With the year coming to a close and another tax season on the horizon, it’s time for small business owners to start reviewing business expenses and preparing for filings. Now is the time to be proactive, because by the time deadlines roll around, you’ll no longer have that luxury.

In this series by Relay — On the Money Mondays — we talk to real, practicing accountants and ask them to answer questions from you, the business owner. In Episode #1, we tackled your questions about tax season mistakes, corporate structure, and different ways to tackle accounting.

Subscribe for future episodes: https://relayfi.com/mondays

Our guest is Safietou Russell, the CEO & Founder of SDR Consulting Inc. Safietou’s been in the industry for 20 years; she’s a CPA, an Enrolled Agent and has a Masters in Taxation. SDR Consulting is a virtual firm based in New York that helps business owners — especially those in the mental health profession — reduce their concerns regarding tax and accounting and focus on their clients, their business and their own well-being.

In this article:

Business Tax Season 101: On the Money Mondays, Episode #1

Just getting started? Get 30% off SDR’s Small Business Startup Course

Want to get a deeper understanding of small business taxes? Until December 31, 2022, you can get 30% off Safietou’s Business Startup Basics course.

The course will teach you:

Different entity types available to you in structuring your business.

Step-by-step guidance on the proper bookkeeping and record-keeping required when running a business.

How you are taxed now that you are in business, so you can avoid those large unexpected tax bills.

What are the biggest small business tax season mistakes?

There are a few very common errors that small businesses make during tax season — especially if they’re new. Making sure you avoid them will help you claim as many tax deductions as possible. These are:

Not understanding your business structure

Not preparing to file your business income

Not understanding your entity type

One of the most common errors small business owners make is not knowing what type of entity they own. Consulting a tax expert on this is a wise investment. Can affect how you're taxed, so it's really important to iron out those details ahead of time. Whether you're a sole proprietor or freelancer, an independent contractor, a Limited Liability Company (LLC), a multi-member LLC, an S corporation, or a C corporation — all of those could have different tax filings, and if you file them incorrectly, you're going to end up with notices and penalties and a big headache.

So it's very vital that you research and know what type of entity you owned and how it's taxed and what your due dates are. Better yet — consult with a tax professional who can identify business tax deductions for you ahead of time.

Not doing any preparation before tax season

The second common thing that tax professionals see is small business owners just being completely unprepared for the tax season come tax time. This includes not knowing how much they made, how much was taxable income, how much their expenses were, not having income clearly separated between personal and business purposes, and what they were eligible to deduct. Really, this all has to be proactive work that’s really important to do ahead of time. And a lot of it can be solved by implementing tax software or accounting software like QuickBooks Online.

It’s best to start tax preparation early — as soon as we head into quarter four. This is the time to get an understanding of what's happened all year because you can actually implement some things before year-end so that you know what to expect during tax season. Because once tax season rolls around, by then it’s reactive, not proactive.

What if you’re not prepared for tax season?

So, what happens when you’re not prepared for tax season?

Suppose that you haven't taken into account all of the financials that happened last year. At that point, you're probably rushing, you're stressed out, and you just want to get taxes over with, so you're probably missing things. You may be missing write-offs, and you may even be missing income — which the IRS may not find for two or three years down the line. And then when they send you that notice, it's plus penalties and interest.

Also, maybe you've missed deadlines. For example, if you're not sure how you're taxed and you're an S corporation or a partnership, your filing deadline is March 15th. And if you find yourself rushing to do your taxes on April 1st, you're already late. You're already late one month, and the penalty is $200+ per partner per month.

Those are some of the costs of not being prepared — but there should be time to be prepared. Life is busy, but if you want to save money on penalties and interests, you want to be as prepared as possible.

Who faces more tax problems: startups or mature businesses?

When it comes to tax season issues and dealing with the IRS, both startups and established small businesses can be affected. However, the mistakes are somewhat more prevalent with startups, because they're so new that they're not sure of their requirements as a business owner.

This is why, before starting your business, it's ideal to meet with an accountant and a lawyer to understand what type of entity you have, how that entity is taxed and your tax rate, and what information you need to be tracking during the year — so that you're better prepared for a tax season and can take advantage of the tax credits available to you.

Some established business owners, however, just get overwhelmed with the work and all the demands of running a business and managing day-to-day cash flow. So federal income tax just becomes out of sight, out of mind. So they may be aware of what they need to do, but there's so much stress in getting prepared and tracking everything throughout the year, that they just let it go by the wayside and focus only on their business. So that's why you see tax season issues with both, but definitely more with startups because they're just properly informed.

What tax penalties can you face?

Tax season penalties can range vastly, and they can be a result of everything from simply misreporting gross income to violating tax laws.

As far as ranges, Safietou has seen penalties seen as high as $10,000. This was a penalty for an entity that had multiple members, and that didn't meet their partnership deadline of March 15th — so they were late filers. And by the time they filed, it was 6-7 partners, times $200, times the number of months that they were late. So the penalties can definitely rack up, which is why it’s all the more important to be well-prepared and get good tax advice and business tax tips from a professional.

How do you pay taxes as a 2-member LLC?

One of the questions we received from small business owners was how to pay taxes as a 2-member LLC.

Tip: Want to submit your own question to On the Money Mondays? You can do so here.

The first thing to know is that as a 2-member LLC, you're taxed as a partnership, and a partnership has a March 15th deadline — so your taxes are filed earlier than your regular individual taxes.

As a multi-member LLC, this partnership tax return is going to summarize all of your income and expenses, and if there's a profit left, that profit is going to be taxed to the partners, to the members of the LLC.

How much you’re taxed is going to depend on your individual situation.

Let's say you're a 50/50 partnership; everything's going to be summarized on the partnership return, a K-1 schedule. A schedule K-1 is going to be issued to each partner for your share of the profit. So if it's a $100,000 profit, you each will get a K-1 that shows $50,000. You then combine that into your personal tax filing and combine it with everything else you have going on.

So you could be working a W2 job, you could have some investment activity, you could have rental property — all of that's going to get combined and determine what your tax liability is. So the partnership itself doesn't pay taxes — it is a flow-through entity! That means the income or losses flow through to the partners and members, and the taxes you pay are determined at your individual level.

Self-employment tax

With that being said, partnership income is also subject to self-employment tax, which is 15.3%. So, in addition to your income tax, federal tax and state tax, you will have self-employment tax on a profitable partnership. So, you’ll pay taxes when you file your individual return, but also it's important to consider making estimated or quarterly tax payments throughout the year, based on the profit that the partnership is making. This way, you're not caught off guard.

The best way to do this is to have a bookkeeping system in place for the partnership so that you can see your profit and loss throughout the year. Take your 50% share if that's your arrangement, and combine that with your personal taxes, do a projection, and see if you need to make a quarterly payment.

When should you switch from an LLC to an S-Corp?

Someone from New York asked, "When does it make sense to switch from an LLC to an S corp?"

This is a common question, and can be summarized with this:

It depends on the numbers!

This is especially if you're in New York, because in New York, depending on the area of New York you're in, your S corporation benefits may be minimized because of New York City taxes. So, there's no magic answer to when it's a good fit because it's not just based on your profit.

First, you want to understand what it takes to be taxed as an S corporation. Number one, you're going to still be an LLC or a corporation. You're making a tax election to be taxed as an S corp, which means that you're going to file an S corporation tax return. There are requirements on the shareholder who's providing services to have reasonable compensation paid out to them from the S corp as a W2 employee — so you'll have a W2 from your business and then you'll have also a schedule K-1.

No taxes generally are paid by the S corp, as far as income taxes — it's a pass-through entity as well. In New York City, they don't recognize S corps, so there is a C corp tax on the S corporation.

Once you understand the compliance requirements, you realize that you now have additional compliance costs:

a payroll service

unemployment insurance

a tax return preparation cost that's going to increase.

You want to factor in these things in addition to the profit that you have. What will be your reasonable compensation that you're going to pay payroll taxes on? What are your overall tax savings after you've done all of that? Does it really make sense to do this?

When Safietou does this type of analysis for clients, it's based on the numbers. Everything is factored in, and a model is created that shows, what things would look like as an LLC, what things would look like as an S corp, and whether making the switch makes sense.

Adding structure to your payments

Another reason to consider having an S corporation is if you have challenges making estimated tax payments.

This may be less for the tax savings, but more for the reason that your taxes can be taken out during the year and you don't have to worry about having a large bill at the end. Minimizing self-employment taxes are less important — but even if you just paid yourself as a W2 employee to add more structure to your pay, that may be a good reason why an S corp is a good fit for you. So, there are a couple of different scenarios of where it would be a good fit. It's not just based on a standard profit number.

Should you switch when you make a certain amount of money?

Should you elect to be an S corporation at a certain revenue number? Once you've hit $30,000? $40,000?

The answer is still: there's no magic number because each individual situation is different.

You could be making $20,000 from your S corporation business, but you also could have a sole proprietorship that brings you into a higher tax bracket. You also could have an investment property or a huge cryptocurrency account that can affect how much you're taxed. So there's no magic number for your business alone to determine if an S corp is a good fit for you. Ideally, as you make more profit, there are potentially more savings. But because of the complexity of taxes, there's no set number that's going to work for everybody.

Is accrual or cash accounting better for taxes?

Another common question is about the difference between cash and accrual, and which method is best for taxes.

Let’s say, for example, you have a business where your collection process is slow; maybe it takes clients three, four, or five months to pay. Does accrual or cash accounting make more sense?

First, let's go over the difference between the two on a high level:

A cash basis taxpayer is someone that pays taxes based on the actual cash received and the actual expenses that have gone out for that tax year. So regardless of when the work was performed, if you receive the money and if you paid out money, that's how your taxes are determined. This is generally good for smaller business owners because you actually have the cash available. If you made $50,000 and you need to pay taxes on it, you at least have received it.

With accrual accounting, the taxes are determined based on you billing the client, sending them an invoice, and then the expenses that have been accrued. So for example, if you bill a client $50,000 and you've performed the work, but they haven't paid you yet, on an accrual basis, you're going to pay taxes on that $50,000 even though you haven't received it. This can put some small business owners in a tough position, because they're paying taxes on money they haven't received.

The purpose of accrual accounting is to better match income and expenses based on timing, especially when you have maybe a four or five-month gap, or maybe even a year gap between when you're incurring expenses and when you're receiving the income from the client. So it could be a good fit in certain situations.

Is it worth switching from accrual to cash accounting?

Largely, this will be business-dependent. Let’s use the travel industry as an example.

In the travel industry, money is collected for trips over a year-long period of time. Expenses are incurred over that year period of time, but the trip doesn't occur until the following year. So, accrual accounting may be a better fit for these types of small business owners. It matches expenses and income and the recognition of the earnings — i.e. when the trip is complete.

So, while there are situations where accrual could be a good fit, generally a cash basis taxpayer is a better fit for smaller business owners who need to pay taxes based on cash that’s actually received.

Another thing to understand when dealing with accrual versus cash accounts is that your record keeping on an accrual basis is a lot more intense. Things need to be a lot more detailed because you have to record bills as you receive them, you record income as you are earning over time, and your expenses may be deferred until you've matched it with the earnings of the income. So it's not just based on when you pay the bill and when you receive money; you literally have to put things in ahead of time, defer things until they're recognized.

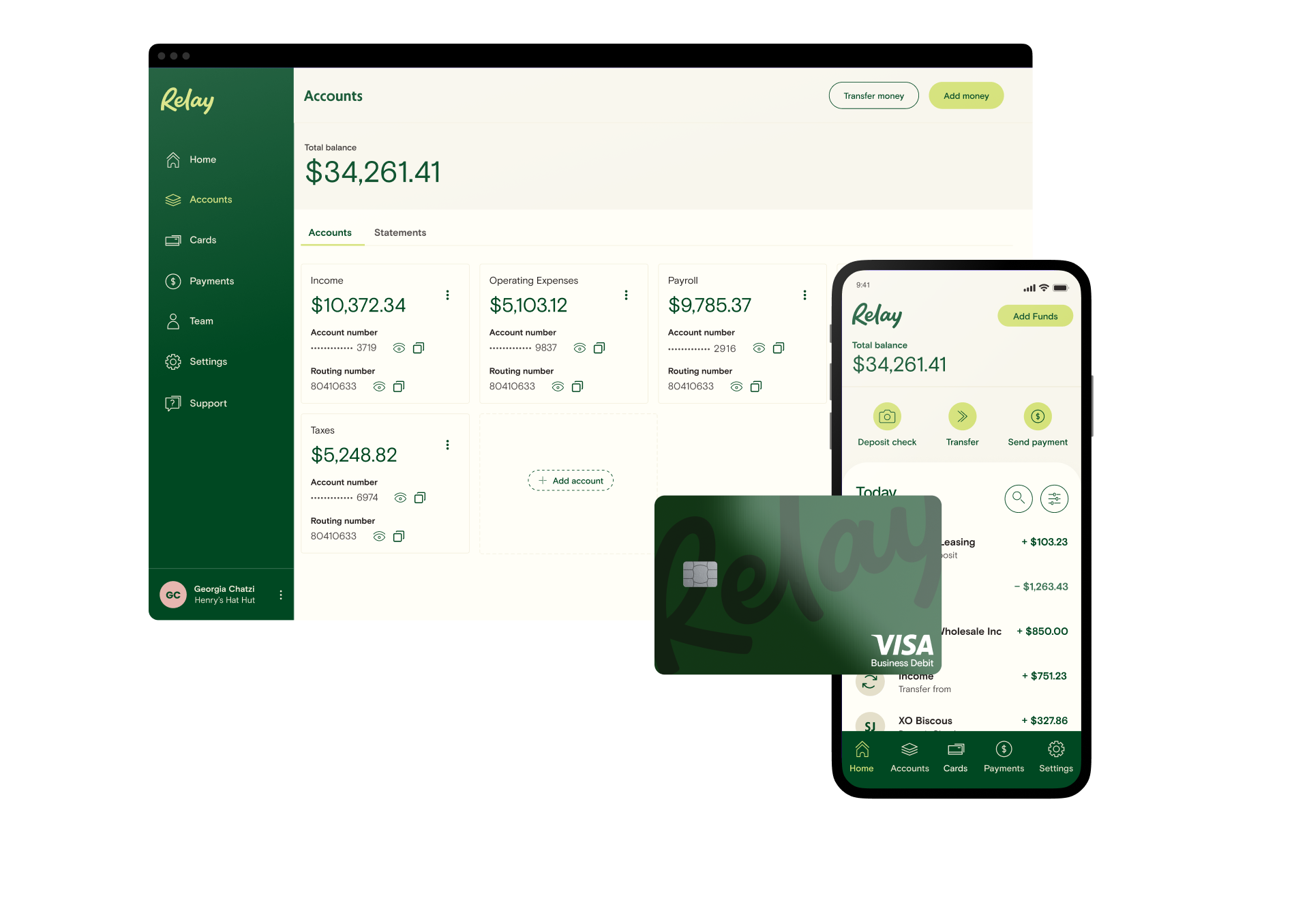

Make the tax season easy — get a separate bank account

One of the biggest culprits of a complicated tax season for business owners is commingling personal and business expenses. Whether you’re making business purchases on a personal credit card or not getting up to speed with tax planning because your spending is disorganized, Relay’s business banking platform can help!

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWith Relay, you get:

Up to 20 individual checking accounts

Integrated accounting with QuickBooks Online and Xero

Up to 50 virtual or physical Mastercard debit cards

The ability to accept payment from PayPal, Stripe, Square and more

Payments and deposits via ACH, wire and check

No account fees, no overdraft fees, and no minimum balance requirements

If you want to get organized with your business finances, start with your business banking. You can apply for a Relay account in minutes, right here. ⬅️⬅️⬅️

Get in touch with Safietou Russell, CPA, EA, MST

Big thank you for joining us for this episode of On the Money Mondays, Safietou! For anyone looking for small business tax help, you’re welcome to reach out and schedule a free 15-minute introductory call:

516-255-6603