Today, we’re rolling out support for third-party check printing, giving you the (much-requested) ability to write paper checks from your Relay account. Here’s how to get started.

The year is 2077. Artificial intelligence has impacted every aspect of daily life. Advanced neural implants have replaced smartphones. Humans have colonized Mars. And your property taxes can still only be paid by check.

We're big fans of all things digital here at Relay. That should go without saying, given our commitment to online banking that puts you in complete control of your cash flow from anywhere. But as much as we love our online account management, virtual cards, and digital collaboration features, there are some situations that still demand a good old analog option—like when you really, really need to write a physical check.

Whether it’s a vendor that only accepts payment by check, or a utility bill that doesn’t provide a digital payment option, paper checks are a reality we just can’t seem to shake. In fact, 40% of business-to-business payments in the US still happen via check. So it should come as no surprise that one of the most common requests we receive is “let us write paper checks!” So today, after much thoughtful deliberation and careful planning, we're finally ready to share our meticulously crafted response: "Ok!"

You bring the book, we’ll do the rest

Sending checks from your Relay account is nothing new; you can already create checks from our web or mobile apps, and we’ll print and send them on your behalf. But sometimes you need to actually hand over that little slip of paper, on the spot, right now—there’s just no way around it. It may not happen all the time, but when it does, it’s a comfort to know you’ve got a check book on standby, ready for your John Hancock. To make that a reality from your Relay account, we’re introducing support for third-party check books. In other words, you can now purchase a check book from an external vendor (think Staples, Costco, Walmart—our personal favorite is TS Direct) with your Relay account and routing number printed on them.

A more secure way to write checks

Checks are handy when you need them, but they’re not exactly known for security. That’s why we’re rolling out a set of security enhancements to protect your business from the risk of check fraud. Here’s how:

Designate a check-writing account

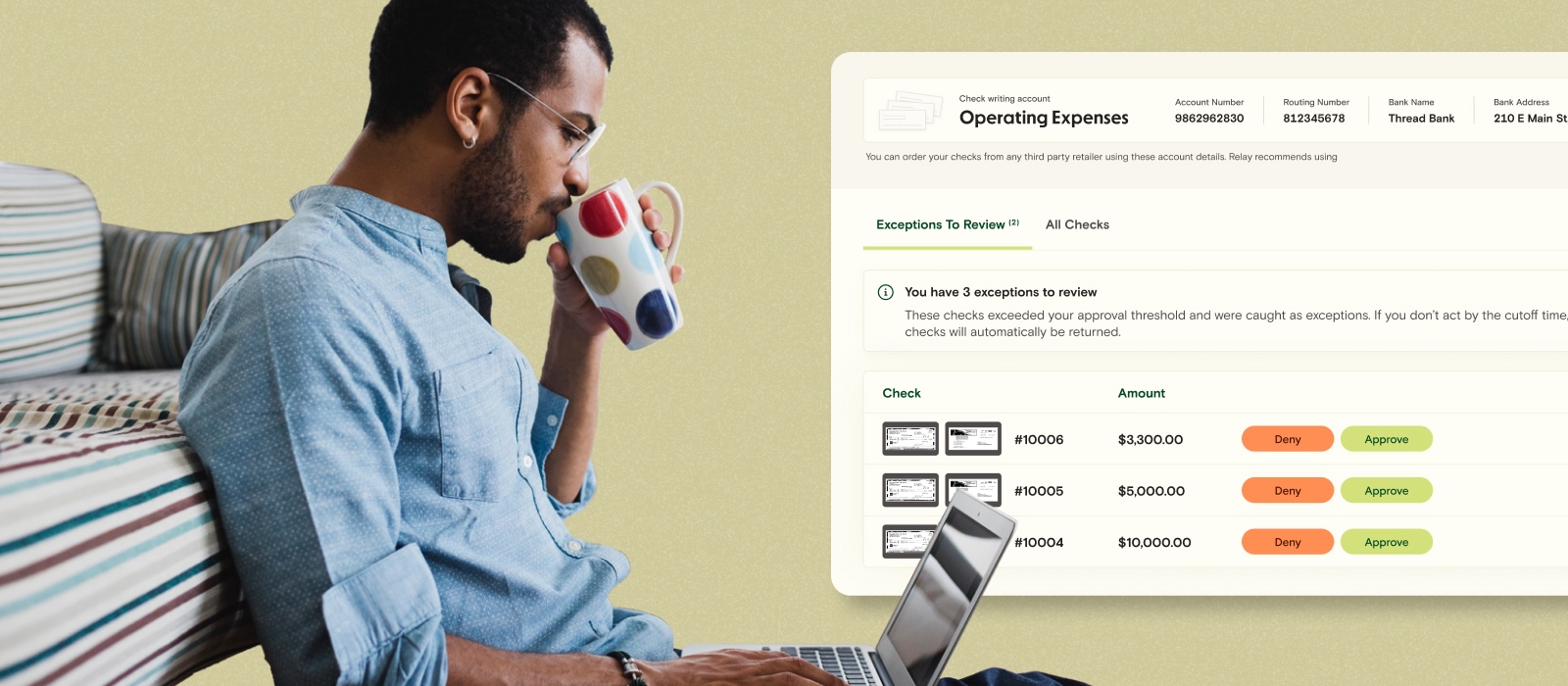

To enable third-party check writing in Relay, you’ll first need to designate a single check-writing account. This will be the account where all of your check transactions take place, with the account number you’ll use when ordering check books. Any check that uses a different account number will automatically be blocked from being deposited (sorry fraudsters, no funny business allowed).

Stay in control of which checks clear

Deposited checks will have an automatic approval threshold of $2,000. In other words, if a check is deposited that’s below the threshold, it will automatically clear unless you choose to reject it (you’ll have until 11:50 a.m. ET the following day to decide). But if it’s above the threshold, we’ll immediately let you know—and wait for you to give us the thumbs-up before letting the transaction proceed.

Assign check admins to your account

Of course, you don’t have to be the only one tasked with approving or denying checks (nobody wants that level of responsibility, am I right?). From your account, you can assign members of your team—like your AP clerk or bookkeeper—to be check admins. When a check is deposited that exceeds the automatic deposit threshold, they’ll receive a notification—via email or SMS—that a new check is awaiting approval. They’ll then have until 11:50 a.m. ET the following business day to approve or deny the deposited check. Checks that aren’t approved—or that go past the approval window—will be rejected, and no funds will be drawn from the account.

Keep tabs on it all from your check dashboard

The Check Dashboard, within the Payments tab in your Relay account, houses everything you’ll need to manage third-party checks. This is where you’ll find the list of checks that are awaiting approval, see how much time is left before they’re automatically denied, access check images, and approve or deny each check.

Get started

To get started with third-party checks, you’ll first need to connect an external bank account to Relay, and fund your Relay account with a minimum of $100. With that out of the way, simply head to the Payments tab in your Relay account, click ‘Third-Party Checks’, and follow the on-screen prompts to enable check-writing. You can log in to Relay to get started.

Happy check writing!