It’s a smart question when your money’s on the line. And as an online banking platform, we often hear this question at Relay. So let’s try and settle it: how safe is online banking?

When people ask whether online banking is safe, they’re really asking two questions:

Is my money safe (i.e., insured) if anything happens to the bank?

Am I safe from being targeted by hackers if I bank online?

We’ll address both questions below. But first, it’s helpful to think about why these questions arise in the first place. To do this, we can use a simple framework.

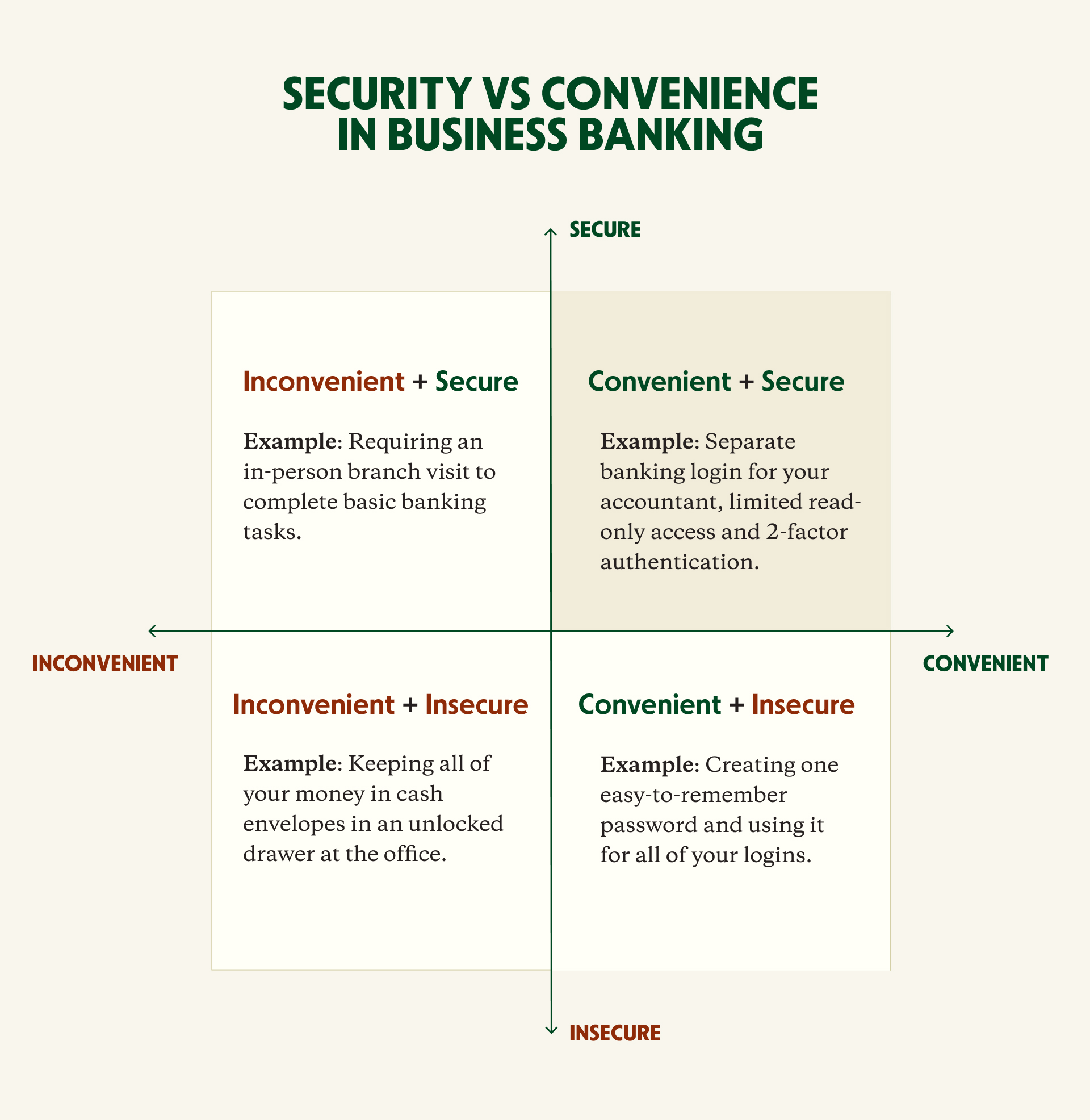

The convenience-security framework

Security is never black or white — it exists on a spectrum. And whenever we try to make something more secure, we tend to give up something else. Usually, we give up convenience.

We can use passwords to illustrate this. Re-using the same password for every login is very convenient. After all, you only need to remember one thing! But the obvious trade-off is that re-using your password is about as insecure as you can get. So to improve security, we could start using unique, strong passwords for everything. Or we could turn on two-factor authentication. Each measure would make us more secure, but we would give up some degree of convenience.

Most people understand this “convenience vs. security” trade-off intuitively. So when you consider moving your business banking online — a much more convenient way of managing money — it’s natural to wonder if you’re compromising security.

Well, are you?

Is online banking safe?

Yes, online banking is safe. 🔐 Digital banking platforms want to protect your money, and most accounts are FDIC-insured. On top of that, online banking platforms invest heavily in cybersecurity to protect their users. And in many cases, online banking features give you more security than you get with a traditional bank. Let’s briefly touch on why this may be the case.

Looking at data from the 2FA Directory, which tracks institutions that offer two-factor authentication (2FA), we can estimate that roughly 22% of major US banks don’t yet offer 2FA protection. So while most major banks have caught up to the importance of 2FA, about a fifth still haven’t. This may mean your bank account is less secure than Gmail.

Most online banking platforms come with 2FA, which is enabled by default in Relay’s case. But online banking also gives you much greater control and lets you respond to security breaches quickly. We’ll take a look at how this contrasts with traditional banking next.

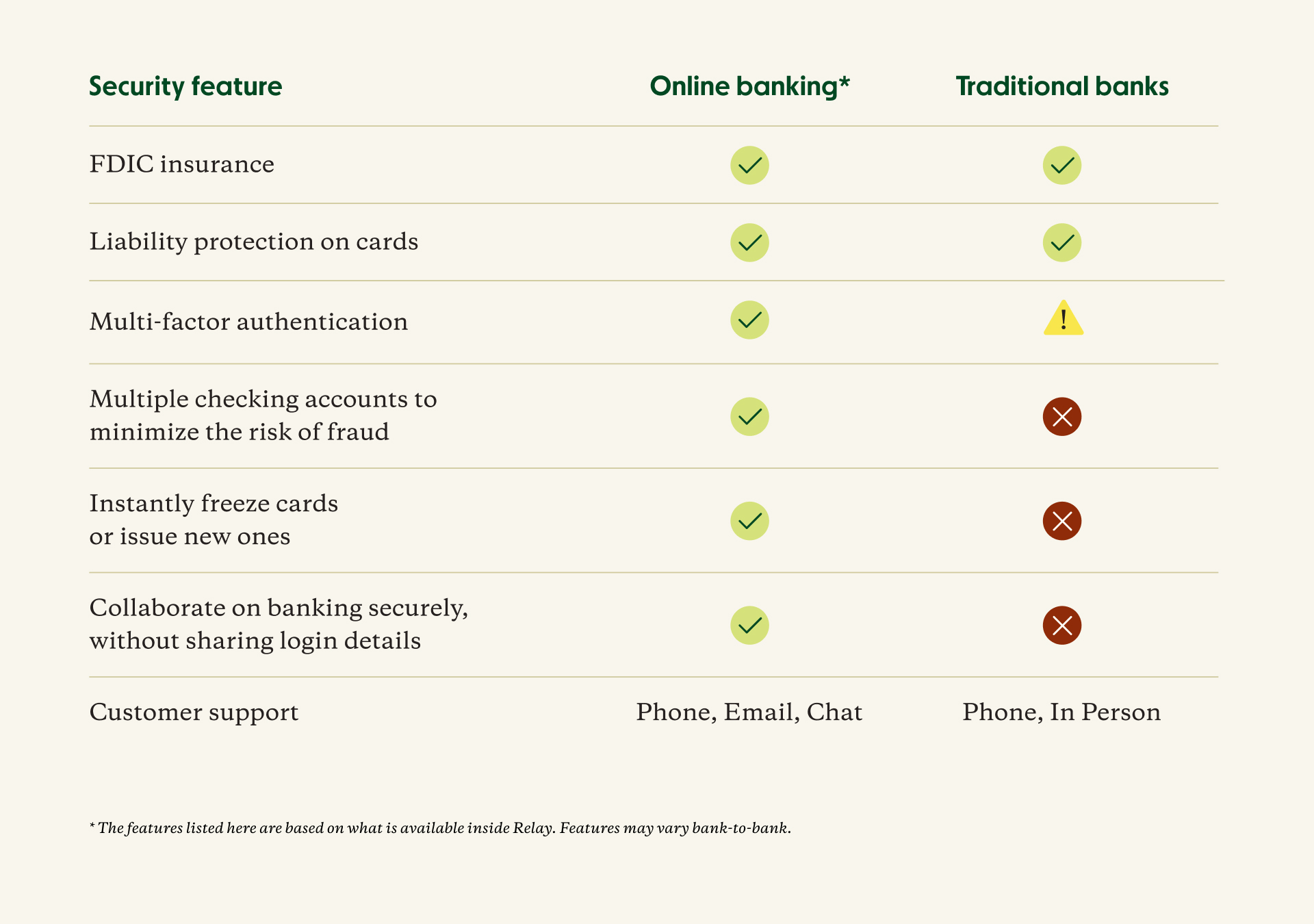

Comparing online banking security vs. brick-and-mortar bank security

When you pit online banking security against traditional bank security head-to-head, digital banking takes the edge. The unfortunate truth is that many traditional banks achieve security by inconveniencing their customers. A typical example is having to physically travel to a branch if your account ever gets locked. (In some cases, this may mean flying across the Atlantic.) Here’s a high-level overview of how the two types of institutions stack up:

Security feature | Online banks* | Traditional banks |

FDIC insurance | ✅ | ✅ |

Liability protection on cards | ✅ | ✅ |

Multi-factor authentication | ✅ | 🟡 |

Separate expense and reserve accounts | ✅ | ⛔ |

Business owner has direct control over cards | ✅ | ⛔ |

Collaborate on banking securely, without sharing login details | ✅ | ⛔ |

Customer support | Phone, Email, Chat | Phone, In-person |

* Exact features may vary platform-to-platform. For the purpose of this comparison, features available to Relay customers are used as a stand-in for online banking.

Now, let’s take a look at each security feature in more depth.

Member FDIC insurance

You’ve probably heard that you should only ever put your money into an FDIC-insured account. It’s good advice. But what does it actually mean?

FDIC insurance protects you, the account holder, in the case of a bank failure. If your bank runs out of money or files for Chapter 11 bankruptcy and you cannot withdraw your money, the FDIC will reimburse you for any losses up to $250,000.

It’s important to understand that FDIC insurance protects you from bank failure, but nothing else. It was established back in 1933 by President Roosevelt 🧑⚖️ to increase the confidence and stability of financial institutions after numerous banks ran out of money during the Great Depression.

Most banks nowadays come with FDIC insurance, and most consumers expect it. However, banks are not required to have FDIC insurance by law, so it’s best to do your due diligence and check if yours is insured. All Relay accounts, for example, are FDIC insured through our partner institution, Thread Bank — which means your money is protected if you bank with Relay.

Liability protection on cards

If someone steals your debit card and goes on a spending spree — are you on the hook for the charges? Liability protection means you won’t be, as long as you’ve taken reasonable care in protecting your card and promptly notified your financial institution about any loss or theft.

You should expect to have liability protection on your cards with most banks, whether traditional or digital. All Relay cards, 💳 for example, come with Mastercard® Zero Liability Protection, which applies to any purchases “made in the store, over the telephone, online, or via a mobile device and ATM transactions.”

Multi-factor authentication

You’re likely already familiar with multi-factor authentication (MFA), also known as two-factor authentication (2FA). If you’ve ever been sent a 6-digit code over SMS while logging into your email account, you’ve used 2FA.

2FA is the number one way to protect your account. According to Microsoft, turning on 2FA can stop over 99% of account compromise attacks. 💪 Often, 2FA may be the only thing standing between you and a cyberattack because, in many cases, even a strong password isn’t enough to protect you.

This is why all Relay accounts come with 2FA by default.

We hope that by now it’s clear that when it comes to standard protections like FDIC insurance, liability protection on cards and 2FA, online banking is just as safe as traditional banking. But let’s go beyond the basics to see why online banking might actually be the more secure option.

When online banking is more secure than traditional banking

Digital banking platforms like Relay are built to give you complete control of how you manage your money. As a result, you also have more ways to protect your account and respond to potential threats. Let’s dive into each.

Multiple checking accounts keep your information secure

Unlike most traditional banks, Relay, for example, lets you open up to 20 free business checking accounts and separate your funds into dedicated income, 📥 expense 📤 and reserve 💰 accounts. It may not be immediately obvious, but one benefit of having multiple checking accounts is increased security.

How is that?

Say your account and routing number get exposed, and you are targeted with ACH fraud. If that account number is just one of many and holds a limited amount of funds — your exposure is minimized. After all, the attackers have no idea what your other account and routing numbers might be. However, everything is compromised if you’re storing all your funds in a single account and your information ends up in the wrong hands.

Full card control helps respond to threats quickly 🏃💨

Online banking gives you better control over your cards than traditional banking, which also means better security. Relay, for example, lets you issue multiple cards on the go, 🗂 adjust spending limits in a few clicks, 🤳 and instantly freeze a card 🙅 if it’s ever compromised.

❗️ This ability to lock cards instantly can be critical, as illustrated by the story of Madeline Pratt discovering employee fraud in her business. Read more here.

Below are the key things to know about how Relay cards.

You can issue multiple cards. Assigning cards for dedicated expenses will limit where and how you expose your card numbers. So even if one is compromised, others stay safe.

You can change spending limits on the fly. Relay lets you update your card spending limits through the website or mobile app and have the new spending limit take effect instantly.

You can change your PIN remotely. You shouldn’t have to visit a branch or wait on hold with someone to update your PIN code. With Relay, you can do this remotely.

You can instantly freeze cards. If you ever need to secure your card for any reason, you can do it instantly using Relay’s web portal or mobile app.

Role-based logins let you collaborate 🙌 on banking securely

As your business grows, you’ll eventually need to give banking access to a team member. It might be your accountant, 🧐 your lawyer 🧑💼 or your administrative assistant, 🤓 but you’ll want to collaborate on banking with someone eventually.

Banking platforms like Relay let you do this securely — with support for multiple users and role-based permission levels you can control. Most traditional banks, on the other hand, were built with just one user in mind. As a result, they lack collaboration features and leave you in the tough position of having to share your personal login information with anyone who needs access. 😰

Customer support that puts you first

Fraudsters and security incidents don’t follow a predictable 9 to 5 schedule, and digital-first companies understand this better than anyone. It’s why here at Relay, we provide support through phone, chat and email — extending support outside regular business hours when needed. And we’re proud to say that our 4.5 Trustpilot score reflects this commitment to our users.

Bank with Relay for better security

We hope this overview gives you a fresh perspective on the role security plays in online banking, and why online banking is at least as secure as traditional banking — if not more so.

If you want to switch to online business banking, we’d love to have you at Relay! We’re *truly* built to keep business owners on the money with unparalleled clarity into exactly what you’re earning, spending and saving. You can apply for a free, FDIC-insured* and 2FA-enabled account in just 10 minutes here.

*FDIC insurance provided by Thread Bank.