Maintaining a healthy profit margin is key for the long-term success and growth of marketing agencies. 🔑 But how can agency owners balance the need to provide high-quality services to clients while also ensuring that their bottom line stays healthy?

It's not always easy—you have to pay freelancers, stay on top of billable hours, and avoid scope creep. The good news is that most marketing agencies are profitable. 📈 That means with the right tools and strategies, you can boost your profits and achieve your business's financial goals.

In this article:

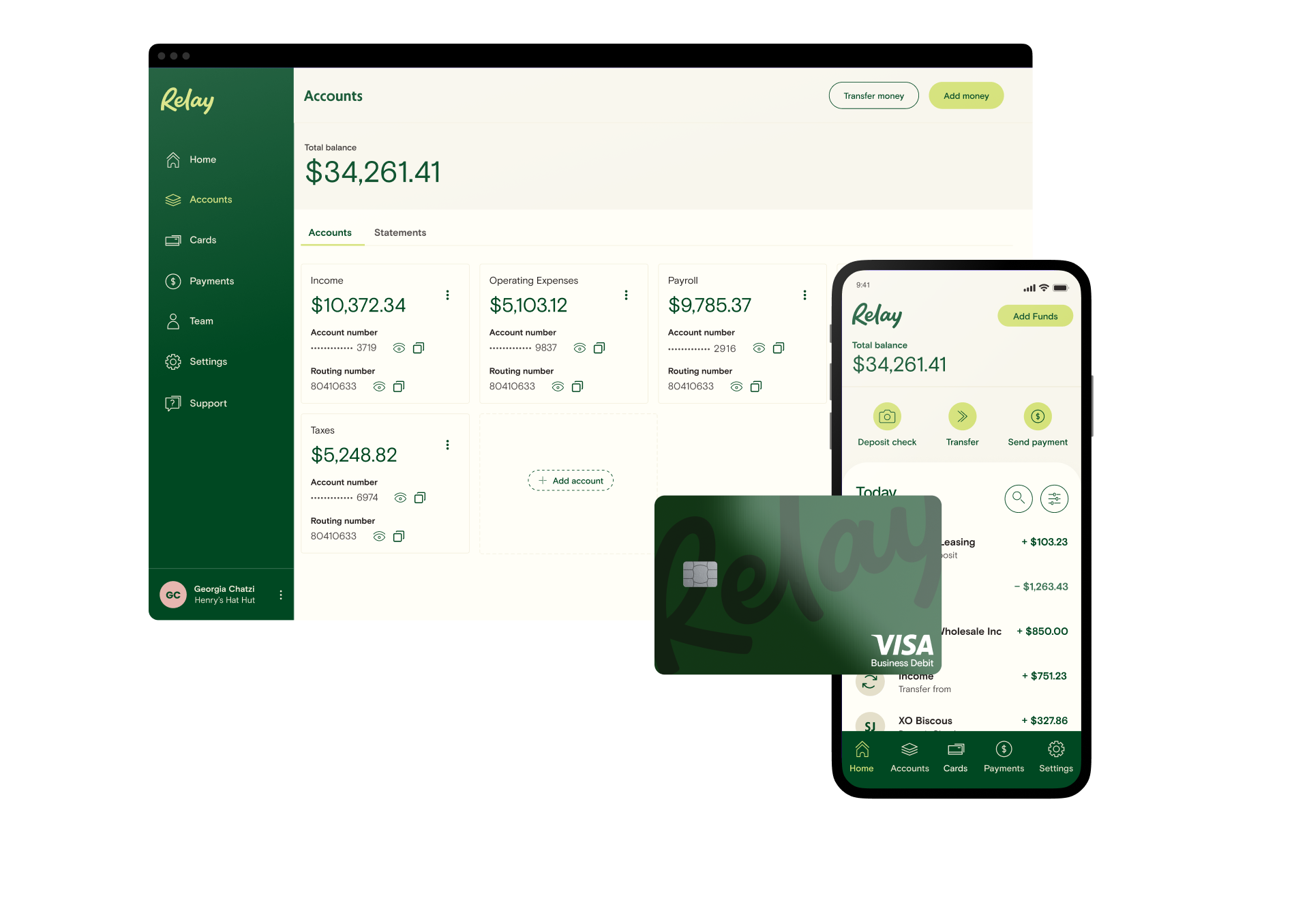

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWhat is revenue vs. profit for marketing agencies?

When discussing profit margins, it's crucial to understand the difference between revenue and profit. Revenue refers to the total amount of money your marketing agency brings in from its activities before any expenses are deducted. This is often referred to as your "top line" figure. 💸

While big revenue numbers are great for any business, profitability is what will ultimately determine your agency’s long-term success. 💡Your profit margin (AKA, the "bottom line"), takes into account all business expenses, including employee costs, overheads, and costs of goods sold (COGS).

What exactly is a profit margin?

In simple terms, a marketing agency's profit margin is the money that remains after all expenses have been paid. It’s an essential financial metric that helps you understand if your business is sustainable in the long run. Your profit margin can also show you if you need to raise your prices, reduce costs, or hire more team members.

A large profit margin means that a company is earning more than it spends, resulting in better cash flow and potential for growth. 💰 A small profit margin means that a company may be struggling to cover its expenses and could face serious financial challenges.

Gross profit vs. net profit margins

When examining your agency's profitability, it's crucial to differentiate between gross profit and net profit. These numbers will give you different insights about your agency's financial performance. 📊

Gross profit is the income left over after you deduct the direct costs associated with delivering your marketing services—like the cost of paying contractors to complete client work. This number reflects how efficiently you can transform resources (like your employees’ time) directly into income.

A consistent or growing gross profit margin means that you are effectively managing costs and have a solid foundation for your business's financial success. 🚀

Net profit, on the other hand, takes into account all expenses, including indirect costs like office space, utilities, and advertising. This number reflects how much money you actually take home after all operating expenses have been paid.

How to calculate marketing agency profit margins 📝

The average profit margin for a marketing agency is between 10-15%. That means a digital marketing agency earning $150,000 annually can expect a profit of around $22,500 per year. 💸 This kind of profit margin is key to achieving your business’s long-term financial goals.

Traditionally, you would simply subtract expenses from revenue to calculate your profit margin. However, finding a marketing agency's profit margin can be a little more complex. Depending on your business model, you'll need to add up billable hours, account for multiple revenue streams, and take a close look at the money you pay contractors and freelancers.

Here are a few tips to help you accurately gauge your marketing agency's revenue, expenses, and of course, profit margin.

Add up your revenue: This includes all the money your agency generates from its services before any costs or expenses are deducted, such as project fees, retainer agreements, or hourly rates. ⏰

Calculate your expenses: Next, sum up all the costs associated with running your agency. This should include employee salaries, overhead costs, marketing costs, and any other operational expenses. 💰

Subtract your revenue from expenses: The resulting number is your net profit. This figure will give you an idea of how much money you're making before taxes. 📝

Determine the profit margin: Last but not least, to determine your profit margin, divide the net profit by the total revenue and multiply the result by 100. This will give you your profit margin as a percentage. ⭐️

Example of a marketing agency profit margin 💸

Let's put this into perspective with a quick example. Suppose you run a marketing agency that brought in $500,000 in revenue this year. Your expenses including salaries, overhead, marketing costs, and other operational expenses amount to $350,000.

By subtracting your expenses from your revenue, you get a profit of $150,000. To calculate your profit margin, divide the net profit ($150,000) by the total revenue ($500,000) and multiply by 100. This results in a 30% net profit margin for your marketing agency for the year.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWhy marketing agencies should put profit first

We've outlined the way in which most marketing agencies calculate profit margins. But there's also another way to approach profit—and it's one of the best ways to increase your business's profit margin and improve cash flow.

The Profit First method is a cash flow management methodology where a company allocates a percentage of revenue for profit first, before paying for expenses. 💰

Profit First overturns the traditional accounting formula of "revenue - expenses = profit" by proposing a system where "revenue - profit = expenses." Instead of searching for profit at the end of each month, marketing agency owners who follow this method make a profit from day one.

For marketing agencies, adopting the Profit First model can be a game-changer. It forces you to put the focus on profit instead of only looking at revenue numbers. As a result, you'll be more disciplined with spending and ultimately, build a more sustainable business.

Example of Profit First for marketing agencies

Using the Profit First method, let's revisit the example of the marketing agency that generated $500,000 in revenue. If you decide to allocate 50% of your revenue as profit from the onset, you would immediately set aside $250,000 ($500,000 x 0.50) for profit. 🤑

You'd take this profit throughout the year as a percentage of each payment you receive from clients. Then, what's left in your bank account becomes your budget for expenses. Subtracting $250,000 from your total revenue leaves you with another $250,000 to cover all of your business expenses.

These numbers are just examples—if you can only take out 5% from each payment for profit right now, that's okay too! We all have to start somewhere. 🙌

Ultimately, Profit First is a game-changer because it puts marketing agency owners in control of their cash flow. Instead of waiting until the end of the month (or the year) to calculate their profit margin, they set aside a percentage of revenue for profit before anything else.

This helps you stay on budget, become more disciplined about spending, and as a result, consistently increase your business's profits. ⭐️

💡 Learn how Profit First helped Dan get clear on cash flow and build a thriving marketing agency

Signs your profit margin is too small

A good profit benchmark for marketing agencies is 10-15%. However, if your profit margin is near that number, but you don’t feel like you have enough to invest in your future, give yourself a well-earned bonus, or save for the future—your profits might be too small. 😕

A slim profit margin can also be a red flag that there are underlying issues at your agency. You might have hired too many people—or not enough.

Here are some signs that your profit margin is too small:

Struggling to meet payroll or hire team members: Consistently tight cash flow may signify a lack of profitability to sustain day-to-day operations. 💸

Feeling like you're not growing fast enough: If your marketing agency isn't seeing significant growth, it could be a sign that your profit margin is too small to support expansion. 📉

Overdue taxes and bills: When your revenue isn't enough to cover expenses, you may find yourself falling behind on paying taxes or other important business bills. 💰

Minimal savings: If your profit margin is too small, you might struggle to save as a business. If you don't have savings, unexpected cash flow problems can feel like emergencies—not minor inconveniences. 🚫

You're not investing in growth opportunities: A slim profit margin may restrict your ability to invest in new services, products, or technology that could propel your agency forward. 🛑

If you're experiencing any of these signs, you should take a closer look at your agency's cash flow management strategies. Remember: maximizing profitability is key to the long-term success and sustainability of your marketing agency.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreHow to boost marketing agency profit margins

Now that you have a better understanding of your agency's profit margin, let's explore some strategies to grow it. Here are some actionable tips for improving your marketing agency's profit margin:

Diversify your revenue 💸

Relying on a single service or product offering can limit your profits and leave you vulnerable to market changes. Consider diversifying your revenue streams by expanding your services, creating new products, or targeting different markets. 🎯

For example, if you provide search engine optimization (SEO) services, you could also offer PPC, email marketing, or social media services. Chances are, your clients already love working with you and would be happy to pay more for more services.

Offering more services is also a win-win for your clients, who can consolidate their marketing needs with one agency. Plus, it can help you stand out from competitors and improve client retention. 🙌

Lastly, remember that you don’t have to hire in-house employees for each new service. You can always hire freelancers on a per-project basis until you have enough clients to justify hiring a new full-time employee. Or, you can consider partnerships with other agencies. Ultimately, it’s up to you and what works best for your agency—just keep in mind that the goal is to boost your profit margin!

Streamline processes to reduce costs 💻

Manual or outdated processes can be costly and time-consuming. By automating or streamlining tasks like billing, invoicing, and project management, you can save time and money in the long run.

For example, improving employee expense management will help you stay on top of team spending, cut costs, and reduce unnecessary spending. You can also leverage automation to reduce manual entry, streamline spending requests, and generate expense reports. With the time you save, you can focus on tasks that will impact revenue growth. 📈

There are endless ways to improve your business's processes. To get started, it's always a good idea to investigate your existing systems and identify inefficiencies. 🔎 Then, you can try out a few different tools and software solutions to find what works best for your team.

💡 Starting a new agency? Learn about marketing agency start-up costs in this comprehensive guide.

Raise your prices 💰

Adjusting your prices is one of the easiest and fastest ways to boost your creative agency’s profit margins, without bringing on new clients or offering additional services.

To decide if you should raise your rates, talk to other entrepreneurs in your industry and compare your pricing and service models. Then, consider the value you bring to your clients and how much it would cost them to work with another agency.

It's also important to communicate any price changes transparently with your clients and provide a justification for the increase. Many clients will understand if you explain that the change is necessary for your business's growth and sustainability.

Implement Profit First ⭐️

As we discussed earlier, implementing the Profit First method can help your marketing agency prioritize profit. But Profit First also gives business owners greater visibility into their cash flow as a whole. 🔮

To get more clarity around cash flow, Profit First recommends that small business owners open multiple bank accounts. This is because when you only have one bank account, it can be tough to know how much money is actually available to spend—versus what's already allocated for payroll, operating expenses, and other costs.

Profit First recommends that small business owners open the following 5 bank accounts. ⬇️

Income account: for receiving client payments and any other sources of revenue

Profit account: for setting aside a percentage of revenue for profit

Owner's pay account: for money set aside to pay you as the business owner

Taxes account: for setting aside money for your business taxes

Operating expenses: for paying software expenses, vendors, and other operating costs

Most likely, you'll also want a dedicated payroll bank account for paying contractors, full-time employees, and freelancers. Depending on your agency's needs, you could even open an additional account for ad spending, printing costs, and other client campaign expenses. 💸

After you open your Profit First bank accounts, you'll need to choose an allocation percentage for each spending category. For example, you could set aside 5% of revenue for profit, 30% for owner's pay, 25% for payroll, 15% for operating expenses, and 25% for taxes.

As a marketing agency, the exact percentages you choose will depend on your business's unique budget. Remember, the most important part is to allocate something for profit each month—even if it's just 1% of your revenue.

💡 You can learn more about how to implement Profit First in this comprehensive guide.

Grow your marketing agency’s profits with Relay and Profit First

The right banking platform can help your marketing agency thrive. That's why we built Relay: to truly serve small business owners like you.

Relay is also the official banking platform for Profit First. With Relay, marketing agencies can easily implement Profit First by opening up to 20 individual, no-fee business checking accounts. Whether you’re starting your 5 Profit First accounts or need multiple checking accounts for client expenses, you can do it completely online—and for free—with Relay. 💸

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreYou can also issue 50 virtual and physical debit cards to manage team spending, earn interest on your business savings, and leverage automatic, percentage-based transfers to streamline cash flow management.

Ready to get started? Sign up for Relay today. 😎

FAQs about marketing agency profit margins

What is the average marketing agency profit margin?

The average profit margin for marketing agencies varies based on size, location, and the services they provide. However, according to research by Promethean, most successful advertising agencies have a profit margin of 15%. 💰

How often should I review my marketing agency's profit margin?

Ideally, you should review your marketing agency's profit margin at least once a month. This will help you identify any changes in revenue or expenses and make adjustments as needed to improve profitability. 💵

How can I increase my marketing agency's profit margin without sacrificing quality?

One way to boost your marketing agency's profit margin while maintaining the quality of your services is to focus on increasing efficiency and productivity. This could include automating certain tasks or investing in new tools and software. You could also consider upselling or cross-selling services to existing clients. This can bring in additional revenue without significantly increasing your workload. 🙌