro, you can build and automate single- or multi-step approval workflows based on amount. Run approval processes and reminders on auto-pilot — no more “just following up…” emails — and keep track of approval statuses from your dashboard.

Best-in-class payment settlement times

Relay Pro users get 50 same-day ACH transfers per month — meaning payments are always made on time. (Once 50 same-day ACH transfers are made in a single month, ACH transfers will settle next-day.) Settlement times for domestic wires are also same-day, and international wires are next-day.

Increase AP collaboration between advisors and clients

As we note in our guide to offering AP as a client service, 37% of small businesses want their accountant or bookkeeper to help with accounts payable. Yet the manual work, cost, and security challenges associated with accessing and making payments from a client’s bank often deter advisors from offering this service.

Firms using Relay can leverage Relay Pro as a cost-effective, efficient and secure way to offer AP services to clients. Depending on the number of clients on Relay, firms can also access incremental discounts on the monthly fee per business, up to 27%.

We’re building for both business owners and advisors because we believe that relationship is at the heart of any successful, growing business. Relay Pro is a powerful way for advisors to provide more value to their clients while growing their firm in the process.

Thank you to all customers and Relay Partners, both present and future.

Yoseph West, Co-Founder & CEO @ Relay

<!-- EMBEDDED_ENTRY_INLINE:5aN2V4kHU4Pz2HXZfN5Jz8:inlineCta -->