Today we’re introducing receipt management to Relay, giving you the tools to capture and store receipts right within your existing business banking platform. Here’s how to save time, streamline your workflows, and stay audit-ready by centralizing receipt collection in Relay.

Searching through empty pockets. Rummaging through overflowing drawers. Picking crumpled papers out of wastebaskets. Hoping that maybe, just maybe, you’ll find the receipt your bookkeeper has been emailing you about all week.

It’s not just you. Collecting, organizing, and reconciling receipts is a pain. Add in a handful of employees charging business expenses to company cards (because let’s face it, the reimbursement rigmarole is no better), and staying on top of those receipts goes from painful to downright agonizing. You’d be forgiven for wanting to ignore the problem entirely—why save receipts when you can just convince yourself they’re not actually that important? But you can’t escape one undeniable fact: capturing receipts is one of the most important things you can do to protect the financial health of your business.

That’s why we’ve launched a suite of receipt management tools that will save you time, put an end to chaotic and inefficient receipt “systems” (so long, shoebox!), and eliminate an expensive extra tool from your swelling list of subscriptions. It’s all part of our mission to keep you in control of your money with an unparalleled level of insight into your spending. Here’s what’s launching, and what it means for your business.

Set a receipt policy, and never lose a receipt again

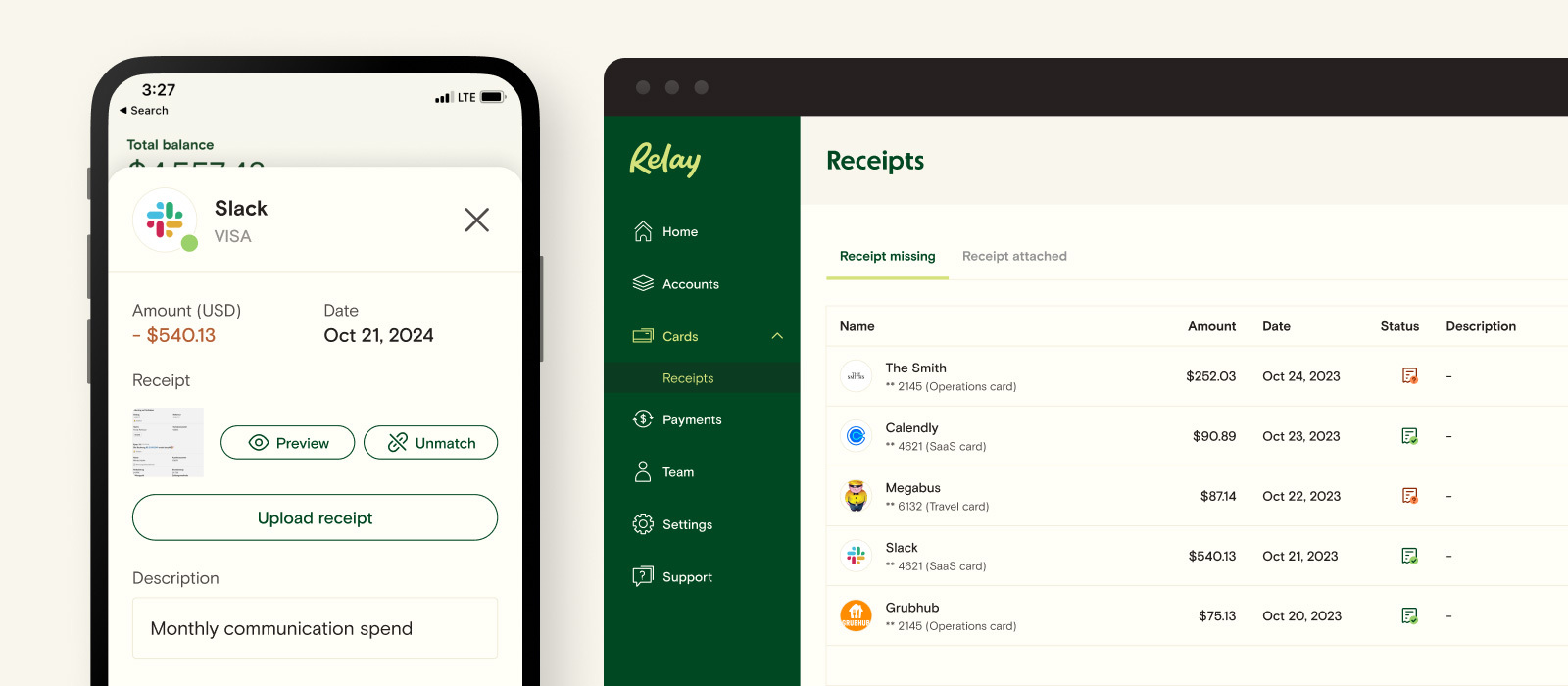

Forget chasing down employees for receipts, or slogging through endless pages of transactions trying to match a receipt to the right purchase. You can now ensure that every expense is accounted for by setting a receipt collection policy for your Relay debit cards. Simply decide which transactions you want a receipt collected for, and we’ll enforce the policy for you.

Account admins have two options when setting a receipt collection policy:

Requiring a receipt for all purchases

Requiring a receipt only for purchases over $75 (IRS rules stipulate that travel and vehicle expenses under $75 don’t require a receipt to claim—but it’s still good practice to hang on to your proof anyway!)

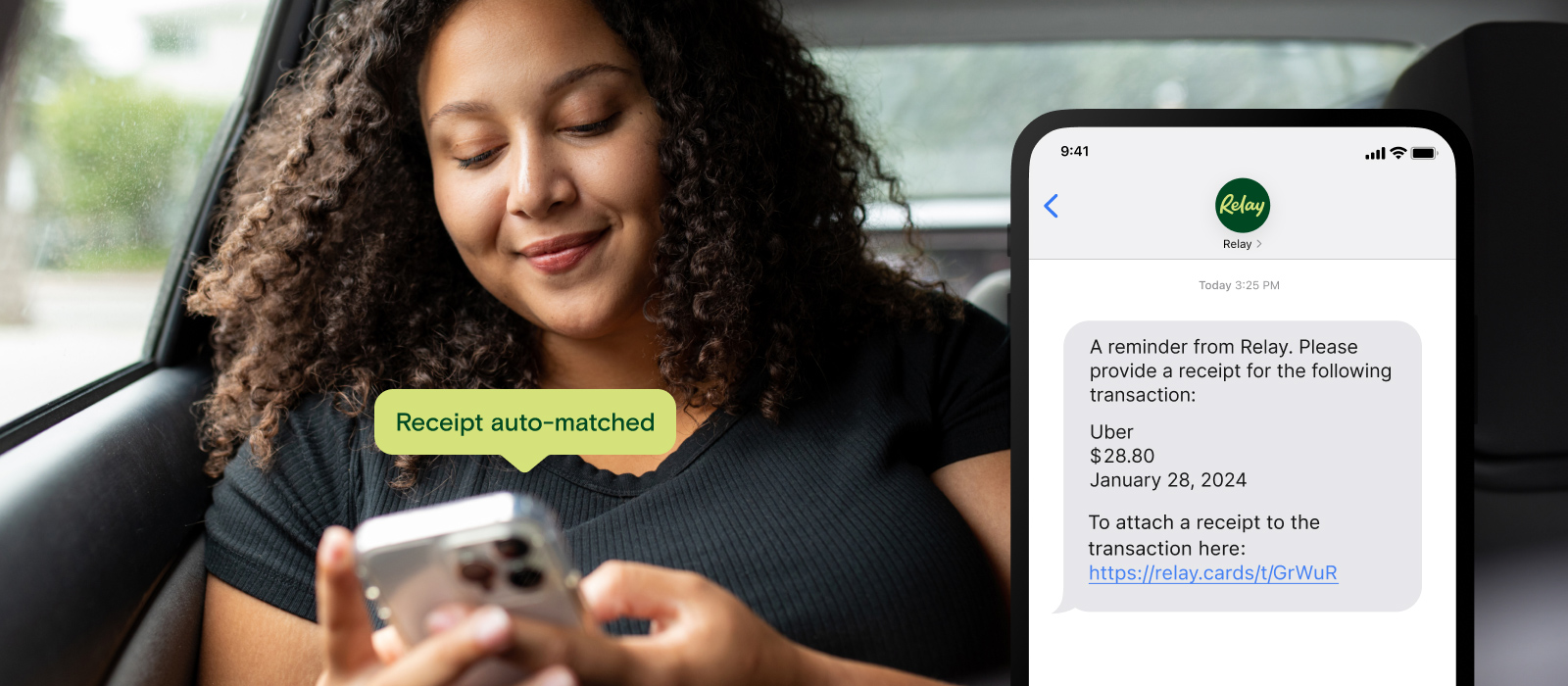

With a receipt collection policy turned on, team members who make a qualifying in-person purchase with their Relay card will immediately receive a text message informing them that a receipt is required. In other words, you can stop hounding your employees to keep all their receipts for business expenses…because we’ll do it for you.

Emily Ubered uptown to catch up with a client over coffee?

📳 RECEIPT REMINDER!

Tony topped up the tank of his truck while on his way to the worksite?

📳 RECEIPT REMINDER!

You get the idea. After all, the best time to collect receipts is right when a purchase happens, not in a mad scramble at the end of the month. Our reminders help make that happen—and you and your team build better financial habits along the way.

Upload receipts in a snap for safe storage and easy access (forever)

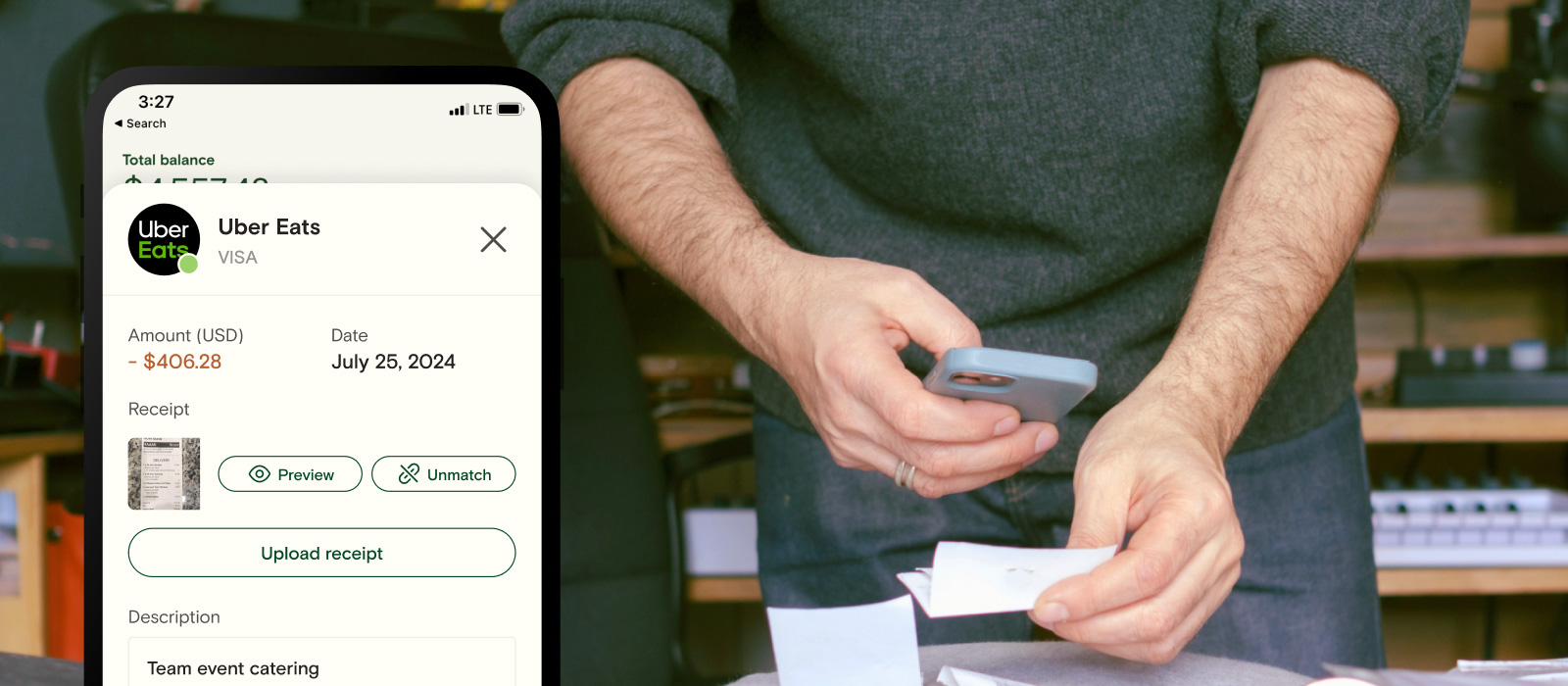

Of course, a receipt collection policy is only as good as your ability to capture them. That’s why we’ve made it a snap for you and your team to add receipts to Relay. For in-person purchases, cardholders can take a photo of their paper receipt and upload it in one of three ways:

Right from their phone using the Relay app

Dragged and dropped to the desktop version of Relay from a PC

Emailed to a dedicated receipt upload email address (think ‘yourbiz@receipts.relayfi.com’)

Email forward receipts to make digital collection a breeze

We haven’t forgotten about digital invoices, either; they can be forwarded to your dedicated receipt email address as well, ensuring they’re safely stored with all your other receipts instead of forgotten in the depths of your inbox. And to make things really easy, you can even have your invoices for recurring digital subscriptions automatically sent to Relay by setting your receipt forwarding address as the billing contact. 🤯

The best part? When your freshly-uploaded receipt lands in Relay, we’ll automatically match it to the relevant transaction in your account, no manual input required. In short: those tedious hours spent matching receipts to transactions are officially behind you.

Any transaction that’s missing a receipt will also be clearly listed in your Relay account, with all the relevant information attached (including who made the purchase and why). That way, you or your advisors will always know which transactions still need a receipt…and which employees need a little extra nudge.

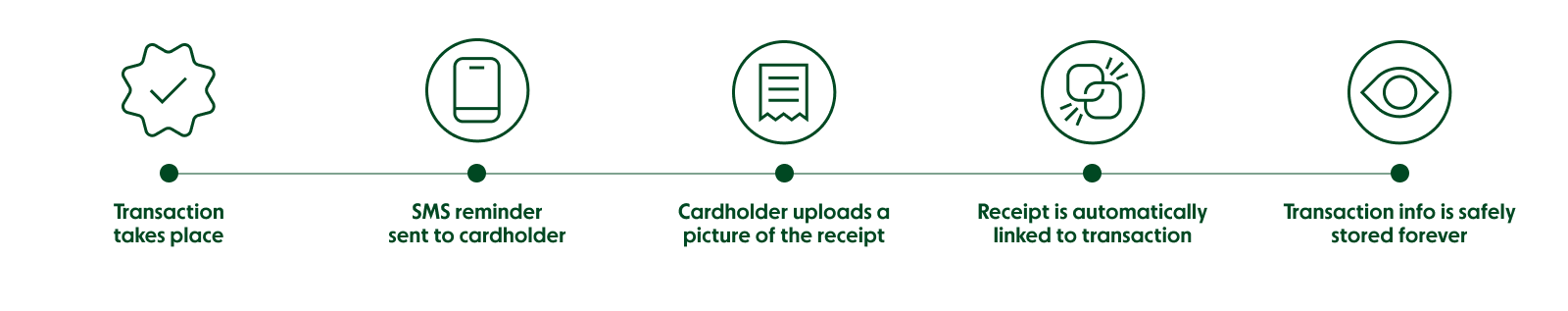

Time for a quick recap so far:

We’ll let cardholders know when they need to send a receipt to Relay

They can snap a picture of the receipt and upload it in seconds

The receipt is magically linked to the relevant transaction in your account

It’s safely stored, and accessible in just a few clicks…forever

Every purchase detail can be found in your Relay account, no paper receipt required

A new way to manage expenses, no extra tools or messy reimbursements required

Most business owners fall into one of two camps when it comes to managing employee expense workflows:

The 'use-a-chaotic-and-jerry-rigged-system-of-shoe-boxes-or-Google-Drive-folders-to-manage-receipts-and-invoices' camp

The 'throw-money-at-the-problem-and-pay-for-an-expensive-tool-to-manage-everything' camp

Needless to say, neither are great options. But with Relay, you get the best of both worlds: receipt management is set up and seamlessly integrated with your existing business banking workflows, and it’s included at no cost as part of your free Relay account. In other words, you’ll always have exactly what you need, exactly where you’ll need it, at the very low cost of ‘zero dollars’.

Eliminate the need for employee expense reports

Combining Relay debit cards with a clear receipt policy gives you a safe and compliant way to enable employee spending—no personal cards required. Simply assign each team member a physical or virtual debit card (up to 50 are included with your Relay account), set a daily or monthly spending limit that works for you, and flip on your receipt collection policy. You'll gain complete control and clarity over team spending, all from right within the Relay platform. From coffees to car rentals, all your team’s expenses can be covered without the reimbursement rigmarole.

Always be audit-ready

A box of receipts is a losing game when the IRS comes knocking. To keep yourself protected should you ever come up for audit, it's best practice to keep your business receipts for at least three years—but even that might not be enough in some special circumstances. For true financial resilience (and peace of mind), your best bet is to keep every receipt safely stored and accessible in digital format. With our new capture tools and receipt collection requirements, you’ll always have the digital proof you need, organized, on hand, and easily searchable. Best of all, it's baked right into your existing business banking platform—meaning one less tool for you and your team to manage.

Receipts + business banking = ♥️

Ready to centralize your receipt workflow in Relay, and put an end to the month-end reconciliation scramble once and for all? Click here to learn how to set up your own receipt capture policy, or head to the Settings tab from your Relay account to get started.