When you choose an accountant for your small business, you're not just choosing someone to crunch numbers—you're entering a long-term partnership that can help your business become more profitable, sustainable, and strategic.

In fact, the experts we interviewed for this article agree that the relationship you have with your accountant is a lot like a marriage. 💍 You'll be sharing sensitive financial information, relying on their advice to make decisions, and working together to achieve common goals.

That's why it's important to take your search for an accountant seriously—and it's also why we asked multiple experts to help us put together this complete guide to finding and choosing an accountant.

At Relay, we've worked for years with accountants, bookkeepers, and other financial professionals to design our online banking platform for small businesses. Now, we’re excited to help you choose the right accountant for your small business, whether you’re just starting out or growing fast. 🚀

Let's dive in!

In this article:

Step #1: Get clear on your accounting needs 🤔

If you’re brand new to business, you might only need an accountant to help you with your taxes. But if you’re a seasoned entrepreneur with employees and multiple streams of income, you’re going to need a lot more support from your accountant.

No matter what business stage you’re at, though, one thing is for sure: to choose the right accountant for your small business, you need to know what you want that accountant to do.

Let’s break down what kind of accounting support the experts recommend for businesses at different stages. ⬇️

Tax returns, tax planning, and beyond 💸

Kate Johnson is an experienced bookkeeper and owner of Heritage Business Services. She helps small business owners and solopreneurs build a strong financial foundation through her virtual bookkeeping services.

Based on her years of experience working with entrepreneurs, Kate told us that from the beginning, “all business owners should invest in tax help.”💰 A tax professional is important because they can help you avoid trouble with the IRS and speed up the tax filing process, giving you more time to focus on your business.

💡 Tip: There are many different types of accountants out there, and not all of them specialize in business taxes. If your only accounting need is tax preparation, be sure to look for a tax accountant specifically.

As your business grows, Kate says your accountant can offer valuable tax advice and help you utilize more advanced tax strategies (AKA, tax loopholes). 🤑 For example, an accountant can help you decide if it’s worth it to have your LLC taxed as an S-corporation.

Ultimately, Kate recommends that a business owner “baby step” their way into a stronger relationship with a tax professional. At first, you might talk to your accountant once a year—but over time, they’ll get more involved in your business and help you make smart financial decisions year-round.

Financial planning, reporting, and planning 📊

Accountants can do a lot more than file your taxes. They can also help you understand your business’s projected income and expenses, prepare financial reports, and streamline your business processes. 🛠️

Here are some more services you might want to look for in a small business accountant:

Prepare and analyze financial statements like profit and loss (P&L) reports, balance sheets, and cash flow statements

Advise you on pricing, cash flow management, inventory, and business financing

Help you prepare a business budget and/or business plan

Identify cost-saving opportunities and help you understand where your money is going

Streamline accounting processes like payroll, invoicing, and expense tracking

If you’re not sure how much accounting support you need, consider your business stage. Are you juggling full-time employees, multiple streams of income, and hundreds or thousands of transactions per month? If so, hiring an accountant to help with financial operations and reporting could save you a lot of time, money, and headaches in the long run. 🙌

On the other hand, if you’re a freelancer with only a few business transactions each month, you may not need as much accounting support. You might be able to manage your finances on your own or with the help of a bookkeeper (more on that below!).

What about bookkeeping?

Bookkeeping is the process of recording and organizing financial transactions like purchases, sales, receipts, and payments. While it’s crucial to your business's financial health, it doesn’t necessarily require an accountant’s expertise. Instead, you might want to hire a bookkeeper (or do it yourself). 🤔

That said, some accountants do offer bookkeeping services as well. If you prefer to have one person handle both your accounting and bookkeeping needs, be sure to ask potential accountants if they provide these services.

💡🎥 Wondering when to hire a bookkeeper? , featuring Blake Oliver, CPA.

Step #2: Create your accountant wishlist 📝

Now that you know what services you need, it’s time to identify what the qualifications and personality traits you’d like your accountant to have. 💭

Here are some things to look for in a prospective accountant:

Years of experience with businesses and industries similar to yours

A strong track record of helping clients save money or improve their financial health

Familiarity with current tax laws and regulations for small businesses

Good communication skills and availability to answer questions or provide support throughout the year (not just during tax season)

Technology-savvy and able to work with your preferred accounting software (like QuickBooks Online or Freshbooks)

💡Tip: Don't forget to consider what personality traits you want in an accountant. If you’re new to business, you might want an accountant who is patient and approachable. If you’re a busy CEO, you might prefer someone efficient, direct, and highly organized.

Does industry expertise matter?

You might be wondering if you need an accountant who understands your industry. It’s a good question—so we asked Steven Brown, Chief Operating Officer of LedgerGurus. Steven’s accounting firm focuses on e-commerce businesses, so he knows a thing or two about industry-specific accounting needs.

Steven says “Business is business, but there are so many nuances from industry to industry.” For example, e-commerce businesses have to manage inventory and collect sales tax. An accountant who truly understands those complexities might be able to give you more customized tax and financial advice. 🗣️

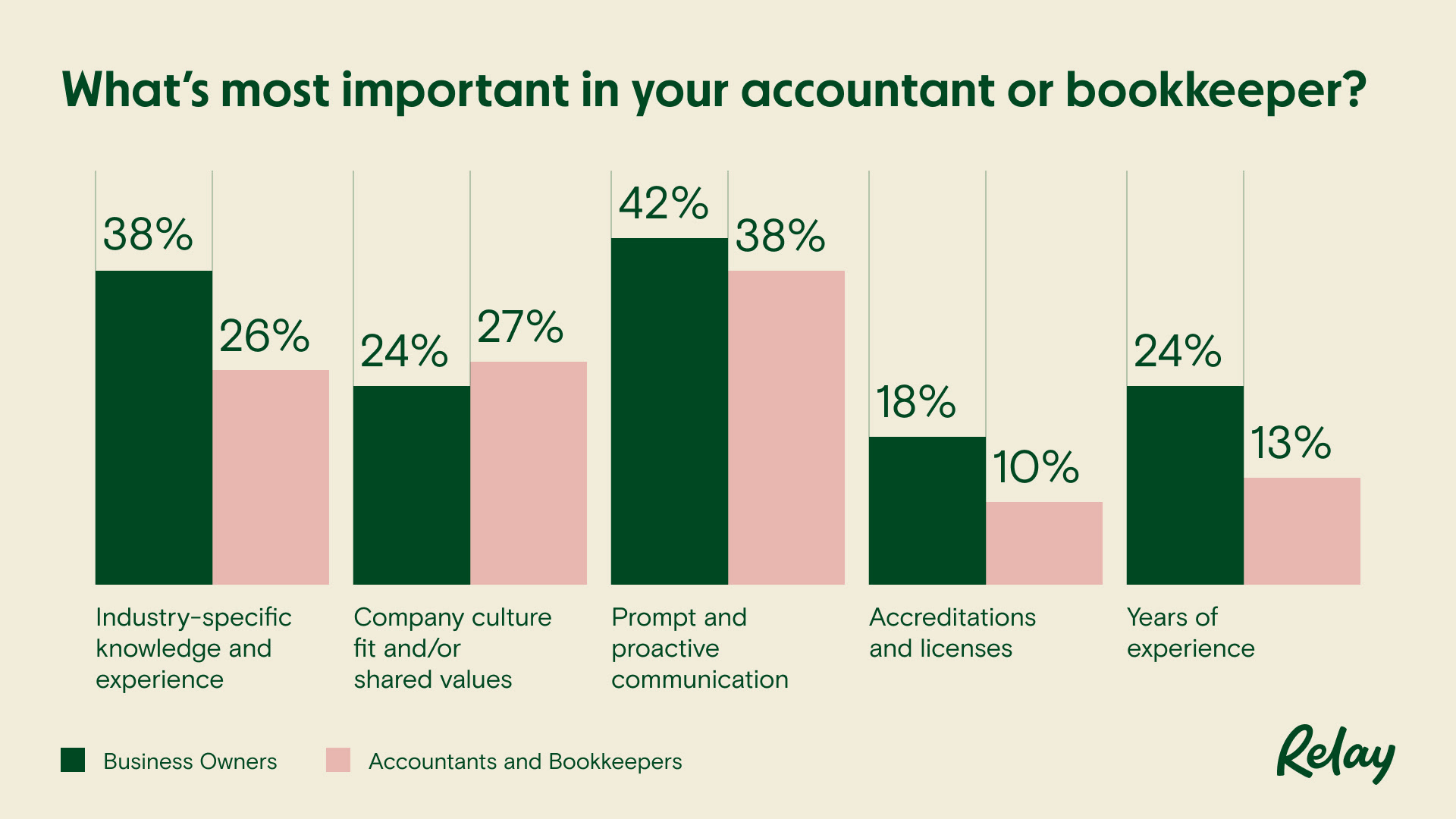

When it comes to choosing an accountant, many small business owners think industry-specific knowledge is very important. In fact, we surveyed Relay’s community of small business owners and 38% said industry experience is the most important thing to look for in an accountant.

On the other hand, only 26% of accountants and bookkeepers agreed. Most of these small business advisors (38%) instead believe that prompt and proactive communication matters most.

Regardless of which qualities you prioritize, it’s crucial to have a clear idea of what you want (and need) from your future accountant. This will help you choose the right person for your business, faster. 🏃

Step #3: Find the right fit 🔍

Now that you know what services you need and who you’re looking for, it’s time to find your accountant.

The good news is that there are approximately 1.4 million accountants to choose from in the United States. The challenge is finding the right accountant for you and your business—and if you don’t know where to start your search, it can quickly become overwhelming.

To help you simplify the process, let’s take a look at the three best places to find an accountant for your small business.

Your professional network 👥

If you’re an entrepreneur, you’ve probably already built a decent professional network. Your friends, colleagues, mentors, and fellow small business owners are the perfect people to rely on when you’re looking for an accountant. 🤝

Ask around to see if anyone you know has worked with an accountant and would recommend them. This can give you a great starting point for your search, as well as peace of mind knowing that someone in your network trusts this person’s services.

Local business groups and events 👨💼

Another great way to find an accountant is by getting involved with local business groups and attending events, like those hosted by your local Chamber of Commerce or Small Business Development Center (SBDC).

These organizations usually have tons of resources for entrepreneurs and can connect you with accountants who understand small business needs. Plus, their events are perfect for networking—you can meet accounting professionals in person, ask questions, and see if they'd be a good fit for your business.

Online directories 💻

Lastly, there are several online directories where you can search for accountants based on location and specific services offered. For example, Relay has an Advisor Directory designed to help small business owners find trusted accountants and bookkeepers. You can use our directory to find an accountant who’s already familiar with Relay (or Profit First, or whatever else is important to you and your business).

You could also check the American Institute of Certified Public Accountants’s (AICPA) directory. The AICPA dates back to 1887 and is the world’s largest member association representing the accounting profession. 🌎

If you’re interested in working with a female accountant, be sure to check the Accounting & Financial Women’s Alliance’s (AFWA) directory. Founded in 1938, the AFWA’s goal is to help women in accounting and finance achieve their potential.

Step #4: Interview multiple accountants 👔

Hiring a good accountant is like hiring anyone else for your small business. Unless the first candidate happens to be a referral from someone you seriously trust, they likely won’t be your first pick.

As a rule of thumb, it’s a good idea to talk to at least 3 different accountants before choosing one. This will allow you to compare pricing, services, and personalities to find the best fit for you. 🤓

Interview questions to ask before choosing an accountant

After you find a few potential accountants for your business, schedule introductory calls with each one. Most accountants will meet with you for free for a 15-30 minute introduction call. 📞

This introduction call is super important to your search process, and you should treat it like an interview. To make sure you’re asking the right questions, here are a few suggestions:

What kind of accounting do you specialize in? (Remember, for example, not all accountants do taxes.)

How much experience do you have working with small businesses?

How do you communicate with your clients?

Can I see some examples of how you’ve helped previous clients save money or improve their financial health?

Do you have any experience working with businesses in my industry? If not, how would you go about learning about my business and its specific needs?

💡Tip: Don’t be afraid to ask prospective accountants for references or case studies from previous clients. This will allow you to understand how they’ve helped businesses like yours in the past.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more#5: Make your decision and get started 👍

By now, you should have all the information you need to make an informed decision about which accountant is right for your small business. When making your final choice, remember that professional expertise and personality fit matter.

You’ll be working closely with this person, so it’s important that you feel comfortable communicating with them and trust their advice.

Once you’ve made your decision, make sure to clearly communicate your expectations and goals to your new accountant. This will help them understand the scope of work and ensure that you’re both on the same page from the start.

The bottom line on choosing an accountant 📝

Finding the best accountant for your small business may seem daunting, but by following these steps and asking the right questions, you can find the perfect fit. Consider your specific business needs, use your professional network, attend local events, and utilize online accountant directories in your search.

With the right accountant, you can confidently make financial decisions and reach your business growth goals. 🚀 Start your search now—your business will thank you.

Stay on the money with Relay

Relay is a business banking platform built to truly serve small business owners and give you total visibility into what you're earning, spending, and saving.

With Relay, you get 20 no-fee checking accounts, up to 2 savings accounts with 1% to 3% APY¹, 50 debit cards to manage your expenses, collaboration features to get help from your financial advisor, and auto-transfer rules to automate money management.

You can get started with a free account by applying entirely online here—in just 10 minutes. ✨

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more