How so? Operating profit tells you how efficiently you’re running your business. How much money do you have left over after all the necessary expenses of running your business are deducted? The operating profit formula helps you figure out this number. It’s arguably one of the most important accounting formulas a small business owner should understand. Let’s explain why.👇

What is operating profit?

Operating profit, or operating income, is the amount of money your business earns after you deduct all the costs required to keep your business running. This includes the direct costs to create the goods or services that you sell, operating costs (for example, the salaries you pay your productions staff), and any long term investment expenses (for example, heavy machinery) that show up as depreciation and amortization on your income statement.

Simply put, operating profit is the money that your business makes from running the business. That means it excludes money made from other sources such as stock investments or real estate. A positive operating profit means that you’re running your business efficiently. 📈

Operating profit is often mistakenly called earnings before interest and taxes or EBIT, but it’s important to note that the two are not synonymous. 🙅 The main difference between operating profit and EBIT is that operating profit only takes into account earnings generated from business operations, whereas EBIT includes non-operating income such as dividends and capital investments. Operating profit is a generally accepted accounting principle whereas EBIT is not.

The operating profit formula and how to calculate it

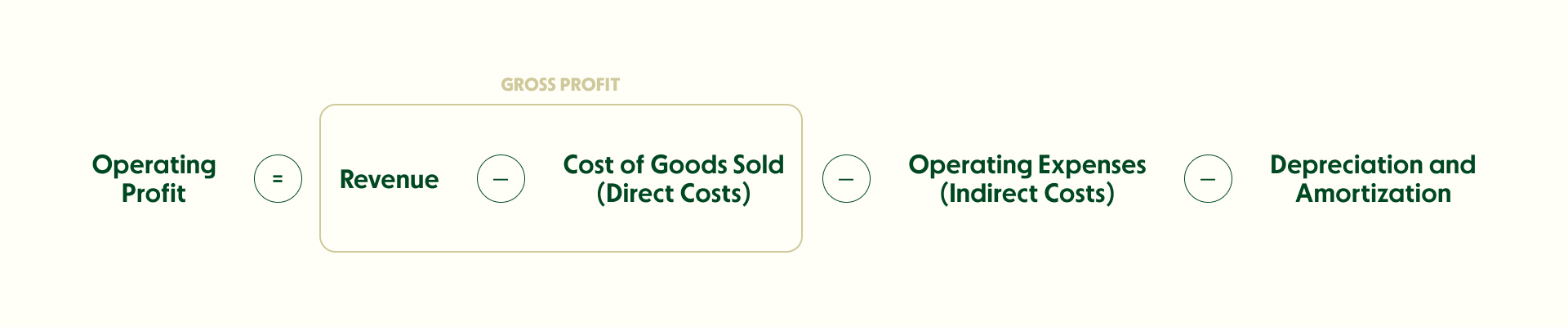

Operating profit is calculated using the following formula:

Operating Profit = Gross Profit (Revenue - Cost of Goods Sold) - Operating Costs - Depreciation - Amortization

Now what exactly does each variable in this formula mean? Let’s break it down. 🔍

Gross profit

Gross profit is total revenue minus the cost of goods sold. It’s the total profit your company keeps after subtracting the cost of materials 🪨 and labor directly associated with producing a product.

Cost of goods sold

Cost of goods sold (COGS) are expenses related to the cost of producing goods or services. They are also commonly referred to as direct costs as they are expenses that relate directly to the creation and production of a product or service.

Examples of COGS or direct expenses include:

🪨 Raw materials, parts, supplies

💪 Labor employed to directly manufacture a product, such as factory workers or machine operators

💧 Utilities associated with the production of products or services

🚢 Shipping costs for sending product or service to market

📃 Commissions or professional fees — specifically in service-oriented businesses such as insurance, real estate, consultancies and law firms

Operating costs

Operating costs or indirect costs are expenses associated with critical operational activities, but not directly related to the manufacturing or purchasing of goods or services.

Examples of operating or indirect costs include:

💰 Salaries and wages (other than direct labor for production employees)

🏢 Rent and maintenance for offices

💧 Utilities

🏦 Banking or accounting fees

📚 Office supplies

💻 Software or technology subscriptions

📊 Marketing expenses

💲 Insurance

🌎 Travel costs

🚗 Vehicle expenses

Depreciation

Depreciation is used to spread the cost of an asset over a specific period of time and is commonly used for large fixed assets such as buildings 🏢, offices, equipment, machinery, vehicles 🚗 and furniture.

Let’s illustrate this with an example. Imagine your business buys a company vehicle for $100,000 and plans to use it over the course of 10 years. Instead of paying for the car in one month at $100,000 and potentially plunging the company into the red for that month, you can depreciate the cost of the car over its useful life and pay it off over 10 years at $10,000 annually.

If you’re a small business, depreciation is an annual tax deduction that allows you to recover the cost of these large expenses. The reason assets are depreciated over a long-term period is to help better match the cost of the equipment with the revenue generated from that equipment over a given period of time. This helps give you not only track the usage of your physical assets but also gives you a heads up of when you need to replace it.

Amortization

Amortization is a method used to spread the cost of intangible assets like trademarks, patents or other forms of intellectual property over time.

If your company applies for a patent and the entire process costs $150,000, given the current 20-year patent term in the United States, the annual amortization would cost $7,500.

What to exclude when calculating operating profit

Alright, so we’ve covered what’s included in the operating profit formula, now here are some things to exclude 🚫:

Income from the sale of physical assets such as real estate

Debt obligations

Investment income from stakes in other organizations

Gains or losses due to changes in accounting strategies

Taxes

Interest

Since operating profit represents the profit of your business without the impact of taxes, debt or capital, they are all excluded from the formula.

Operating Profit vs. Gross Profit vs. Net Profit

Operating profit differs from gross profit and net profit, but it can be derived from them and vice versa — here’s how they’re related to one another.

💰 Gross profit is revenue minus the cost of goods sold.

💰 Operating profit is the money you make after paying for all expenses except for interest. A positive operating profit shows that your business is well run from an operational perspective, and is a good indication of whether your company is able to pay its debt and earn money.

💰 Net profit is the money you make after paying all expenses and taxes.

What does the operating profit formula tell you?

Operating profit is an accurate indicator of a business’ health because it only includes expenses that are necessary to keep a business running. It measures the demand for the company’s products or services (sales) and how efficiently a company can deliver those products or services (costs).

If your business turns a positive operating profit, it means you’re efficient at controlling costs and you’re likely to turn a positive net profit as well. Generally, when operating profit increases, the operating profit margin rises with it. 📈

The relationship between operating profit and operating profit margin

Operating profit margin is a profitability ratio that measures a company’s ability to generate profit. 💰

You can calculate operating profit margin with the following formula:

Operating Profit Margin = [Operating Profit/ Sales Revenue] x 100

Your company’s operating profit margin is a good indicator of how well it’s being managed and how efficient it is at generating profits from sales. 👏 A downward trend in operating profit margin is a healthy sign as it shows that costs and expenses are rising faster than sales.

Looking at your past operating margins is a good way to gauge whether your business’ performance has been getting better or worst. 📊 Calculate your operating profit margin for previous reporting periods, and you’ll see both the direction of change (positive or negative) as well as how great a change it was.

_________________________

And there you have it! ✨ The not-so-secret operating profit formula is a key metric that can help your business gain better insight 👀 into your profitability. You should have a better understanding of all the variables in it and how to calculate operating profit for your own business needs.

If you are a business owner looking to learn more about business budgeting, check out our blog to learn more.

![Operating Profit Margin = [Operating Profit/ Sales Revenue] x 100](https://images.ctfassets.net/49ge8pf5w0bo/2JY2oWdBfQfuzaQjGN1pNp/b8aaf8902885c03ade23ebd45232eba5/Business_Banking_Blog_Header_-_Operating_Profit_Formula_1.3.jpg)