With the new Partner Program, we’re introducing meaningful cash rewards for advisors, more partner perks, an Advisor Directory to help you find more clients who already bank with Relay, and Ambassador Sponsorship opportunities—all geared towards accelerating your firm’s growth and longevity.

Advisors and Relay share the same mission: to enable real financial clarity and cash flow control for business owners. Entrepreneurs rely on advisors—their accounting and bookkeeping firms—to help them make the smartest financial decisions for their businesses. At their best, these are make-or-break, indispensable relationships. That’s why our goal at Relay is to make these advisor-client relationships stronger. Advisors have been integral to how we’ve built business banking since day one. Our very first customers were exclusively accountants and bookkeepers, and the advisor community has remained a core part of Relay to this day.

So, in reimagining our Partner Program, we asked accountants, bookkeepers, business owners, and our own teams: what would lead to better collaboration between accountants and clients—and ultimately to better business outcomes for both?

Those conversations led us to a Partner Program that encompasses five things:

Business banking that’s truly built for you and your clients

Dedicated support, including white-glove onboarding and account management

🌟 New: Predictable, transparent and meaningful partner rewards

🌟 New: An Advisor Directory that helps you get more clients

🌟 New: Ambassador Sponsorship opportunities for your firm

We’re very excited to share what the new Partner Program looks like. Let’s dive in!

Business banking built for you and your clients

As an advisor, you’re all too familiar with how inefficient banking setups can hold back your clients, your own firm, and the work that ultimately leads to your client’s success.

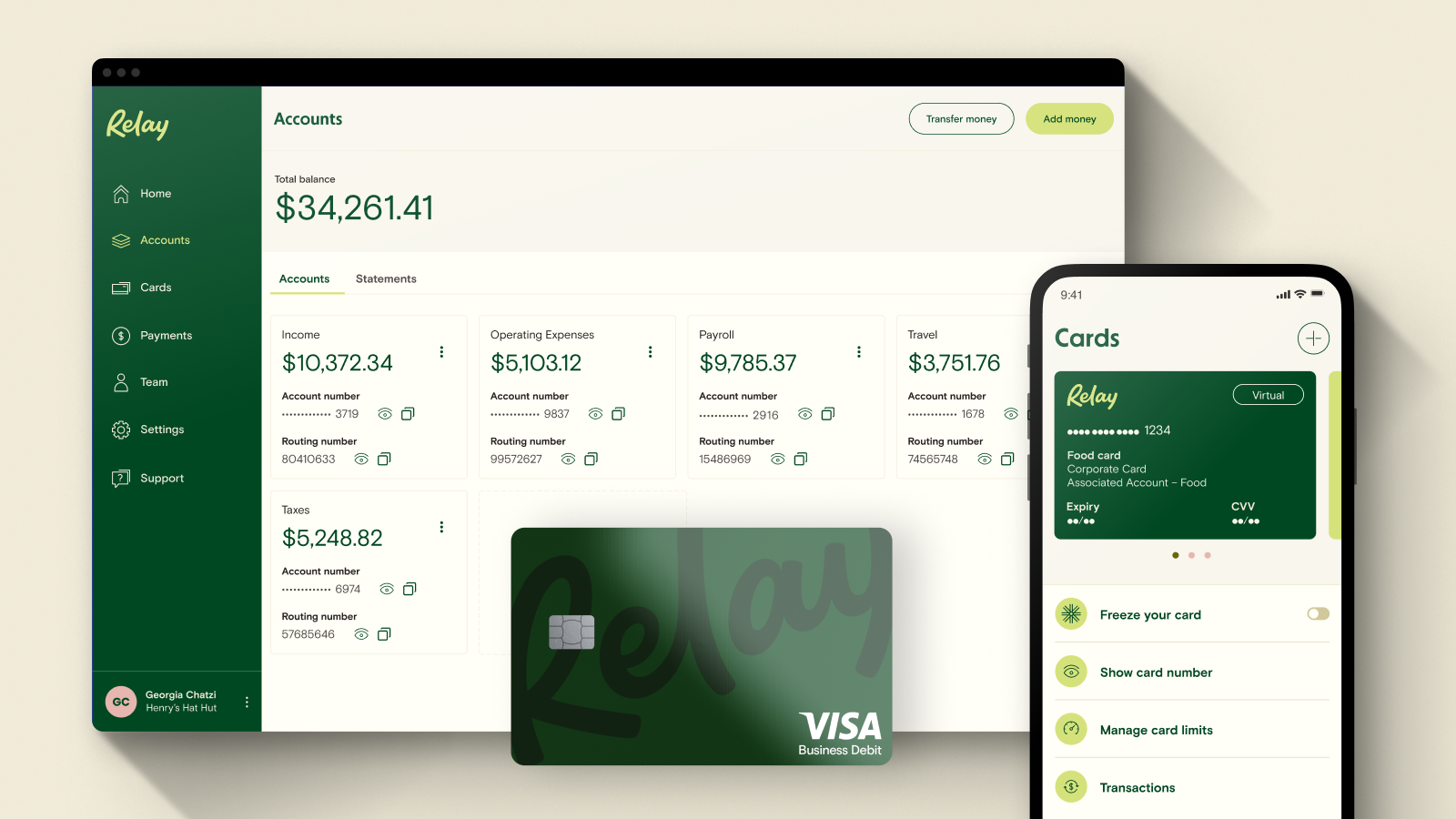

Inefficiencies of traditional banks add up: the time-sink of broken bank feeds, the hassle of trying to get access to client banking or securely collaborate with firm staff, and poor quality data that eats up your time piecing together transactions. So with Relay’s Partner Program, you and your clients get banking that enables true visibility and control.

Free, powerful business banking for your firm

Every Partner gets a Relay account, with all Pro features included, free of charge. That means:

No account fees, overdraft fees or minimum balances

Up to 20 individual checking accounts

Savings accounts with 1-3% APY

50 physical or virtual Visa® debit cards

Payments via ACH transfer, check and wire

Free subscription to Relay Pro (usually $30/mo), which includes:

Free same-day ACH payments

Free international and domestic wire payments

Bill pay automation integrated in Relay

Partner portal to manage all clients in one place

On average, Relay saves advisors three to five hours of work per client each month, because collaboration between clients and advisors on Relay is easy and secure. Every client you invite to Relay gets added to your firm’s Partner Portal. That means:

A Partner Portal where firm staff can safely access and switch between client accounts from a single login

Role-based permission levels for firm staff (clients always stay in control of what a staff member can access)

Direct bank feeds to QuickBooks Online and Xero and statement syncs with Hubdoc and Dext—all of which you can set up and manage on behalf of each client

Ultra-detailed transaction data that speeds up reconciliation and leads to less back-and-forth with clients

Accounts payable automation for clients that pulls unpaid invoices from QuickBooks Online and Xero

All of this spells out better workflows, less time spent wrangling data, and more opportunities for advisory client work. So how do you get clients to switch their banking and achieve this?

White-glove onboarding, account management and resources

Many accounting and bookkeeping firms fall in love with Relay and want to get multiple clients on the platform. To navigate the conversation about making a switch, they need resources and direct support in communicating the value of Relay to their clients.

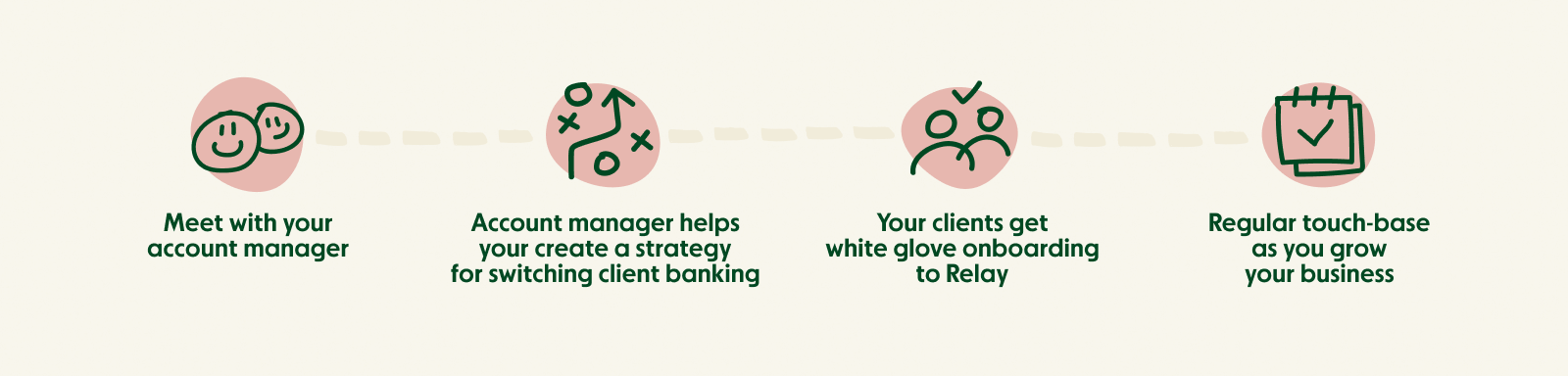

That’s why we pair every Partner with a dedicated account manager. They’re here to teach you the ins and outs of Relay’s platform, create a strategy for getting clients to switch their banking, provide white-glove onboarding for your clients, and train them on how to get the most out of Relay.

Here’s what every Partner can expect:

Step 1) Meet with your account manager and get a deep-dive into Relay’s platform

Step 2) Account manager helps you create a strategy for switching client banking

Step 3) Optional: Account manager does a demo of Relay to clients directly

Step 4) Your clients get white-glove onboarding to Relay

Step 5) Regular touch-base with your account manager as you grow your book of business

We know how important it is to have someone to call on when you have questions or need help—especially when it comes to your client’s banking. That’s why our account managers are here to support your firm.

Additional resources

In addition to your account manager, we want to make sure you have the resources needed to help clients make the switch. Which is why you get access to the Banking Partner Certification and a Smart switching wizard.

Banking Partner Certification

Our 11-part certification is designed to give you real confidence and expertise in advising clients on their banking setup. Equipped with this training, you’ll know exactly how to help clients make smarter decisions about their day-to-day banking services and cash flow. Get started here.

Smart switching wizard

Bank switching can be challenging—so we’ve built an in-platform switching wizard that ensures nothing slips through the cracks. Relay’s switching wizard automatically captures your client’s existing transactions and helps you move every dollar, deposit and payment into Relay with nothing missed along the way. Learn how to make the switch.

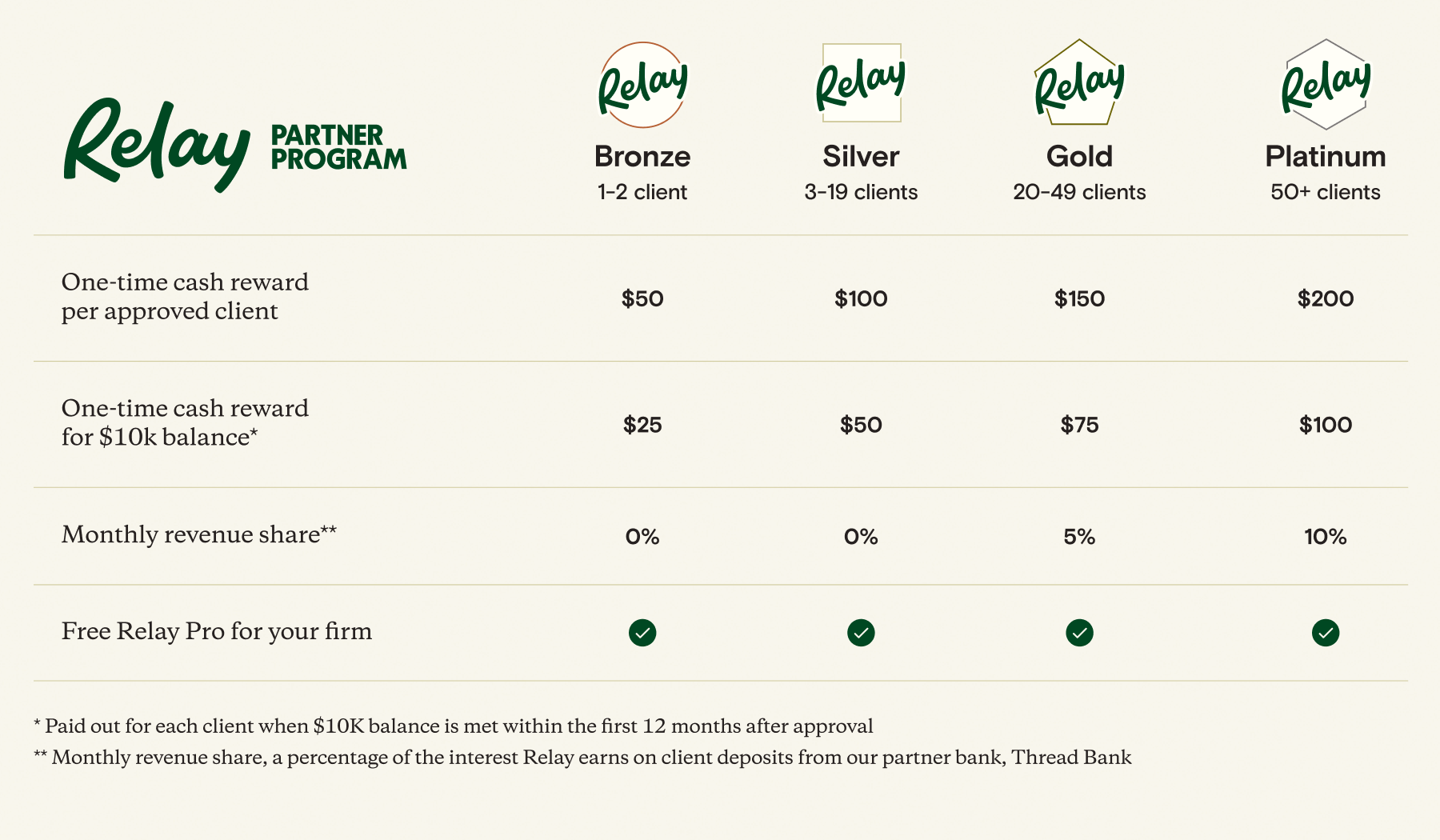

🌟 Predictable and transparent partner rewards

Switching over client banking is no small task, but the rewards are great. Reliable bank feeds, better data, smoother workflows, or getting accounting done up to five times faster.

We want to reward you further. Those rewards should be easy to understand, track, and work towards—and you should be free to use them in whatever way you think is best for your firm. With that in mind, we’ve completely overhauled the partner tiers and made it much clearer how and when you will earn rewards.

Partner Program reward tiers

Please see the Terms and Conditions here

>>> Download the Partner Program PDF

You’ll be rewarded cash for every new client that you sign up to Relay. Your rewards will be sent to you every month. You won’t have to keep watch of your tiers either—we’ll notify you when you reach the next level!

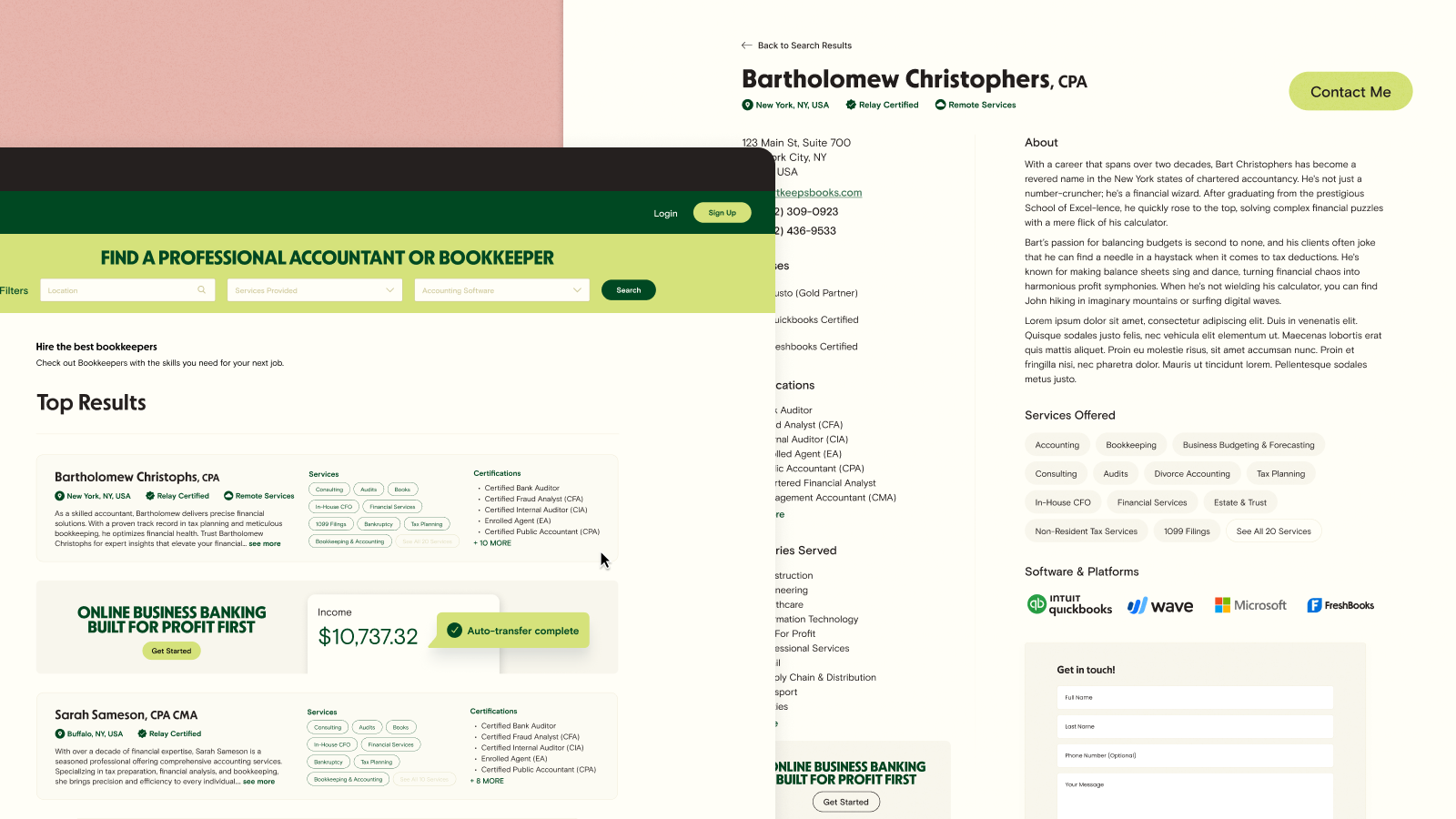

🌟 A new source of clients: Relay’s Advisor Directory

Our team hears it from entrepreneurs all the time: “Can you recommend any accountants or bookkeepers to me?” In fact, 64% of small businesses who bank with Relay are not working with an accountant or bookkeeper—but many are in search of one.

That’s why we’re launching an Advisor Directory to showcase your firm to our audience of small business owners. Qualifying Partner firms will be promoted to businesses that land on Relay’s website in search of a firm. New Relay clients who do not already have an accountant or bookkeeper will be encouraged to find one in the Advisor Directory.

The Advisor Directory is currently being built, and will be launching in early 2024. To prepare for the launch, partners with a Relay account for their own firm can now apply to be listed on the directory by filling out their advisor profile from their Relay account. Once your application is approved, you’ll be ready to make an impression as soon as we go live to our community of small business owners.

>>> Apply to be listed

🌟 Become sponsored as a Relay Ambassador

Many advisors go beyond running their firms. You’re at the forefront of what’s possible with financial technology, which means you lead local communities, speak publicly, and help educate entrepreneurs about new tools like Relay.

That’s why we’re opening up a Relay Ambassador program to our Partners, to encourage you to go out and teach business owners how to build more successful, resilient businesses.

If you want to host a local workshop, meet-up or community webinar where you introduce entrepreneurs to Relay and educate them on the benefits of banking with us, we will sponsor your event. That means, Relay will:

Give you an official Relay Ambassador designation so you feel confident representing the product

Sponsor your workshop or event, so you can cover the costs of hosting

Provide you with educational resources like presentation decks so you can lead a productive session

To apply to be a Relay Ambassador and get your event or workshop sponsored, please complete the application at the link below. Applications are open to Silver Partners and above.

>>> Apply to be a Relay Ambassador

Growing together

The accounting and bookkeeping community has been essential to making Relay what it is today, helping shape our product and mission from the earliest days. We’re in it with you for the long haul.

And the reimagined Partner Program is here to support you in a deeper way than before—we hope you’re just as excited about the launch as we are.

If you still have any questions about our new Partner Program, be sure to visit our program FAQ. And if you’re a firm who’s considering becoming a Relay Partner, you can get started by visiting the link below.

Stay tuned for more opportunities to further connect with Relay’s team and other advisors, showcase your expertise to small businesses and grow your firm.