The recent news from Brex is incredibly disappointing.

On Thursday, June 16, Brex announced that they are firing thousands of small- and medium-sized businesses. These companies were deemed to “no longer qualified” for banking services from Brex. Little explanation was given as to why, or what makes a business qualified.

No doubt a difficult decision by Brex. But in my view, the wrong way to treat your customers.

Small businesses are the backbone of the economy and represent more than 90% of all US businesses — yet they are chronically underserved.

We already know they’re underserved by traditional brick-and-mortar banks. Banking with these institutions usually means endless hidden fees, outdated infrastructure, and non-existent customer service.

Which is why it’s so saddening to see SMBs get overlooked yet again.

Starting a business takes guts. It tests you. Small business owners put everything on the line to grow and sustain their companies. And they need partners who can support them along the way.

At Relay, we’ve been committed to building banking that *truly* serves small businesses from day one, and we're here to stay. Because when we look at this landscape, we see endless opportunities to equip SMBs with tools that help them grow.

This news only energizes us to serve small businesses more deeply.

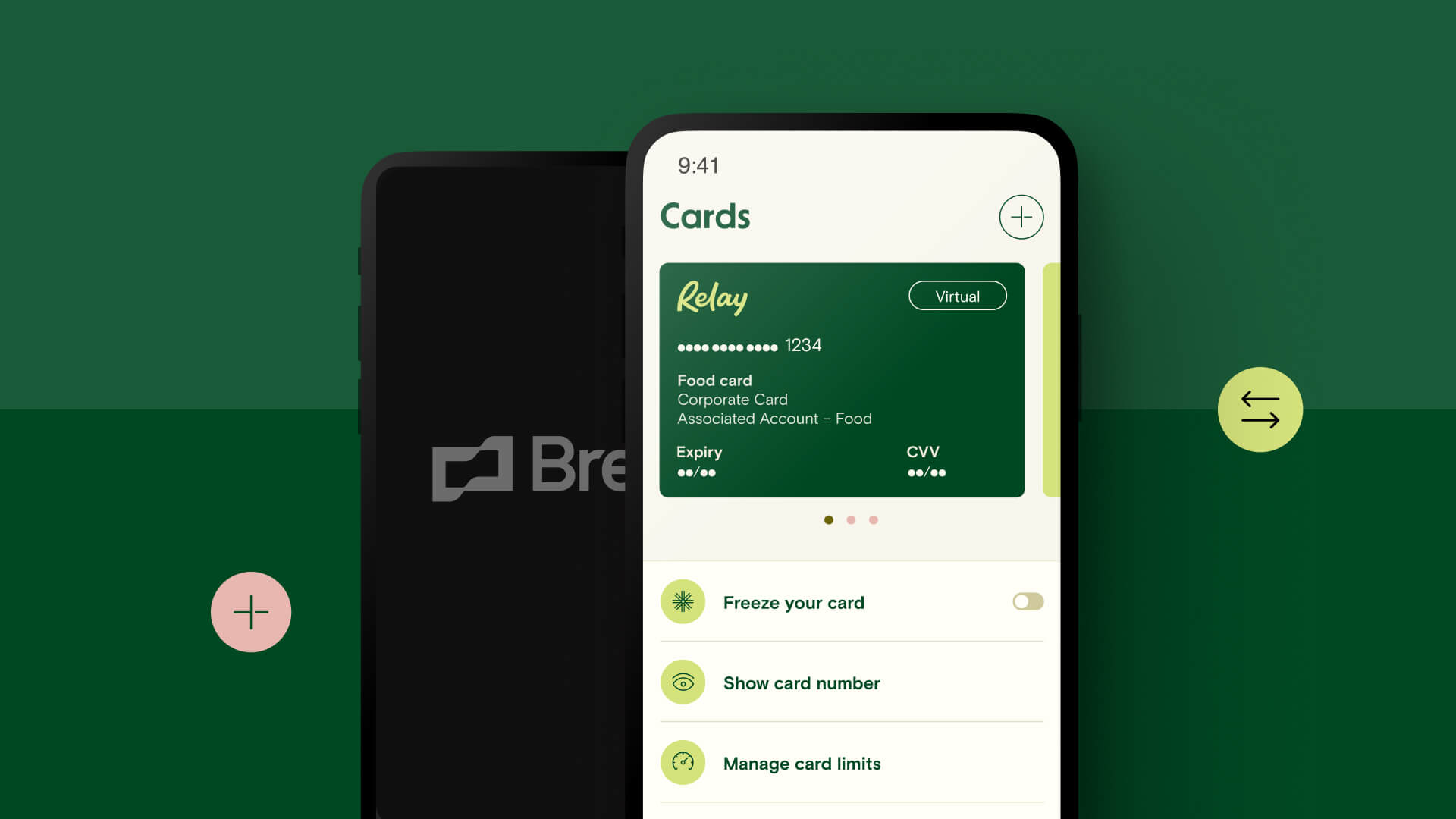

If you’ve been fired by Brex as a customer, we would love to have you. Relay is an online banking and money management platform that helps you stay on top of cash flow, get unparalleled clarity into operating expenses, and manage your team’s spending.

Relay is here to support your businesses, no matter how big or small. When you're ready to make the transition, you can sign up for Relay here.

- Yoseph West, Co-Founder & CEO @ Relay