Your nonprofit has a meaningful mission, passionate volunteers, and a plan to serve your community. But before you start fundraising, you'll need to open a bank account—and navigate a few nonprofit bank account rules. ⛴

Understanding these rules before you visit the bank (or apply online) will help your nonprofit save time, stay compliant, and focus on what matters most: your cause. ❤️

In this article, we'll cover:

When should a nonprofit organization open a bank account?

Small business owners need to keep their business and personal finances separate, and the same is true for nonprofits. Your organization should open a bank account as soon as possible—for most nonprofits, this will be after they incorporate and register with the IRS.

Opening a dedicated nonprofit bank account will make it easier to keep track of donations, maintain accurate financial statements, and protect your organization from fraud. Plus, it will make it easier for you to accept payments from your supporters. 💵

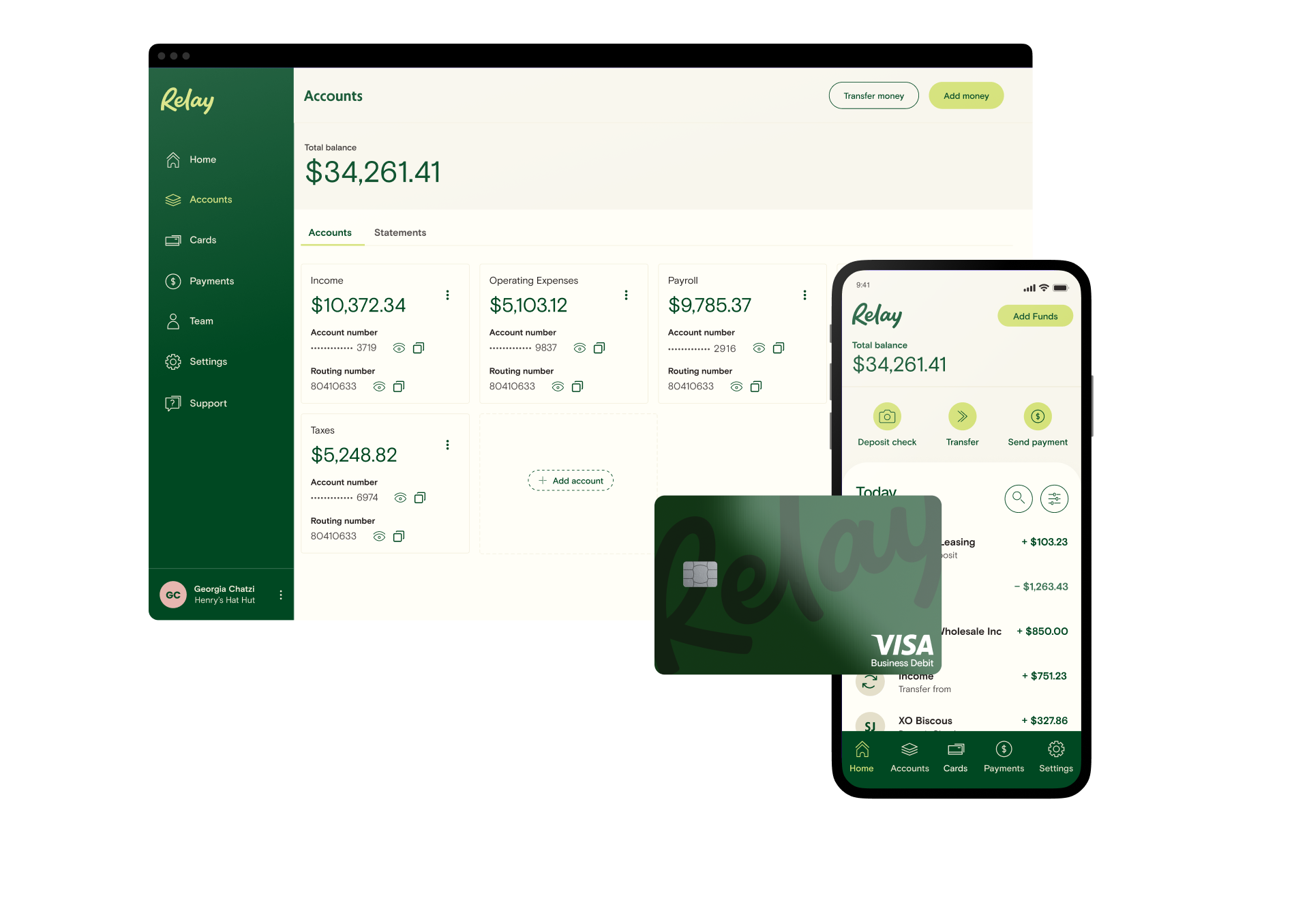

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreUltimately, the best time to open a nonprofit bank account is before you start accepting donations or spending your nonprofit’s money. That way, you can stay on top of the organization’s finances and avoid future bookkeeping headaches.

5 nonprofit bank account rules for every organization

There are over 1.5 million nonprofits in the United States, collectively generating about $2.6 trillion in revenue each year. These nonprofits are tax-exempt—but they're still considered business entities by the Internal Revenue Service (IRS). That means a nonprofit is able to open a business checking account, like any other for-profit business. 🤝

However, nonprofits need to follow a specific set of requirements when opening and managing a bank account. These policies might vary from bank to bank, but in this section, we'll cover the five most common bank account rules every nonprofit needs to know.

1️⃣ Nonprofits need to be incorporated and registered with the IRS.

Personal checking accounts are relatively easy to open, but nonprofit bank accounts come with some extra paperwork. 📝 To prove that your nonprofit is a legitimate organization and eligible for a bank account, you’ll need to complete these two steps:

File your articles of incorporation: This process involves filing your nonprofit's organizing documents with your secretary of state. Like forming an LLC for a business, a nonprofit corporation limits the founders' and board of directors' personal liability.

Apply for a Federal Employer Identification Number (EIN): Your EIN is like your nonprofit's social security number, identifying it with the IRS. To get your nonprofit's EIN, you'll just need to fill out IRS Form SS-4 online.

Your nonprofit’s EIN and incorporation are almost always required to open a business bank account. For some banks, this is all you’ll need to get started.

To make your nonprofit truly official, though, you’ll need to formalize your nonprofit’s bylaws and tax-exempt status. Though not essential for opening a bank account, these two steps will help ensure your nonprofit’s money is properly handled and taxed:

Write your nonprofit’s bylaws: These governing documents set out your nonprofit's purpose and outline day-to-day operations. Your bylaws may also cover internal controls, like how your organization will handle donations and manage spending.

Apply for your nonprofit's tax-exempt status: Nonprofits need to get 501(c)(3) approval from the IRS. However, this process can take some time. If you want to accept donations while you wait, you can still open a bank account.

Note: The IRS will retroactively recognize your tax-exempt status if your 501(c)(3) application is approved. However, if it’s denied for any reason, donor contributions won't be considered tax deductible. ⚠️

2️⃣ Nonprofits need to define at least one person as the account owner.

When you open a business or nonprofit checking account, the bank will need to know who is responsible for managing it. This person is known as the “account owner” or "signer" and they are authorized to handle your nonprofit's money.

The account owner might be one of your board members, an executive director, or a treasurer. Whoever you choose, make sure they understand their responsibilities and can be trusted to act in your nonprofit's best interest. 🙏

Who should have access to my nonprofit’s bank account?

The account owner is the main person who will have access to your nonprofit’s money. They will be able to make transactions, sign checks, and receive account statements. However, remember that the funds in your nonprofit's bank account are the property of the organization, not the account owner. 🙅♀️

But what if other people need to log into your nonprofit’s bank account? Larger nonprofits might have an entire team dedicated to managing donations or accounts payable. Even small nonprofits may want to grant access to an accountant or bookkeeper.

Unfortunately, most banks only provide one set of login credentials for the account owner—and while getting help with your finances is always a good idea, sharing your password isn’t. 🔐🚫

If someone needs access to your banking information, you’ll have to download your bank statements and share them manually—or you can find a banking platform that allows you to create individual, role-based logins.

With Relay, your nonprofit can open multiple, no-fee business checking and savings accounts. Then, you can securely invite collaborators with different levels of access. For example, you could give your nonprofit board read-only access or allow your treasurer to send certain types of payments.

3️⃣ Nonprofits may need to maintain a minimum balance.

Most financial institutions require that you keep a minimum balance in your business checking account. If you don’t, you’ll be charged a monthly maintenance fee. 💰

However, some banks and credit unions will reduce or waive the minimum balance requirement for nonprofits. You might just need to provide additional paperwork proving that you’re a tax-exempt organization.

If you want to avoid minimum balance requirements altogether, online banking platforms are a great option. For example, Relay doesn’t charge maintenance fees, overdraft fees, or require a minimum balance. 🙌

💡Learn more in our comprehensive guide to digital vs. traditional banks

Of course, it’s always a good idea to have some cash in your nonprofit reserves. But if you’re in between fundraising periods or working with a smaller budget, finding a bank without a minimum balance requirement can help you save on unnecessary costs and monthly fees.

4️⃣ Banks must report large cash transactions.

Sometimes, nonprofits have to make big cash deposits or withdrawals. Maybe you hosted a successful fundraising event or need to pay an expensive vendor. Either way, your transactions might be affected by the following nonprofit bank account rule. ⬇️

Under the Bank Secrecy Act, banks need to report any cash transactions over $10,000 to the IRS. Because of this, your bank might require you to fill out additional paperwork for large transactions.

Fundraising campaigns can trigger this reporting requirement, so make sure you notify your bank in advance if you expect to receive cash donations of any significant size. 📣 It's also extremely important to keep accurate records of any cash deposits or ATM withdrawals, no matter the amount.

If the bank (or the IRS) does find a reason to take a closer look 🔎at your finances, you'll want to have detailed financial reports to prove that your transactions are legitimate and aligned with the purpose of the organization.

5️⃣ Nonprofits need to keep detailed banking and financial records.

Every organization should keep detailed financial records, but it’s especially important for nonprofits. This is because tax-exempt organizations with over $50,000 in gross receipts must fill out IRS Form 990 each year. 🗃

Note: There are some exceptions. To find out if your nonprofit needs to fill out Form 990 with your tax return, check out the IRS requirements here.

Form 990 gives the IRS a complete overview of your organization’s activities and financial data—and it’s critical for maintaining your nonprofit status. You will need to include a detailed list of your expenses, revenue, liabilities, assets, and tax deductions.

If you keep detailed banking and financial records, filing Form 990 will be a lot easier. Plus, you’ll be prepared if your organization is ever audited. ✅

It can be tough to keep up with your nonprofit’s bookkeeping, but online banking platforms like Relay can help. 📊 Relay’s accounting integrations allow you to sync detailed transaction data directly into QuickBooks Online or Xero.

This helps your bookkeeper quickly reconcile transactions each month, so your financial records are always up to date. Whether you’re filing Form 990 or dealing with an unexpected audit, you’ll be ready. 🙌

⭐️ Learn how nonprofit bookkeeper Ufuoma Ogaga stays audit-ready with Relay.

Choosing the best bank for your nonprofit

With the right banking partner, your organization can navigate these nonprofit bank account rules with ease. So how do you find the best bank for your nonprofit? 🧐

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreFirst, you should evaluate what your nonprofit needs. Maybe you want to avoid monthly fees, give your team role-based logins, or simplify bookkeeping with account integrations. This banking “wish list,” will help you compare your options and make the right choice for your nonprofit. 🏦

Ultimately, the right bank for your nonprofit will help you keep your money safe, stay on top of cash flow, and fulfill your organization’s mission. 💪

Relay: the cash flow clarity your cause deserves

At Relay, we help nonprofits simplify bookkeeping, securely collaborate with their financial advisors, and stay on top of spending. From no-fee checking and savings to powerful accounting integrations, Relay is uniquely built to serve nonprofits.

Here are a few more reasons why nonprofits love banking with Relay:

✅ Open 20 individual checking accounts: Organize income, expenses, and cash reserves with multiple checking accounts. You can create individual accounts to set aside grants, budget for day-to-day operating expenses, and beyond.

✅ No account fees or minimum balances: With no monthly fees, overdraft fees, or minimum balance requirements, Relay helps nonprofits avoid unnecessary costs.

✅ Automated savings: Relay helps you add more breathing room to your budget with automatic savings. Plus, you’ll earn 1-3% APY* on every dollar.

✅ Entirely online banking: Open checking and savings accounts, issue debit cards, and send and receive payments completely online—no in-person branch visits required.

✅ Advanced security measures: Feel safe knowing your money is protected by FDIC insurance provided through Thread Bank. Plus, all debit cards are covered by the Visa® Zero Liability Protection Policy.

✅ 50 virtual or physical debit cards: Create new debit cards for specific projects and expenses, and get instant access to virtual debit cards for online and mobile payments.

✅ Built for teams: Relay lets you set debit card spending limits and receive detailed data for all team spending. You can also invite your accountant, assistant, and other team members to Relay with secure, role-based logins.

✅ Streamlined bookkeeping: Relay allows you to sync detailed banking data directly into QuickBooks Online or Xero, making bookkeeping a breeze.

Ready to get started? It just takes ten minutes to apply online. Sign up for Relay here!