As a small business owner, your cash management strategy needs to include a plan for time-sensitive payments. In a crunch, payment methods like cash and paper checks are rarely practical. That’s why, sometimes, business owners need to send money via a wire transfer. 🌏

A wire transfer is a fast and secure way to send and receive both domestic and international payments. Whether you need to pay an overseas vendor quickly or can’t rely on cash for a local contractor, a business wire transfer might be exactly what you need.

In this article, we’ll cover:

What is a business wire transfer?

A wire transfer moves funds electronically from one financial institution—or individual—to another. There are two main types: domestic 🇺🇸 and international wire transfers. 🌏

A domestic wire transfer moves funds from one U.S.-based financial institution to another U.S.-based financial institution. International wire transfers move funds from a U.S. bank account to an overseas bank account.

Small business owners may choose wire transfers over other money transfer services for a variety of reasons. For example, wires typically have ⬆️ higher transfer limits than ACH. Since wire transfers are sent directly from one account to another, these payments may also process more quickly than other methods. 🏃

Examples of business wire transfers

Small businesses can use wire transfers for a variety of reasons, such as:

Purchasing business real estate 🏫

Paying overseas vendors 🌏

Buying replacement equipment 🏗️

Reconciling late payments ✅

Purchasing fast-moving inventory 👕

Covering transactions when credit cards aren’t an option 💳

Streamlining the account payables process 💸

Receiving payments from clients 💲

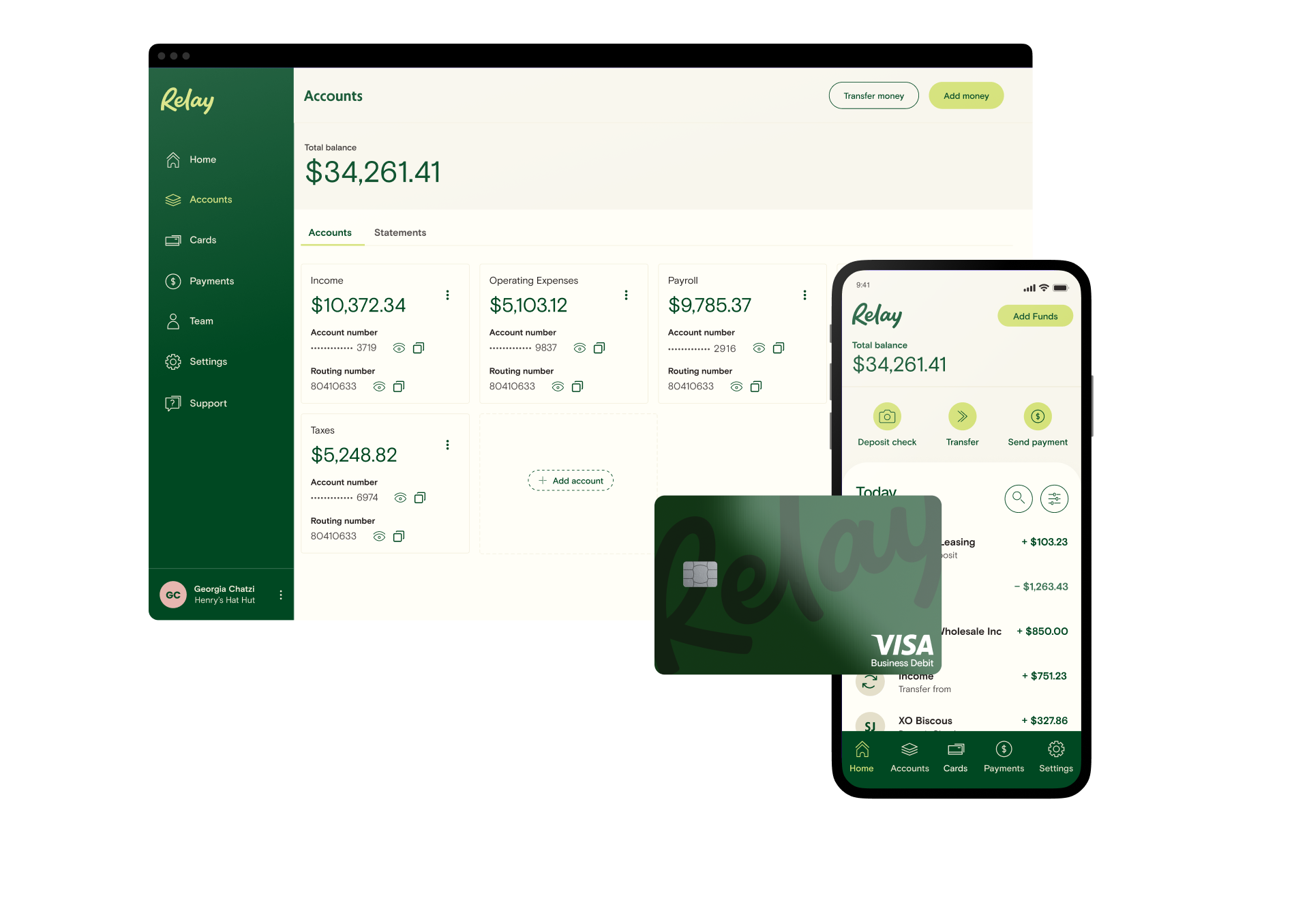

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreHow do business wire transfers work?

Simply put, a bank wire transfer sends funds electronically through a wire network. In the United States 🇺🇸, the Federal Reserve manages the FedWire network for domestic wire transfer activity. For international wire transfers 🌏, a network like SWIFT may be used to transfer funds.

The sender will give the transfer details to their financial institution to initiate a wire transfer. This information includes:

✅ The sender’s bank account number, ACH and ABA routing number

✅ The recipient’s full name

✅ The name of the recipient’s bank and the bank’s address

✅ The recipient’s bank account number, ACH and ABA routing number

✅ The recipient’s address

✅ The amount of money being transferred

Once the sender provides this information and pays for the transfer, the sender’s financial institution will initiate the transaction. Then, the sender’s financial institution sends the wire transfer details to the recipient’s financial institution.

The recipient’s financial institution will review the transaction details and transfer funds from its own reserve into the recipient’s bank account. The recipient’s bank and the sender’s bank will then settle the payment. 🎉

International wire transfers

Relay offers two ways to send international wires: Local Network and Swift Network.

A Local Network wire transfer is cheaper to send and typically arrives faster. The Relay team can help you track and locate a Local Network wire, but there’s no detailed end-to-end tracking, making it ideal for frequent transactions and smaller amounts.

A Swift Network wire transfer has higher fees and takes longer to arrive, but you can follow it every step of the way—via an MT103 report—until it lands in your recipient’s bank account.

Learn more about the two types of international wire transfers that Relay offers here.

Wire transfer fees

Wire transfer fees vary widely from one financial institution to the next. Relay (that’s us! 👋), for example, is an online banking platform that charges $5 to send a domestic wire transfer. Traditional banks, on the other hand, typically charge $25+ for the same service.

Are ACH payments and wire transfers different?

ACH payments and wire transfers are two different types of electronic fund transfers (EFTs). Wire transfers are sent directly from one financial institution to another. But ACH payments first pass through a clearing house network (like NACHA) before they’re sent to the recipient’s business bank account or savings account.

Wire transfers typically have faster processing speeds than ACH payments do. Domestic wire transfers are typically settled within one business day. But they can take anywhere from one to three business days to process. International wire transfers may take between three to seven business days to process.

ACH vs. wire transfer costs

Wire transfers are typically more expensive than ACH payments. However, this will vary depending on what kind of business bank account you have.

With Relay, you can receive domestic wires for free. That’s right—there are no incoming transfer fees! You can also send domestic wire transfers for $5. Other banking platforms may charge anywhere from $15 to $35+ per outgoing wire transfer.

ACH payments are typically used for domestic fund transfers and are often free to send. Keep in mind, it typically takes one to three business days to process this form of payment.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreBenefits of business wire transfers ✨

Wire transfers give businesses a fast and secure way to send and receive payments. Let’s dive into some of the other benefits of wire transfer payments:

Wire transfers are fast 🏃

Since wire transfers move funds directly from one bank to another, they typically have faster processing times than other payment methods.

Easy overseas payments 🌏

Your payment options may be limited when you send or receive an international transaction. Wire transfers are a great option for completing overseas payments. Plus, wire transfers may have better exchange rates than other international payment methods. 💶

Wire transfers are relatively secure 🔒

Business wire transfers are relatively secure. Since wire transfers are processed directly between banks 🏦, there's a lower risk of fraud or error compared to traditional paper checks.

Keep in mind that wire transfers can’t be reversed once they’re started. ⛔ Confirming the transaction details and your account balance before you send payment is a good idea.

Wire transfers are convenient 😎

Wire transfers are an established payment method and most financial institutions can facilitate these payments for individuals and businesses.

Send and receive business wire transfers with Relay 💱

If you’re looking for a business banking platform that offers competitive rates on online wire transfers, Relay’s online banking platform may be right for you!

Relay gives small business owners the ability to open 20 free business checking accounts — with no monthly fees, overdraft fees, or minimum balance requirements. 🙌 💸 Relay also offers 50 virtual or physical debit cards, savings accounts, percentage-based auto-transfer rules, and more.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWith Relay, you can receive international and domestic wire transfers for free. Plus, you can send international wire transfers for just $10 per transaction, and send domestic transfers at just $5 per transaction. 🥳

Plus, with Relay Pro for $30 per month, you can send international and domestic wires (and same-day ACH payments) for free!

Ready to get started? Sign up for Relay here.