Most small business owners know they need to stick to a budget, but many don’t know where to start or how to budget correctly. 🤷 In fact, 82% of businesses fail due to poor cash management. That’s why you should be using the cash budgeting method.

Cash budgeting is a method of budgeting that shows expected cash sales and expected cash expenses to determine if you have enough cash to fulfill your expenditures. Having a cash budget helps you understand how much money you have and where you can make adjustments to free up cash.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowAt Relay, we want to make it easy to understand precisely what you’re earning, spending and saving so you can make the smartest decisions for your business. But with so many different budgeting methods to choose from, it can be challenging to find the right one for your business.

That’s why we put together an entire series about business budgeting and everything you need to know about cash budgeting, like what it is, why it’s essential and how to create one for your business. Let’s dive in. 👇

In this article:

What is a cash budget?

Cash budgeting involves calculating cash inflows and outflows to determine the cash you aim to have in the bank at the end of each fiscal period. The objective is to give you a clear picture of how much money you have and if it’s enough to cover your expected expenses.

For example, you may forecast $10,000 in revenue this month, but if you offer credit or payment plans to your customers and only 40% of them pay in cash, this only results in $4,000 available to pay your bills this month.

Cash budgeting differs from other budgets, like value proposition or envelope budgeting, because it focuses explicitly on cash flowing in and out of your bank account. Budgets are an opportunity to forecast by estimating future income and expenses, set achievable targets for growth, anticipate your company’s cash position and stick to a long-term plan.

And since we all know that cash flow is a critical part of a successful business, it’s essential that you prepare a cash budget effectively (yes, we’re talking about you). Let’s look at how you can do just that.

How to prepare a cash budget

Have you ever found yourself in a position with insufficient cash to pay your bills? And were you puzzled because you had one of your biggest sales months yet? A cash budget will prevent these cash flow issues from happening by forecasting actual cash transactions, allowing you to prepare ahead of time.

With cash budgeting, there are five basic steps you’ll need to follow:

With each step, you’ll want to ensure you provide realistic numbers and look ahead for any irregular or unexpected expenses. If it sounds challenging, don’t fret! The longer you work on preparing cash budgets, the easier it will be to make them accurate. Let’s break down each of the five budgeting steps.

🔧 Use the right tool or template

There’s no reason to recreate the wheel every time you budget. That just leads to wasted time and money. So if you can, save time by investing in budgeting software or using a template in Excel or Google Sheets.

A business banking software with built-in budget management, like Relay, is a great option to free up time looking through financial statements. Relay offers up to 20 free checking accounts to help categorize your cash into multiple categories, making it easy to anticipate expected cash receipts.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowIf you use a spreadsheet template, be sure to double-check your formulas—no matter if they’re simple or complex. You don’t want to think you’re in a great financial position, only to fall short because of a miscalculation.

Or, if you are interested in more in-depth cash flow management and visual forecasting or full-blown ERP systems, check out our favorite software here.

⏰ Decide on a budget period

Estimate your cash inflows and outflows weekly, monthly, quarterly, or annually. The right period of time between each budget will depend on your company and how granular you need the process to be, though many businesses budget on a short-term, quarterly basis. Regardless of each given period, review the budget regularly to ensure you’re on track.

💰 Decide on a minimum cash balance

How do you stay on track? Well, that will depend on the amount of cash you need to have on hand. Aspects like your monthly bills, seasonal sales fluctuations and irregular bills can all affect cash flow. Be sure to include an additional cash buffer here for unexpected expenses.

↩ Calculate your cash inflows

Next, calculate your estimated cash inflows which start with sales and your current assets. But remember, not all sales represent cash in hand and will vary depending on your rate of accounts receivable being paid.

Also, consider the slow times of the year that impact your cash fluctuations. If you’re in your first few years of business, this will be harder to estimate but easier to forecast over time.

Estimate the number of credit sales vs. cash sales and how fast you are usually able to collect those credit sales. Stay on top of billing and reminders for outstanding accounts receivable to keep cash flow moving through to the end of the period.

↪ Calculate your cash outflows

Then list your bills and expenses that you need to pay, such as:

🏡 Rent

💰 Insurance

🚗 Fuel

🛠 Repairs & maintenance

🖇 Supplies

💡 Utilities

📈 Marketing

💼 Payroll

Some outflows will be fixed expenses, such as rent and insurance, while others will be more difficult to estimate as they may vary, such as fuel, depreciation or raw materials. Calculate the average of these irregular expenses, anticipating any increase or variation.

For example: If you travel for business, rising fuel costs across the country will inevitably increase the amount you spend on fuel. You will need to consider this in your budget or look for other ways to decrease this, such as more virtual, rather than in-person, meetings.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowCash budget example

Let’s walk through an example of cash budgeting to give you a better understanding.

For example: Take a look at your profit and loss balance sheet to get a general idea of your finances. If you’re using accrual accounting, this is simply a number used for accounting purposes.

Here’s a simple profit and loss statement:

Revenue | $24,000 |

Expenses |

|

Rent | $5,000 |

Utilities | $2,000 |

Loan payments | $1,500 |

Payroll | $6,000 |

Marketing | $4,500 |

Total expenses | $19,000 |

Profit | $5,000 |

But here’s what that translates into in your bank account if you allow sales to be put on credit:

Beginning cash balance | $3,500 |

Cash inflows: |

|

Cash sales | $12,000 |

|

|

Cash outflows: |

|

Rent | $5,000 |

Utilities | $2,000 |

Loan payments | $1,500 |

Payroll | $6,000 |

Marketing | $4,500 |

Total cash outflows | $19,000 |

Ending cash balance | ($3,500) |

Being short $3,500 is a big difference from thinking you have a $5,000 cash surplus. These discrepancies can be detrimental to your business if not caught ahead of time, especially if it happens consistently.

How to analyze your cash budget

Now that you’ve prepared your cash budget, let’s figure out what it means for your business.

If you calculate your estimated cash flow and the result is negative, you may be in a position where you need to borrow, decrease expenses, or increase revenue. But first, figure out why you are coming up short with cash before making adjustments.

A negative cash flow is typical for new businesses but is not sustainable long term. That’s why you need a plan in place in the event that you need to correct your cash flow. A negative cash flow can result from timing issues, such as bills coming due before customers pay, or high operating expenses, which should be looked at to see if any can be reduced or eliminated. This is an excellent opportunity to negotiate payment terms with your customers and your vendors.

Another solution for negative cash flow would be to find ways to increase revenue, such as offering price incentives or adding a new service. If nothing else, consider financing to cover the negative cash flow statement—but use it wisely.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowHow to automate cash management for free

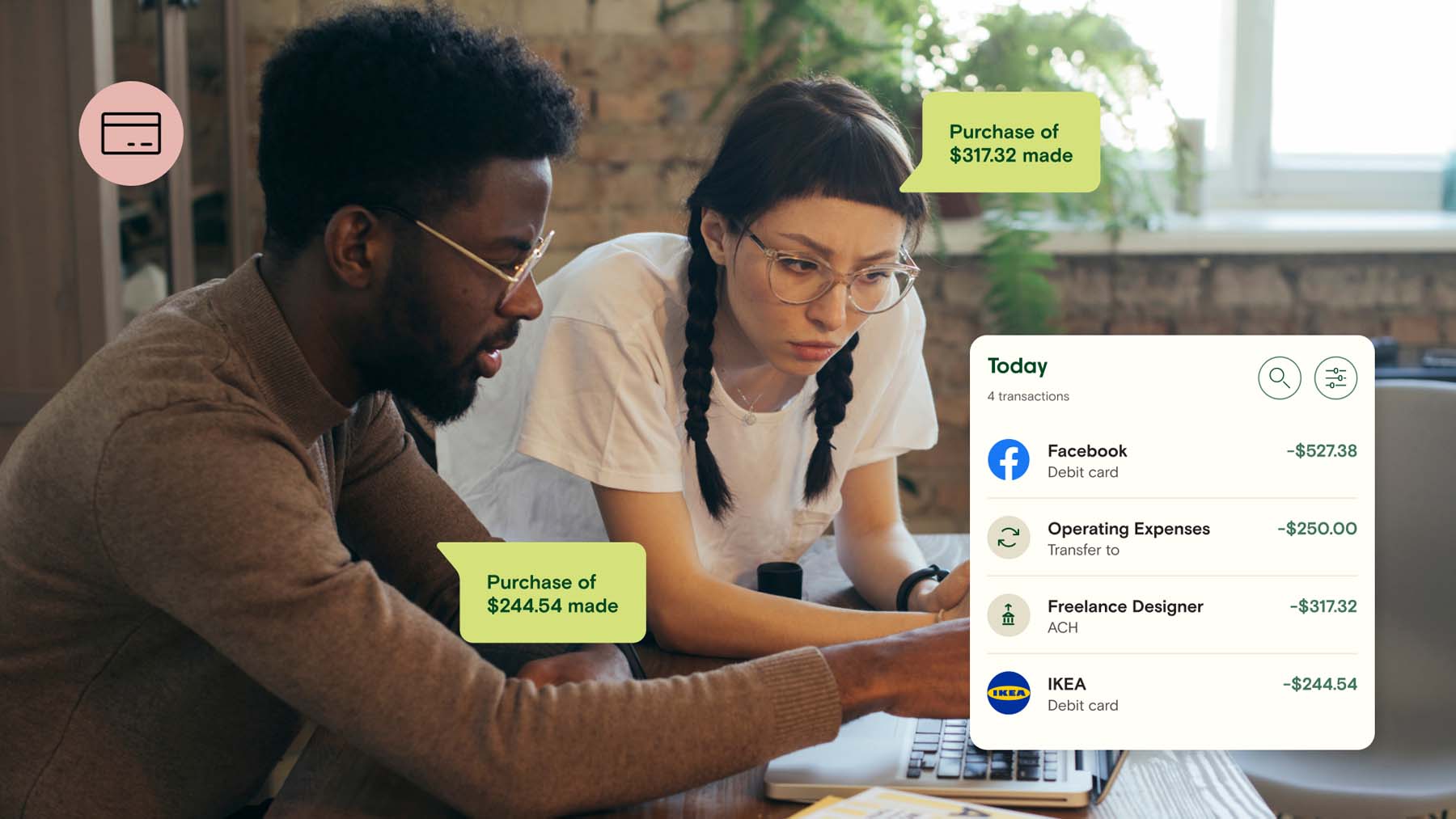

Relay allows you to open up to 20 free checking accounts per business and create “compartments” for each type of expense, such as taxes, payroll and marketing. Once you have completed your cash budget, you can manage every kind of expense with a separate account and set aside cash specifically for those expenses.

Is a cash budget right for your business?

Ultimately, there is no one-size-fits-all approach to business budgeting, but having enough cash to pay your bills is crucial to the success of your business. We hope this series about business budgeting gives you a good understanding of cash budgeting and multiple budgeting methods.

As your business grows, you will need a bank that offers more than just a basic checking account. With Relay, you can better categorize and separate expenses to understand precisely what you’re earning, spending and saving.

If you’re looking for an online banking and money management platform that helps you implement your cash budget, try Relay today!