When it comes to choosing business banking, business owners have a lot of options. But finding all the relevant information out there and comparing solutions side-by-side can be overwhelming. And since here at Relay we often get compared to Novo, we put together this handy guide on Relay vs. Novo to help you decide which platform is a better fit for your business.

Relay is an online banking and money management platform that helps small business owners keep track of exactly what they’re earning, spending and saving. Novo is a business banking alternative aimed at solopreneurs and freelancers. While both Relay and Novo offer no-fee banking services for entrepreneurs, there are some key differences between the two. In this article, we’ll cover the ins and outs of each.

In this article:

🏦 What is Relay?

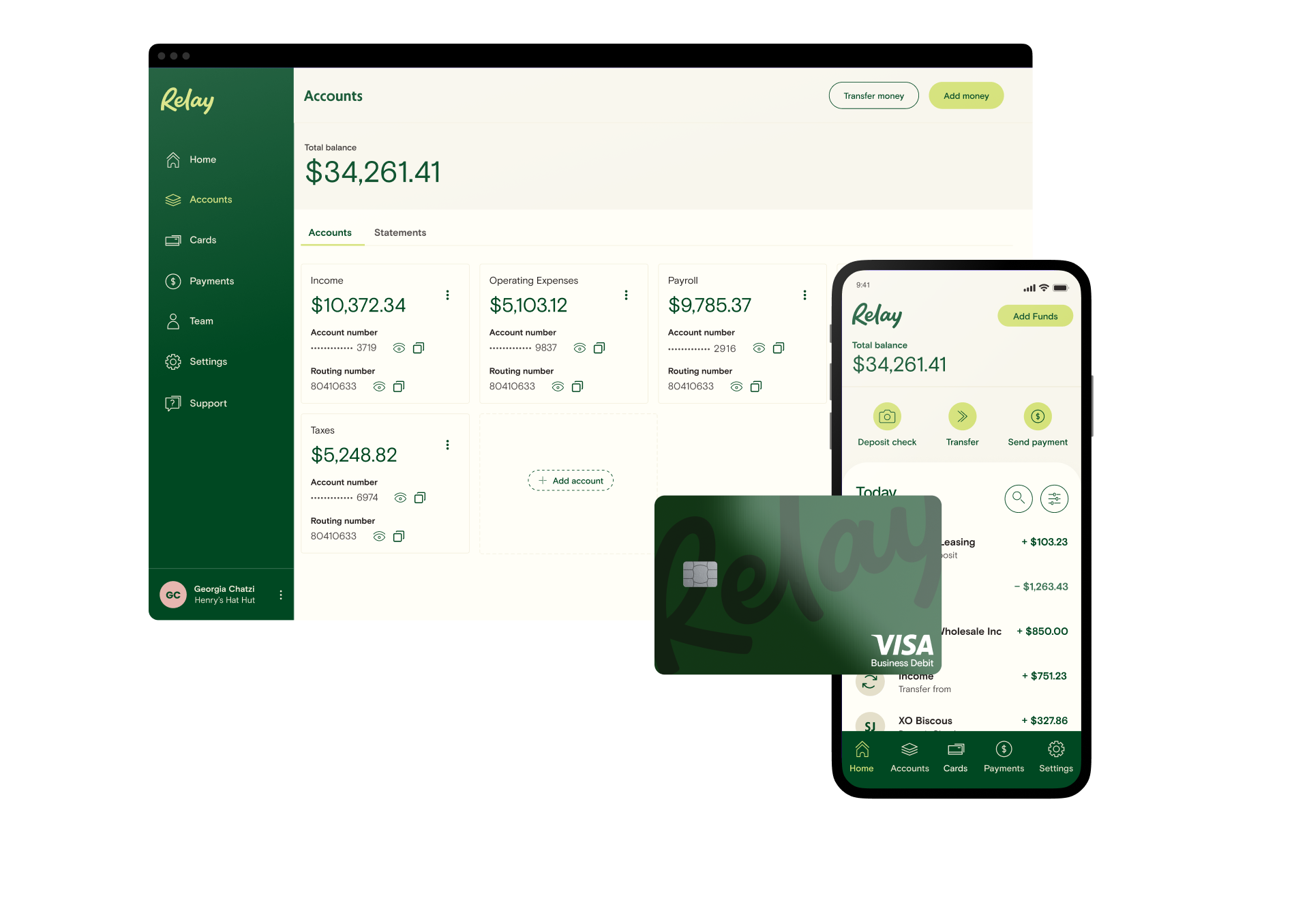

Relay is an online banking and money management platform that makes it easy for small business owners to understand precisely what they’re earning, spending and saving. As a banking platform, Relay goes beyond small business checking basics and truly helps you make the smartest 🧠 decisions for your business.

We set out to solve some of the most painful parts of small business banking — like high account fees, opaque pricing, messy banking data, lack of visibility into cash flow and lack of customer support. As a result, Relay lets you open up to 20 free business checking accounts with unique account and routing numbers; issue up to 50 virtual or physical debit cards for your team, and speed up your back-office workflows with direct integrations into your accounting software.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreMost importantly, with Relay’s 4.5 Trustpilot-rated customer support, you get access to knowledgeable support specialists dedicated to understanding what you need to achieve your goals.

What is Novo?

Novo is a financial technology company that offers simple business banking without monthly fees, whose banking services are provided thanks to a partnership with Middlesex Federal Savings. One of Novo’s stand-out features is its integration library. You can manage your business finances on the go by connecting to a suite of 15+ other money management and fintech tools. Novo also helps with sending invoices, making Novo a good option for service-based businesses.

Sole proprietorships, freelancers and startup founders get access to one checking account, 10 virtual sub-accounts and one debit card. While you do not need to maintain a minimum balance to hold an account, a $50 deposit is required to get started with Novo.

With Novo, you get access to additional perks like refunds on all ATM fees at the end of the month, plus discounts on integrations like QuickBooks Online, Hubspot and Zendesk.

Differences between Relay vs. Novo

The main difference between Relay vs. Novo is that Relay offers a comprehensive suite of banking and money management tools like accounts payable automation, 20 checking accounts and up to 50 debit cards, whereas Novo is a banking platform best suited for freelancers and solopreneurs, offering one checking account and debit card per user as well as an invoicing tool. Neither Relay nor Novo offers banking options with interest-bearing accounts or APY.

📊Relay vs. Novo comparison chart

Today, the best banks for small businesses don’t stop with basic banking services. You should be on the lookout for unique bank offers, advanced business tools and unlimited transactions. Below, we compare and contrast the key differences between Relay and Novo.

Feature | Relay | Novo |

Ideal fit for | Small businesses with 2 to 100 employees | Solopreneurs and freelancers |

Free checking accounts | Up to 20 individual checking accounts with unique account and routing numbers | 1 checking account + 10 virtual reserve accounts (also known as sub-accounts) |

No monthly account fees | ✅ | ✅ |

No minimum balance requirements | ✅ | 🟡 ($50 opening deposit required to get started) |

No overdraft fees | ✅ | ❌ ($27 insufficient funds fee) |

Free ACH payments | ✅ | ✅ |

Free check deposits and incoming payments | ✅ | ✅ |

Mobile check deposits | ✅ | ✅ |

No fees on deposits | ✅ | ✅ |

Currency exchange for international wires | ✅ | ❌ |

Domestic wires | $5 (Free with Relay Pro) | 🟡 (Can only be sent through a 3rd party integration) |

International wires | $10 (Free with Relay Pro) | 🟡 (Can only be sent through a 3rd party integration) |

Same-day ACH | ✅ (Relay Pro) | 🟡 (1.5% fee for Express ACH) |

Savings accounts | ✅ (Up to 2) | ❌ |

Debit cards | ✅ (Up to 50) | ✅ (1 card per user) |

Business credit cards | ✅ | ❌ |

Cashback and rewards on card spend | ✅ | ❌ |

Accounts payable automation | ✅ (Relay Pro) | ❌ |

Collaboration permissions | ✅ (7 unique user permission levels) | ❌ (No user permission levels) |

QuickBooks Online integration | ✅ | ✅ |

Xero integration | ✅ | ✅ |

Gusto integration | ✅ | ❌ |

FDIC insured | ✅* | ✅ |

Bank from | Web, iOS, or Android | Web, iOS, or Android |

Trustpilot rating | ⭐ 4.5 (Source) | 3.7 (Source) |

*FDIC Insured via Thread Bank.

💰 Cash flow management

Relay and Novo each take a different approach to how they help businesses with cash flow management. Relay gives you highly detailed transaction data, and is built to help you manage cash with multiple checking accounts (also known as the digital envelope system). As a result, you get 20 individual checking accounts which you can use for specific expense categories, like operations, payroll, taxes, marketing expenses, and so on.

Novo, on the other hand, equips you with one primary checking account and 10 virtual reserve accounts, also known as sub-accounts. While reserve accounts can help you budget more effectively just as regular checking accounts, they’re somewhat more limiting, as you can’t transact from them until you transfer the funds back into your primary account.

💳 Debit cards

When it comes to debit cards, Relay offers up to 50 virtual and physical debit cards for your business and your team members, Novo limits cards to one physical debit card per customer. Why does this matter?

With access to up to 50 debit cards, you can keep better track of your expenses — for example by issuing cards dedicated to marketing spend, or cards specifically for your team members. By having your team use debit cards that are issued by the business (rather than their own), you avoid the hassle of reimbursements. Moreover, Relay lets you set spending limits and instantly freeze cards if they’re ever lost or stolen.

While 1 debit card may suffice when you’re first starting out or are running as a sole proprietor, it’s important to future-proof your business so you’re ready to grow when the time comes. After all, the last thing you want to do is spend time changing business banks only to have to switch again when you’re ready to grow.

📩 Accounts payable and accounts receivable

As your business grows, you’re bound to run into administrative challenges when managing bill pay, unless you have something that can help you automate accounts payable (AP).

Relay comes with built-in AP automation features that you unlock when you sign up for Relay Pro. The Pro upgrade is a convenient option when your business reaches the point where it needs help managing AP. With Relay Pro, your unpaid bills will be imported from QuickBooks Online or Xero, and you’ll be able to manage all outstanding payments and organize all payees in your Relay dashboard. Pro features also let you set up automated single or multi-step approval rules — based on dollar amounts — so that no bill gets paid unless the right person on your team signs off on it first.

Novo does not offer any accounts payable automation features, but it offers to help you with accounts receivable (AR) instead. That means you can create and send invoices to customers for ACH transfers, Stripe, PayPal and Square payments, and accept ACH and mobile check payments to avoid transaction fees. This makes Novo a convenient solution if you want to commit to bundling your invoicing with your banking.

🔄 App integrations

Integrations make digital banking platforms that much more powerful.

In this area, Novo offers a lot of native integrations into some of the most popular apps. These include Quickbooks Online, Stripe, Xero, Shopify, Slack and many more. Novo also offers discounts on some of the most popular app integrations to save you money.

While Novo offers a large number of integrations into various financial software, Relay provides deep integrations with QuickBooks Online, Xero for accounting and Gusto for payroll. You also get access to an expansive collection of money apps thanks to Relay’s integrations with Plaid and Yodlee. Because Relay’s integrations were designed to help accountants and bookkeepers speed up bookkeeping workflows, they come with reliable bank feeds that don’t break.

🏧 ATM access

As a business owner, it’s important that you have access to your money without being penalized. Both Relay and Novo offer a wide fee-free ATM network for added convenience.

With Relay, you get access to a network of 55,000 Allpoint ATMs with free cash withdrawals and deposits. The only time you may need to pay for withdrawing cash with Relay is if you use your card at an out-of-network ATM if that ATM charges its own fees. With Novo, Any ATM fees are refunded. This means you can withdraw money anywhere and get refunded on ATM fees at the end of the month.

🤝 Collaboration features

Running a business is far from a one-person operation. Even if you’re a sole proprietor, you need to collaborate with your accountant, lawyer, or eventually, potential business partners. And as you scale, you may want to give limited banking access to specific team members.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreRelay comes with secure collaboration built into your banking. You can invite internal and external team members and manage their access with role-based permission levels. For example, you can give someone secure read-only access to banking, give them full administrative access, or restrict them to just managing cards. It’s all up to you! More on Relay’s user permission levels here.

Novo, on the other hand, does not offer distinct user permissions, as it’s a better fit for smaller businesses. If you do need to collaborate with someone, you may have to invite them with full administrative access.

🧑💼 Banking experience

Banking experience is one of the key reasons many business owners are switching to digital banking. So how do Relay and Novo stack up in this area?

Relay offers 24/7 support without having to visit a branch in person — phone and chat during regular business hours, and email support on weekends. This means you get access to knowledgeable support specialists dedicated to understanding what you need to achieve your goals.

Novo offers online support through their mobile app, through email, as well as a phone number listed on the back of the Novo debit card. Novo’s team is available Monday through Friday.

Relay vs. Novo: Which business checking account should you use?

So which is better, Relay or Novo? The answer largely depends on your business’ needs. While Relay is a better fit for small businesses that are looking to scale and may need more advanced banking and payments support in the future, Novo may be better-suited for freelancers and solopreneurs that are looking to bundle invoicing with their banking.

If you’re looking for an online business bank account with zero monthly service fees, transaction fees, minimum cash deposit requirements and low wire transfer limits, Relay might be the better option for you. With Relay, you get multiple checking accounts and powerful AP features to better manage your cash flow, as well as role-based user permissions to collaborate seamlessly.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreAt a glance, Relay goes beyond the everyday banking basics:

✅ No monthly maintenance fees, overdraft fees or minimum deposit requirements

✅ Up to 20 individual checking accounts

✅ 50 virtual or physical Visa® business debit cards

✅ Payments and deposits via ACH, wire and check

✅ Deposits from payment processing providers like PayPal, Stripe and Square

✅ Direct integrations with accounting software like QuickBooks Online and Xero

Signing up to Relay is free, and applying online takes minutes. You can get started here.