America's 1.5 million nonprofit organizations are at the heart of our communities, from supporting arts and culture to providing essential services for people in need. ❤️ To successfully deliver these programs—without running out of resources—effective nonprofit budgeting is key.

According to the National Council of Nonprofits, about 8% of 501(c)(3) organizations manage budgets of over $1 million per year. However, most nonprofits are community-based and work with smaller budgets of less than $500,000 annually.

No matter the size of your organization, it can be tough to strike a balance between program spending and donor funding. Creating a detailed nonprofit budget will allow you to reach your goals, fulfill your mission, and most importantly, serve your cause and community. 🙏

In this article, we'll cover:

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowWhat is nonprofit budgeting?

The primary purpose of nonprofit budgeting is to ensure that the organization can meet its goals without running out of money. It involves tracking where your funds are going and identifying areas where you may need to cut back or raise more money.

At the end of the budgeting process, you should have a detailed financial plan outlining the organization’s revenues and expenses. 💰 This nonprofit budget will help you understand what your organization needs to run smoothly and allocate resources effectively.

Operating budgets vs. program budgets 🤔

Nonprofits use an operating budget to track revenue from various funding sources and allocate expenses for both programs and overhead costs. Usually, this annual budget is created once per year and reviewed on a monthly or quarterly basis. 📆

Your organization might also have multiple project budgets to plan for different programs, like fundraising initiatives and community outreach. If each program your nonprofit runs has a specific funding source, individual program budgets can help you track related spending more closely. 🔎

You may want to create both types of budgets to help your team stay on track and avoid overspending. For even more detailed planning, you can also create a capital budget (used for long-term projects) and various grant budgets (for defining how you’ll use funds if your grant proposal is accepted).

With so many different revenue sources and expenses, it can be tough to manage your nonprofit budgets. That’s why Relay (that’s us! 👋) helps nonprofits organize cash across multiple checking accounts. Our online business banking and money management platform allows nonprofits to open 20 individual checking accounts for program budgets, operating expenses, and beyond. Learn more here.

Sample budget for nonprofit organizations

All nonprofit budgets, regardless of the organization's size, share the common goal of effectively managing resources to fulfill their mission. 👥 💸

But what does nonprofit budgeting actually look like in practice? Here’s a very basic example—but remember that your organization’s budget might be more complicated than this (or maybe even simpler!).

Expenses:

Salaries & Benefits: $80,000

Rent & Utilities: $20,000

Professional Services: $10,000

Supplies & Materials: $2,500

Revenues:

Donations and Grants: $120,000

Fundraising Events: $10,000

Program Fees: $5,500

This example shows the estimated expenses and revenues of a nonprofit organization that runs community programs. The organization has planned to spend $102,500 on operations and projects (expenses) and expects to raise $135,500 through donations, fundraising events, and program fees (revenues).

📊 Relay’s nonprofit budget template comes with a more detailed sample budget. Check it out here!

Ultimately, remember that your budget should categorize revenue by different funding sources and your expenses by program vs. overhead costs.

5 steps to nonprofit budgeting 💰

When it comes to nonprofit budgeting, the planning process should start at least three months before the start of the next fiscal year. This will give your nonprofit board of directors plenty of time to review and approve the final budget. ✅

Most likely, your organization's executive director will lead the budgeting process, but a nonprofit accountant can also provide support. Larger nonprofits might even create a budget planning committee.

No matter who's in charge, nonprofit budgeting can be overwhelming. Here's your step-by-step guide to creating an effective and sustainable budget to fulfill your organization's mission.

1. Evaluate your organization's financial health 🔎

Before you can develop an accurate budget, you'll need to gain a clear understanding of the nonprofit's financial situation. This will require examining your past budgets, current assets and liabilities, cash flow, and fundraising performance.

Here are a few questions to guide you through the process:

What are your nonprofit's current annual revenue and expenses?

Were any expenses in the previous year unnecessary?

How accurate were your revenue projections last year?

How much money do you have in reserve?

Is your donor base consistent or growing?

Does the organization have any liabilities or debt?

Delving into your organization's financial reports is crucial during this process. Your nonprofit's accountant (or your accounting system) can help you analyze balance sheets, income statements, and cash flow statements to get a comprehensive picture of financial health. 📈

2. Set effective financial goals 🎯

To create an effective budget for your nonprofit, financial goals are a must. From hiring new team members to launching new programs, it’s crucial to clearly define how much cash your organization needs to act on its strategic plan. 📊💰

The best way to do this? Make your goals SMART—specific, measurable, actionable, relevant, and time-bound. That means you might have to do some research during this phase. If you want to move into a new office space this year, you can estimate the rent. If you want to hire a new marketing director, you can look up salary trends to discover how much you need to pay them.

Let's say your team is setting a goal to increase donations. Here's how you might make this a SMART financial goal:

"Our nonprofit will increase overall contributions by 20% by the end of 2024 through partnerships with local businesses and corporate sponsors."

Vague goals are hard to achieve and can confuse your team. But when your goals are SMART, your entire organization will be able to stay focused, accurately measure results, and properly prioritize funding. 🙌

3. Estimate your nonprofit's income 💸

By now, you've created a solid foundation for a super-effective nonprofit budget. The next step is to forecast your organization's revenue for the upcoming year. This can be challenging because, unlike for-profit businesses, nonprofits rely on a wide variety of funding sources.

Whether your nonprofit relies on foundation grants, program ticket sales, or corporate contributions, it can be tough to predict revenue. However, that doesn't mean it's impossible.

Here are two common ways to estimate your nonprofit's income.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register Now🏷 The discount method

With this approach, you determine the anticipated funding from each fundraising source by multiplying the expected amount with the corresponding probability percentage.

For example, if you are seeking a $10,000 grant with a 75% chance of being awarded, adjusting the revenue forecast to $7,500 accurately reflects the projected income.

✂️ The cutoff method

Instead of predicting revenue by individual grants or line items, the cutoff method looks at revenue as a whole. To use this method, simply calculate the projected fundraising revenue by multiplying the estimated total amount with the probability estimate.

For example, if you have a strong fundraising track record and anticipate an 80% chance of achieving the predicted $100,000 revenue goal, the forecasted amount would be $80,000.

Forecasting revenue isn't easy, especially for nonprofits. If you're managing a multiple six- or seven-figure budget, asking a financial expert for help is always a good idea.

4. Calculate your nonprofit's expenses 📊

Knowing what you want to accomplish and how much money is available, you can now create your expense budget. This is one of the most essential aspects of nonprofit budgeting.

Start by separating expenses into two distinct categories: program expenses (the actual services provided) and overhead (administrative costs that aren't directly related to service delivery). Then you can break down each category into subcategories like staff, rent, supplies, transportation, and so on.

Here are a few more tips to help you calculate expenses. ⬇️

Review historical data: Look at the previous year's budget and actual expenditures to understand patterns. Have you overspent consistently in certain categories? How much do you need to set aside for the cost of fundraising efforts?

Factor in inflation: Be sure to account for the rate of inflation when calculating future expenses. This is especially relevant for costs like utilities, supplies, and rent.

Plan for the unexpected: Make sure to leave some breathing room in your budget—and if you don't have operating reserves set aside for slow fundraising periods, consider adding a budget line to build your savings.

Collaborate with your team: Gather feedback from staff members who are directly involved with the different programs or departments of your nonprofit. They'll be able to provide valuable input on potential expenses.

You might not be able to predict what your donors give, but you can control a lot when it comes to spending. 💸 If you're feeling overwhelmed, try using your goals to prioritize expenses—and remember, you can always increase spending if you're able to raise more revenue later in the year.

5. Approve and implement your nonprofit budget 📝

Congratulations! You've created a comprehensive operating budget that will help your nonprofit succeed. Now all that's left to do is share a proposal budget with your board members, get their approval...and implement it. 🥳

Here are a few tips for successfully implementing your budget:

🗣 Communicate, communicate, communicate

Make sure staff members are aware of the budget and why it exists. Explain to them how it ties into your organization's goals and mission. Emphasize how each person's role in helping the team adhere to the budget is actually contributing to a larger purpose—the success of your nonprofit! 🤩

But don't stop there: continue to frequently communicate with your team, board of directors, and other stakeholders to make sure everyone is on the same page regarding the budget.

💡 Review the budget regularly

At least once a quarter (but ideally bi-monthly or monthly), compare actual expenditures against the projected budget to make sure your nonprofit is on track.

This is especially important during periods of rapid growth or shifts in strategy. As your organization changes, you may need to make adjustments. Remember: a good budget is a flexible budget, whether that means increasing expenses because you received more income, or being able to cut back during tough times.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register Now💸 Leverage money management tools to stay on budget

To truly stick to your budget—and ensure you have enough money to fulfill your nonprofit's mission—you need an efficient way to manage cash flow and organize spending. Relay is an online banking and money management platform that can help you (and your team members) avoid overspending, get clear on income, and simplify financial management.

Here’s how nonprofit leaders stay on budget using Relay:

Organize cash across 20 free business checking accounts: Create individual accounts to set aside grants, budget for day-to-day operating expenses, and beyond. At a glance, you’ll be able to understand how much money you’ve allocated for every spending category.

Build nonprofit reserves with auto-savings and 1-3% APY*: Prepare for a rainy day (or an exciting long-term project) with Relay’s no-fee, interest-bearing savings accounts. Plus, reach your goals faster with automated savings.

Set spending limits on 50 virtual or physical debit cards: You can issue debit cards for specific projects, programs, expenses, and team members. Then, set spending limits to stay on budget, all the time.

Delegate and collaborate with role-based logins: Whether you’re ready to delegate financial activities or need to collaborate with your bookkeeper, Relay makes it easy—and secure. Just invite your team members to Relay and assign them a specific role with specific permissions. No more sharing logins via email!

Get started with a free nonprofit budget template

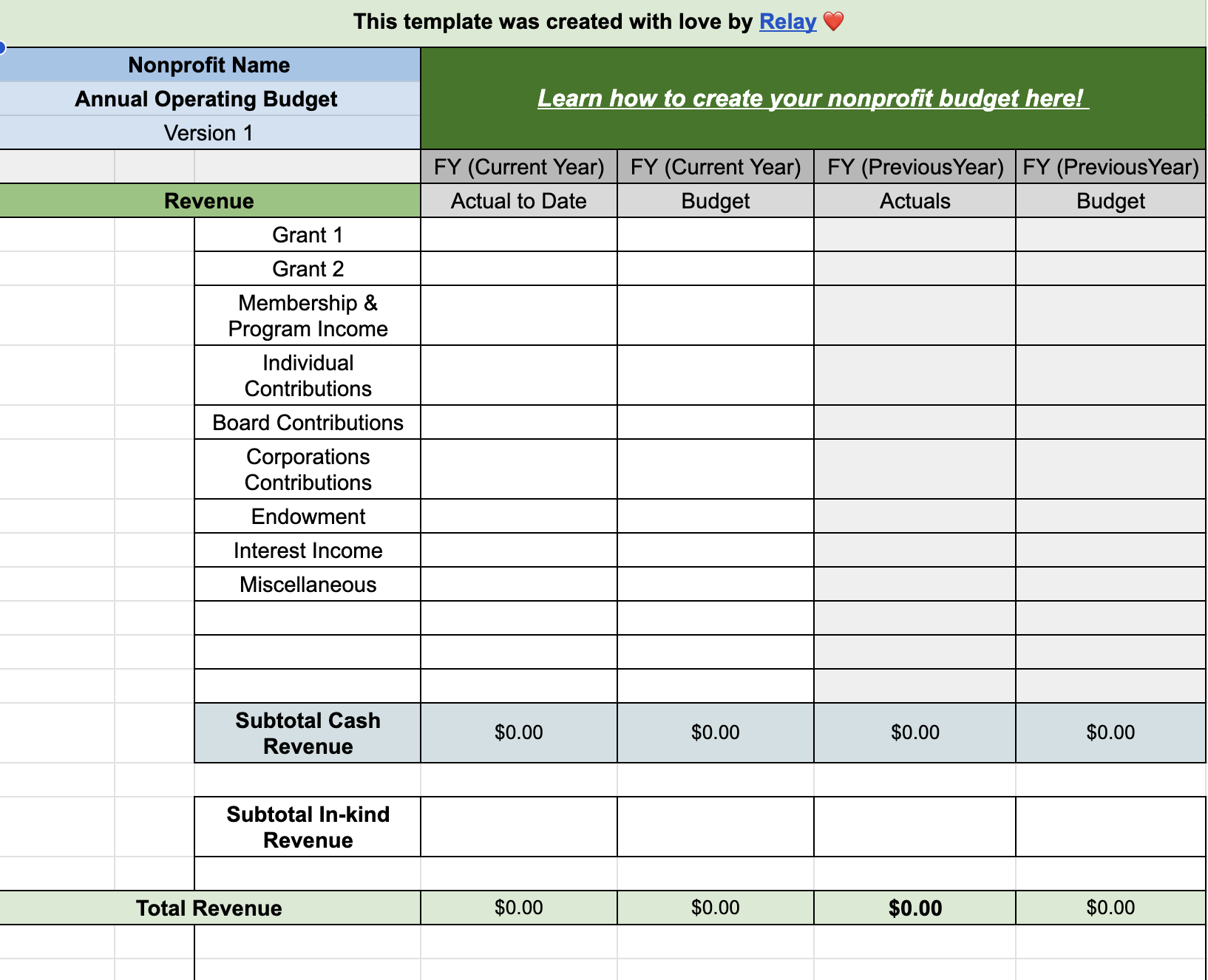

Creating a budget from scratch can be daunting. To get started, you can use our free nonprofit budgeting template. Just click here to access it in Google Sheets. 💻

This budget template is designed to help nonprofits quickly and accurately estimate operating expenses while creating a plan to reach their goals in the new year. Every nonprofit is unique, so feel free to adjust the categories and templates to fit your needs.

Nonprofit budgeting can be tough, but by following these steps, you can set SMART goals, accurately estimate income, and calculate your expenses. And don't forget—you can make implementing your budget a breeze with Relay. You've got this! 🙌

The cash flow clarity your cause deserves

Relay is an online business banking and money management platform that offers no-fee business checking and savings accounts. We've already talked about managing your budget with Relay, but we know nonprofit financial management doesn't stop there.

Here's why nonprofits love using Relay to get crystal clear on cash flow, spending, and saving:

✅ Open 20 individual checking accounts: Organize income, expenses, and cash reserves with multiple checking accounts. You can create individual accounts to set aside grants, budget for day-to-day operating expenses, and beyond.

✅ No account fees or minimum balances: With no monthly fees, overdraft fees, or minimum balance requirements, Relay helps nonprofits avoid unnecessary costs.

✅ Automated savings: Relay helps you add more breathing room to your budget with automatic savings. Plus, you’ll earn 1-3% APY1 on every dollar.

✅ Entirely online banking: Open checking and savings accounts, issue debit cards, and send and receive payments completely online—no in-person branch visits required.

✅ 50 virtual or physical debit cards: Create new debit cards for specific projects and expenses, and get instant access to virtual debit cards for online and mobile payments.

✅ Your security is our top priority: Feel safe knowing your money is protected by FDIC insurance. Plus, all debit cards are covered by the Visa® Zero Liability Protection Policy.

✅ Built for teams: Relay lets you set debit card spending limits and receive detailed data for all team spending. You can also invite your accountant, assistant, and other team members to Relay with secure, role-based logins.

✅ Streamlined bookkeeping: Relay allows you to sync detailed banking data directly into QuickBooks Online or Xero, making bookkeeping a breeze.

If you’re ready to bank with Relay, you can make the switch in 3 easy steps: open your account (completely online), transfer deposits, and move your payments. Plus, with our in-app switching tool, you won’t have to worry about leaving any transactions behind.

To get started with Relay for nonprofits, sign up here. 😎