If you make $1 million a year in revenue but only keep a profit of $20,000—is your business successful? 🤔 Some say the answer is subjective, depending on your goals and the stage your business is in. While true, profit (or even more importantly, profitability—more on that later) allows a business to survive and thrive in the long term.

To get a full picture of your business success, it's important to understand the relationship between revenue, profit and profitability. So let’s take a closer look at revenue vs profit and what these metrics tell us. 🔍

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowWhat’s the difference between revenue vs profit?

The main difference between revenue and profit is that revenue refers to how much money a business makes while profit refers to how much a business keeps after deducting expenses.

Another way to understand the difference is to look at the equation for calculating profit:

Total Revenue - Total Expenses = Profit

💡 Tip: The Profit First method flips this traditional accounting formula on its head, and helps business owners habitually build truly profitable businesses.

What is revenue?

Revenue is the total income your business generates from selling goods or services before any expenses. 💰 If you add up the total sales generated by your company, that is your company’s total revenue for the year. 📅

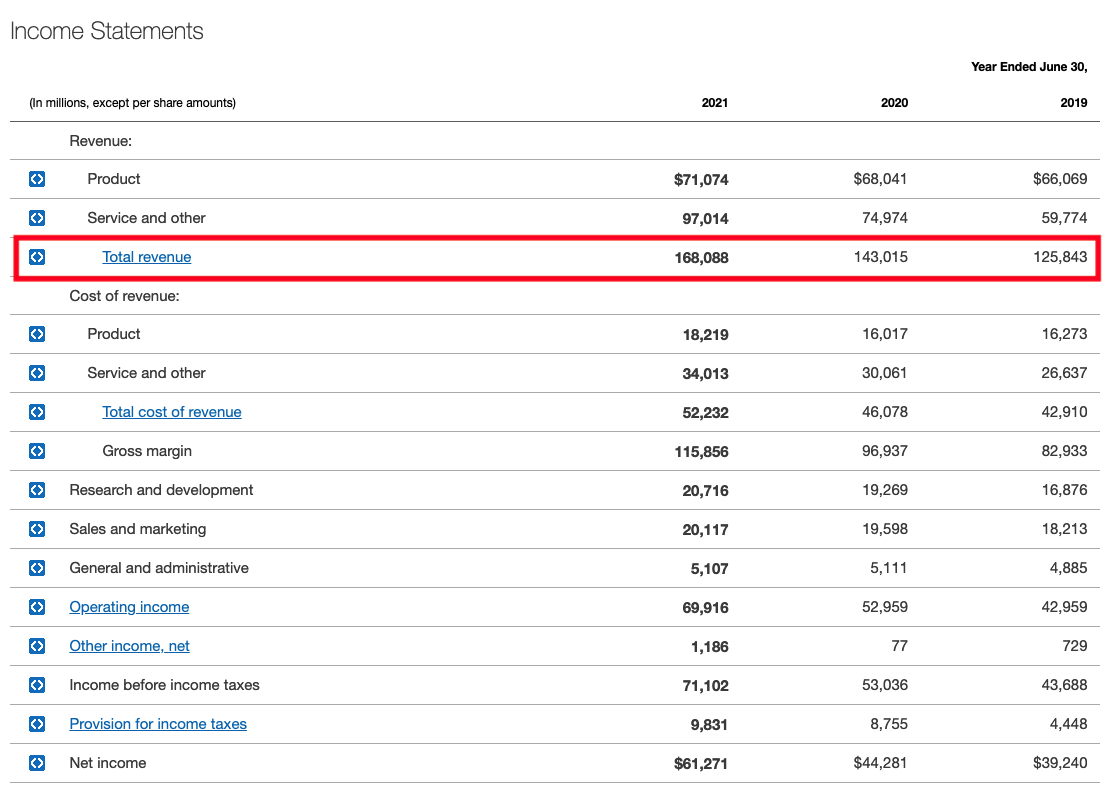

Revenue is often referred to as “top-line” because it sits at the top of the income statement and represents the money flowing into your company. 🔝 Depending on the type of goods or services your company sells, your income statement may look different compared to other companies. You’ll sometimes see revenue broken down further, for example, into product or service revenue, such as in the Microsoft income statement example below. 👇

This screenshot shows Microsoft’s 2021 Q4 income statement. Total revenue is reported on the top line.

Ever heard the saying that “revenue is vanity, profit is sanity”?👂 While it’s true that profit is a critical metric, don’t be too quick to dismiss revenue! Revenue reflects the demand for your products and services and is an indicator of year-over-year business growth. So, we can’t downplay its importance. With that covered, let’s turn to the other important metric: profit.

What is profit?

Profit = Revenue - Expenses

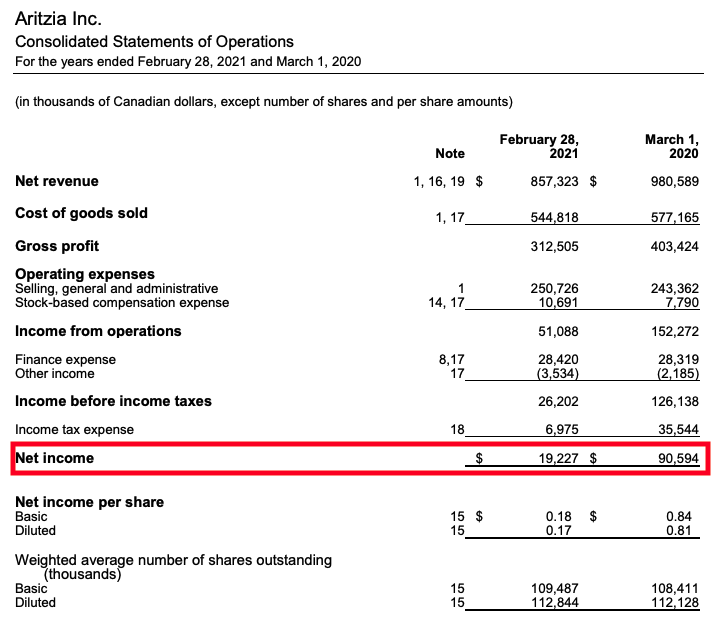

Profit or “net income” is the total amount of money a business keeps after deducting expenses. In financial jargon, profit is often called the “bottom line,” as it’s literally found on the last line of an income statement.

This screenshot shows Aritzia’s 2021 Q4 income statement. Net profit is reported on the bottom line.

For most small businesses, profit is the more important metric to understand as it represents how much money the business gets to keep after deducting the following:

Costs associated with the production of goods, such as labor and raw materials

Operating costs such as rent, utilities, marketing, new product research, or administrative expenses

Salaries (including what you pay yourself!)

Taxes

Interest

Depreciation

Amortization

According to economist Milton Friedman 🤓—the entire purpose of most businesses, at least traditionally speaking, is to generate profits. The higher the profit, the more money your business earns.

Profit can be depicted as either a positive 📈 or negative number 📉. When net profit is a negative number, it’s referred to as a loss because the company did not make enough money to cover its expenses.

Types of profit

Just as you might see different revenue types on your income statement, there's also more than one type of profit. Here's how to make sense of the most common types:

Gross profit

Gross profit is defined as revenue minus the cost of goods sold. This would refer to the cost of materials and labor directly associated with producing a product. Gross profit doesn’t include other fixed costs such as rent and the salary of individuals not involved in producing a product.

Operating profit

Operating profit is gross profit minus operating expenses such as rent, payroll and utilities. Operating profit represents the total earnings before interest and taxes.

Net profit

You get net profit by deducing all your expenses from your revenue. This includes everything from the cost of goods sold and payroll to taxes and interest payments. It’s what your company keeps after every other expense has been paid off.

💡 Tip: Some small business owners treat net profit the same as their salary. If this is you, it's time to rethink things! Business owners should do both: pay themselves a fair salary for their work (one day you'll want to hire someone to replace yourself) AND make a profit.

What’s more important: revenue or profit? 🤔

For small businesses, profit is the more important metric to understand as it represents how much money you get to take home at the end of the day, after deducting the costs of goods sold, operating expenses, taxes, payroll, and interest. However, business owners probably shouldn’t care about profit as much as they should about profitability. 🏆

What is profitability?

How does profitability differ from profit? Profitability—also known as profit margin—measures your company’s ability to generate profit relative to revenue. It is usually expressed using ratios, like gross or net profit margin.

Most business owners understand the basics of profitability— if revenue from sales covers your expenses, you’re turning a profit. If your revenue is $1 million and your expenses are $500,000, then you make a profit of $500,000 or a profit margin (profitability) of 50%.

Why profitability is more important 🥇

Profit alone can be misleading because it doesn’t show the full financial picture. Let’s illustrate this with an example using two companies.

Company A | |

|---|---|

Revenue | $4,000,000 |

Expenses | $3,600,000 |

Profit | $400,000 |

and...

Company B | |

|---|---|

Revenue | $2,000,000 |

Expenses | $1,600,000 |

Profit | $400,000 |

Both companies take home the same amount of profit—$400,000—but are they equally profitable?

The answer is no because Company A has to spend far more money to generate the same amount of profit as Company B.

In other words, Company B is a lot more efficient at turning a profit. This also makes Company A a lot more sensitive to any increases in cost.

Let's explain this by using a hypothetical scenario where a cost, like fuel, has increased.

Companies A and B respectively spent $800,000 and $400,000 on fuel last year

Gas prices rise 10% this year

If all other factors remain the same, Company A’s:

costs would rise by $80,000

profit would drop to $320,000

profit margin is 10%

Company B’s:

costs would rise by $40,000

profit would decrease to $360,000

profit margin is 20%

Company B is more resilient to cost changes 💪🏻 when compared to Company A because of its higher profit margin. Even though prices increased by the same percentage for both companies, because Company B spends less on this expense, they are more profitable in this situation.

How to improve the profitability of your business

If you’re a business owner, you care about your bottom line. Here are some tried and true tips on how to increase profitability for your company.

Become a cash management pro ✉️

Organizing all your expenses into multiple banking accounts can help you get a clearer picture of your cash flow: how much your business spends, how much you’re paying taxes, and how much you’re earning.

For example, you can set up different checking accounts for each of the following:

Payroll 💰

Utilities 🏠

Marketing expenses 👩🏻💻

Taxes 💲

And anything else your business needs to track 💡

You can also follow a time-tested approach like the Profit First method to help you do this.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowLearn how to budget

A well-planned business budget can help you forecast earnings and expenses, achieve financial goals, keep the right amount of cash on hand at all times, and keep your business profitable.

Learn more about other business budgeting methods >

Be more efficient

Increasing revenue doesn't necessarily result in increased profitability. Operating costs, marketing costs, and the cost of raw materials can add up. Find efficiencies in your operations and learn to work smarter, not harder.

For example, if you spend a lot of time managing accounts payable or payroll the traditional way, consider automating these processes to save time, money, and resources.

Bank with Relay

Relay is a business banking platform built to truly serve small business owners and give you total visibility into what you're earning, spending, and saving.

With Relay, you get 20 no-fee checking accounts, up to 2 savings accounts with 1% to 3% APY¹, 50 debit cards to manage your expenses, collaboration features to get help from your financial advisor, and auto-transfer rules to automate money management. Get started with a free account by applying online in 10 minutes. 🚀