With an extensive background in accounting, audit compliance, and consulting, Ufuoma empowers nonprofit organizations to build sustainable revenue streams and drive change within underserved communities.

“Access to reliable and frictionless banking systems with minimum fees is often one of the biggest challenges nonprofit organizations face.” — Ufuoma Ogaga

Beyond bookkeeping

“We offer accounting and advisory services for nonprofit organizations with emphasis on grant management, audit compliance, sustainable cash flow, capacity growth, and community transformation.”

The challenge Ufuoma’s firm faced was finding a banking solution that worked for nonprofits. A system that could give her clients a clear and organized picture of their financial past and present—including the ability to maintain better segregation of duties and internal controls.

As a tech-forward thinker, Ufuoma wanted a tech-centered solution. The criteria she was looking for included:

Multiple accounts for fund separation

Access to accounts for multiple internal stakeholders like the Board of Directors, auditors, etc.

Simple “click and complete” transactions, including the ability to open an account online in minutes

Transparency and clarity with documented approval trails into transactions to ease the stress of audits

Safe and secure online banking without the trips to a physical branch

Why Ufuoma chose Relay for her nonprofit clients

The ability to see it all, all the time

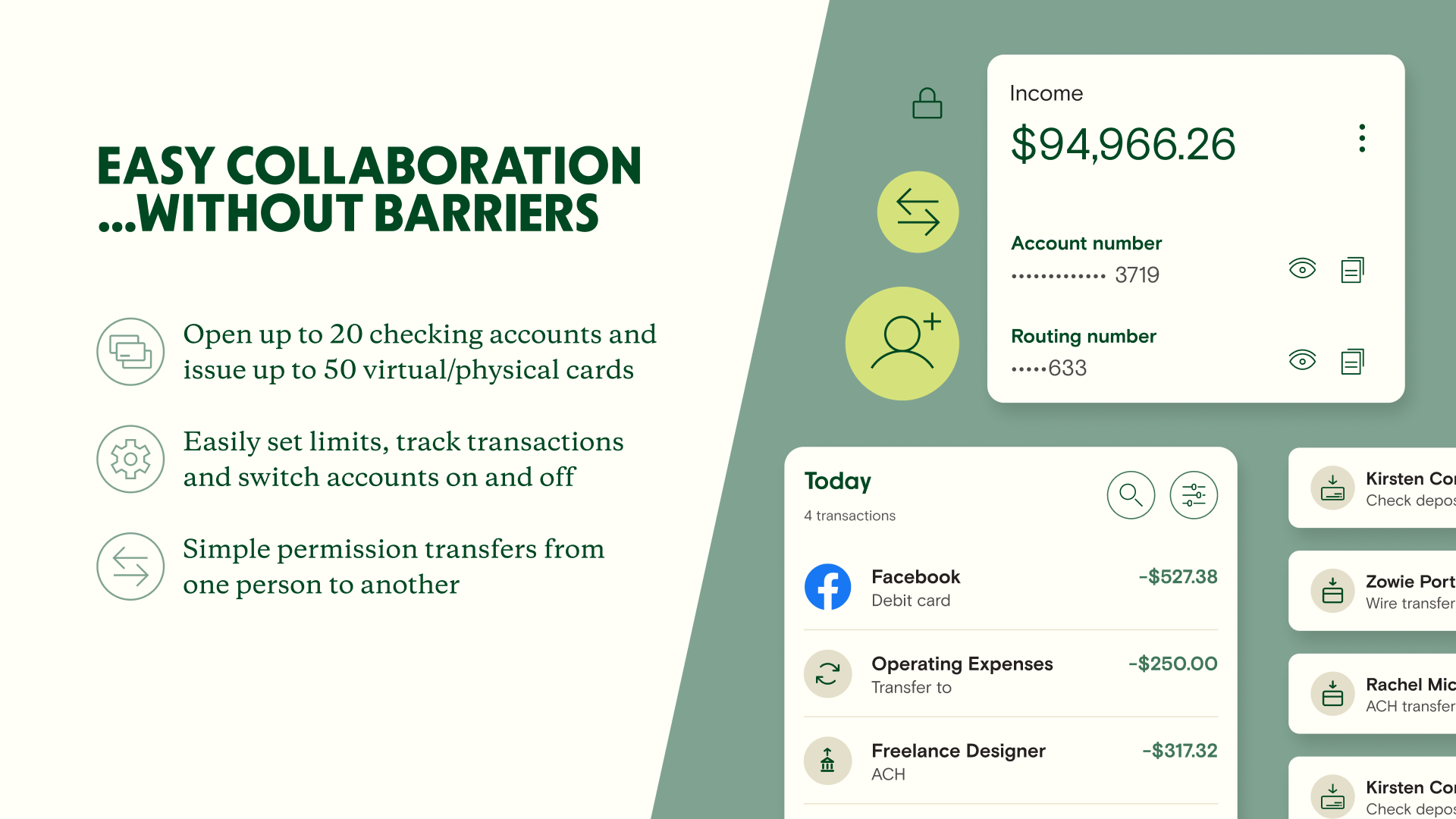

Most traditional banks put nonprofits in a tough spot due to limited collaboration features—resulting in shared logins and poor security. But advisors like Ufuoma need access to banking data to best serve their clients. Which is why Relay makes it easy for nonprofits to collaborate with their advisors—providing secure access protected by app-based 2FA. As a result, the friction to retrieving statements and check images throughout the month is removed.

According to Ufuoma, “Relay removes barriers for clients: they no longer have to remember to send us their information at month-end. Instead, Relay gives all internal stakeholders full transparency on money inflows and outflows in real-time. This access helps us ensure our clients’ financials are accurate at all times and ready for an audit.”

Staying audit-ready

Audits are common in the nonprofit sector; thus, maintaining audit preparedness is critical for organizational success. Ufuoma's secure access to client accounts via Relay enables her to keep their books in a constant state of audit readiness and aid expeditiously with vendor requests.

As Ufuoma explains, "When a client's financial institution prohibits third-party accountant access for statement and check image retrieval, responding to auditors becomes needlessly encumbered. Clients must then divert their attention from critical responsibilities to perform administrative tasks - hardly an optimal use of their time. Relay liberates us from this friction, providing the required access sans the extra legwork."

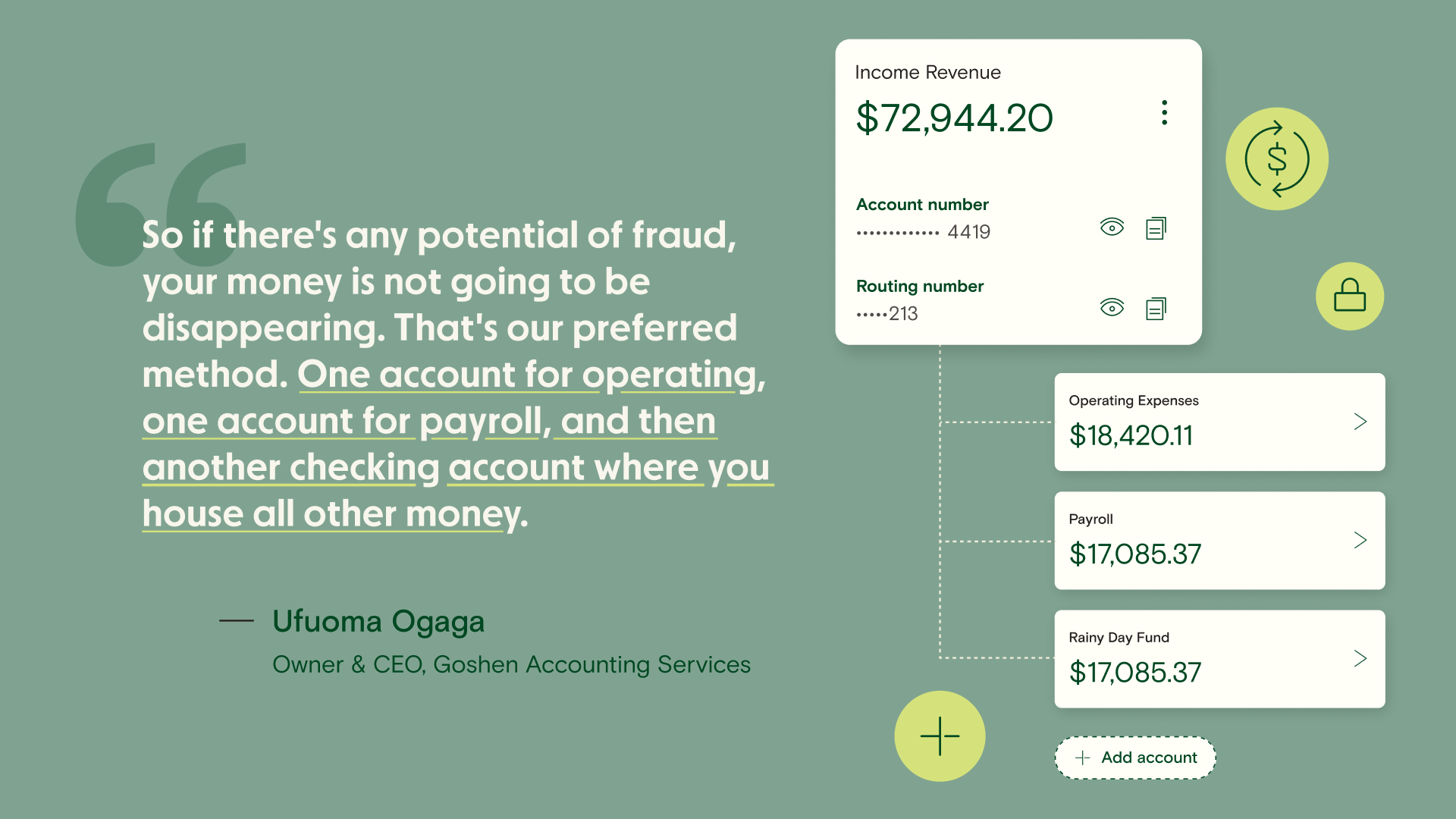

Fund separation for fraud protection

Security is always a concern when it comes to managing money. Ufuoma appreciates the fact that with Relay, her clients can have up to 20 separate no-fee checking accounts. She recommends that her clients reserve a single account for incoming revenue and use it to connect to third-party apps and give to funders on ACH forms.

With Relay, her clients can have multiple individual checking accounts that are purpose-specific. Each account has its own unique routing number. Permission to access each account can be set up according to an organization’s needs. So, if any one account is compromised, all other accounts remain protected.

For Ufuoma, having multiple accounts adds a layer of security and lessens the likelihood of unauthorized transactions draining cash. She recommends clients have one account for operating, one account for payroll, and then another bank account where they house all other money.

Quick and easy collaboration… without barriers

“With a nonprofit organization, nobody owns it. It's community-driven and board-governed,” says Ufuoma, who adds that because of this, she advises her clients to give at least three people access to the organization’s financial assets. “So, the Executive Director (the primary person that would do most of the spending), the treasurer (who should be authorizing or signing off on anything more than $5,000 or whatever their financial policy is), and another board member as a third party backup.”

Multiple people accessing and operating an organization’s finances requires multiple cards, which Relay has covered. Relay also makes it possible to switch access to accounts on or off—in just a few clicks.

With traditional banks, says Ufuoma, “in order for you to change who the authorized people on the account are, you need a letter from the board of directors in writing, and often you have to go physically into the bank to make the change. Traditional banking becomes extremely difficult to manage for clients in multiple states that require multiple people access.”

Relay makes it simple to add and remove users as an organization’s leadership changes with a click of a button. One of the things Ufuoma loves about Relay “is that opening an account can be done in a 5-minute process with providing a nonprofit information and one authorized person’s driver’s license.”

The right tools to put everything in the right place

Relay makes it possible for Ufuoma and her clients to maintain the checks, balances, and paper trail required by the nonprofit sector, collaborate with ease on tax and audit preparation, and do all of the above safely and securely without having to spend precious time visiting a bricks and mortar bank branch.

“Using Relay has made it possible for nonprofit organizations to continue to transform communities without the additional headache of dealing with traditional bank complexities.” - Ufuoma Ogaga

What nonprofits get with Relay

Up to 20 free checking accounts, with no account fee or minimum balance requirements

Free check payments, mobile cheque deposits and ACH payments

No hidden banking fees

The ability to apply for an account online in just 10 minutes

Safe and secure banking without having to visit a physical branch

Seamless accounting software like Xero and QuickBooks Online

Automated savings accounts that earn you 1% to 3% APY¹ (Annual Percentage Yield)

Got ten minutes? Then you have time to sign up for a free business banking account from Relay. And if you’re a bookkeeper or accountant interested in reading more about why Relay is right for you and your clients, click here.