If you’re a small business owner that works with independent contractors, you need to be familiar with two tax forms: Form W-9 and Form 1099. What are these forms, and how do they work in conjunction with one another?

Here at Relay, we build business banking that makes your tax season easy. When you bank with Relay, you can collect W-9 forms at the time of payment and generate 1099 reports at year-end. But not everyone is familiar with how W-9s and 1099s work. If that’s you, this guide will help you stay compliant and organized with both forms! With that out of the way, let’s take a closer look at the forms.

IN THIS ARTICLE

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowWhat is a W-9 form?

A W-9 form is an Internal Revenue Service (IRS) tax form that is filled out by independent contractors who complete work for your business. Think of it as a filing card containing information such as a person’s legal name, address, taxpayer identification number (TIN), and social security number (SSN).

As a small business owner, you should collect this W-9 form from anyone who is not a part-time or full-time employee, such as independent contract workers, freelancers, self-employed individuals and sole proprietors.

It’s best to always ask for a copy of the W-9 form at the onset of a worker’s contract to ensure you have the contractor’s information. (Tip: if you bank with Relay, this process is completely automated for you!)

What is a 1099 form?

A 1099 form is a tax form that your business has to send to the IRS during tax season, and it’s used to report any and all non-employment income over $600 that you paid out to contractors.

What is non-employment income exactly? It includes:

Rent

Awards and prizes

Medical and healthcare income payments

Crop insurance proceeds

Cash payments for fish purchased from anyone who makes a living catching fish

Cash paid from a notional principal contract to an individual, partnership, or estate

Amounts to an attorney

Any fishing boat proceeds

Or any other miscellaneous income.

This also includes income you paid to independent contractors, self-employed individuals and freelancers.

1099 forms must be filed with the IRS. Additional copies must be given to the payee and the state tax department (if applicable), and your business must keep one for its records.

As always, individuals must report all income earned on their tax return, which includes income reported on a 1099 form.

Main difference between W-9 vs 1099

The main difference between a W-9 and a 1099 is that a W-9 is used by a business to collect information about a contractor that does work worth over $600 for the business, whereas a 1099 is used by the business to report to the IRS how much it has paid to contractors. In other words, W-9s flow from contractors to the business and are used to create 1099s at year-end, which then flow from the business to the IRS and other relevant parties.

Let’s illustrate this with an example: you hire a freelance writer for your business blog. Before the writer turns in their first draft, you have them fill out a W-9 and file it away. Then, in January, you see the freelancer earned $1,000 for the current tax year. This freelancer now needs a 1099 so you can report their income to the IRS.

W-9s are filed away by the business, acting almost like a catalog library for contractors. However, 1099s are filed with the IRS and a copy is sent to the contractor so they can file the income on their tax return.

Who is considered an independent contractor?

How do you tell the difference between contractors and employees?

Contractors provide services without being bound by the requirements of an employee. They can set their hours, use their own tools, refuse work, and complete work in their preferred way. They are also responsible for their health insurance and retirement accounts and submitting their taxes in the form of business taxes or self-employment taxes.

Employees, on the other hand, must abide by set business hours, use the company’s tools and strategies to do their work, and are usually provided health insurance and retirement accounts. Employees are issued W-2 forms, which report their wages paid with tax withholding for payroll taxes.

Do you need a W-9 to issue a 1099?

No, you do not need to get a W-9 to issue a 1099, as long as you can obtain a tax ID number or SSN from the individual (which is required to issue a 1099). However, to shield your business from any penalties related to reporting false tax information, it is best to request that your contractors complete an IRS form W-9 themselves and send it back to you. This way the onus falls on them to supply you with accurate and up-to-date information.

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowTypes of 1099s

There are many different types of 1099 forms, each used for a different type of income.

The most popular is Form 1099-NEC, which is required for all contractors that earn more than $600 in a financial year. As a small business owner, this is likely the form you’ll deal with the most often. But here are some of the other 1099 you may run into:

A 1099-INT is used to report interest earned in the tax year to the IRS.

A 1099-DIV is used to report dividend income earned in the tax year to the IRS.

A 1099-G is used to register money received from governments.

A 1099-R is used to report distributions or payouts from a pension or retirement account, as well as annuities and life insurance payouts.

A 1099-B reports income from securities or property handled by a broker, such as the sale of stocks, commodities, and other securities.

A 1099-S reports income from real estate transactions during the tax year.

The 1099-MISC form is a catch-all for income that doesn’t fit into any other 1099 category.

Who is responsible for remitting the taxes?

Business owners are responsible for sending a copy of each required 1099 form to the respective entity or individual. However, the business owner is not responsible for tax remittances. The individuals who received payment (and the associated 1099s) are responsible for remitting their own taxes.

That said, there are some circumstances where the payer (i.e., the business owner that pays the contractor fee) is required to withhold 24% of the payment. This is known as “backup withholding.” In this situation, the backup withholding requirement should be noted on the W-9 form by the payment recipient (i.e., the contractor) so the business owner knows to withhold 24%.

Note: If you’re the payer responsible for backup withholding, you are also responsible for reporting that 24% to the IRS on Form 945 and sending the withheld money to the IRS. These payments typically follow a schedule similar to payroll taxes (those reported on Form 941), which means you’ll be making monthly or semi-weekly deposits.

Backup withholding comes into play if:

The individual did not provide a correct Taxpayer Identification Number (TIN) on their W-9 form.

The contractor did not certify their TIN.

The TIN is incorrect according to the IRS.

The IRS tells the contractor their income payments are subject to backup withholding because they didn’t report interest and dividends on their tax return.

Tips for submitting 1099 tax forms

Now that you know more about W-9s and 1099s, here you’ll find some helpful tips for submitting 1099 forms to ensure the right ones get to the right people.

First, you should know that you’ll receive multiple copies of the 1099 form (up to 5), with each one meant for a different recipient.

Copy A is meant for the IRS

Copy B is meant for the recipient (i.e., the payee)

Copy C will stay with you for record-keeping

Copy 1 is meant for the state tax agency

Copy 2 is also meant for the recipient

Here are the steps in which you should approach W-9s and 1099s:

1. Collect a W-9 from each contractor at the beginning of your relationship. Don’t wait until the end of the year to see if they’ll earn more than $600.

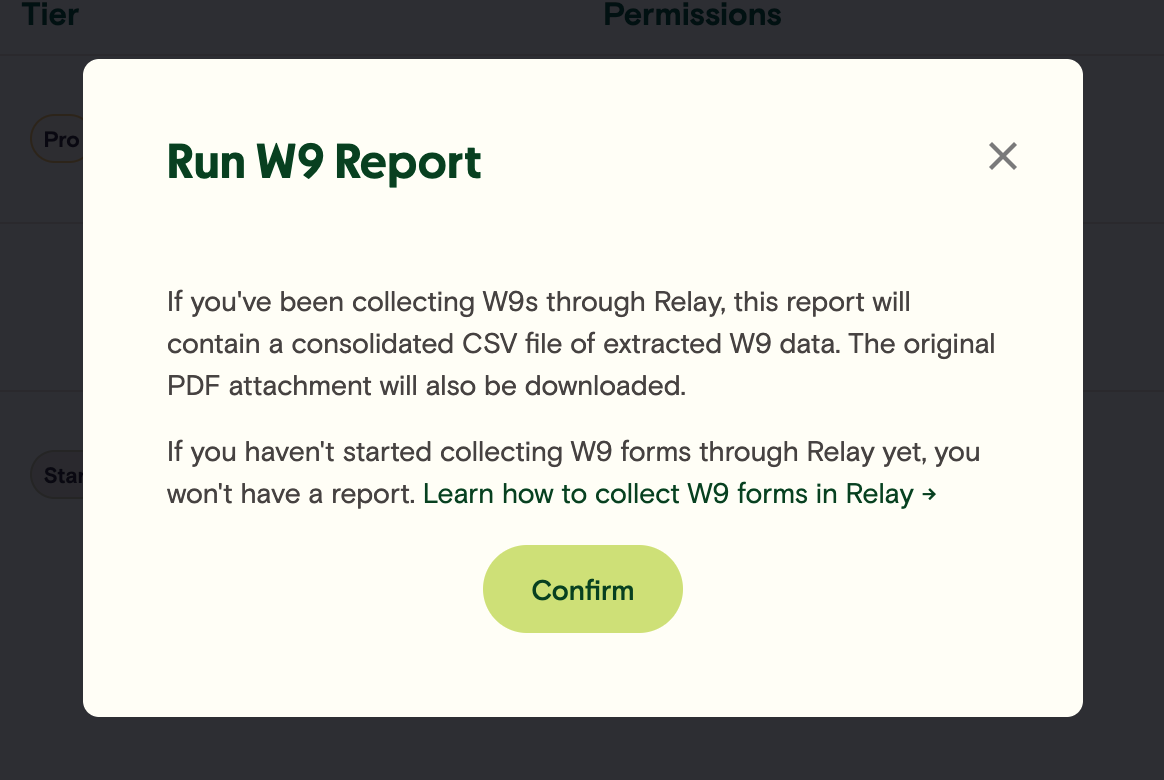

Tip: Relay allows business owners to automatically request a W-9 directly from your banking dashboard. Contractors will get an email and be prompted to input their information, meaning you’ll never have to worry about inputting the wrong information yourself!

2. When tax season comes around, be sure that you are using the most recent tax year 1099 form, which can be filed by mail or electronically.

Tip: If you use Relay as your business bank, you can export all your 1099 data into a CSV at year-end and bulk upload it into Track1099, Tax1099, QuickBooks or Xero — saving a ton of time and manual entry during tax season.

3. Fill out each 1099 form using the information from the individual’s W-9 form - their legal name, address, Taxpayer Identification Number or Social Security Number.

4. Calculate the total income you paid them during the year.

5. Submit Copy A to the IRS.

6. Submit Copy B and Copy 2 to the taxpayer.

7. Submit Copy 1 to your state tax department (if applicable)

8. Keep Copy C for your records.

Important IRS dates & penalties

The due date for sending Form 1099 to the IRS and your contractors is January 31 the following the tax year.

If not filed or filed late, the following late penalties can be incurred:

$50 if filed within 30 days

$100 if filed more than 30 days late but before August 1

$260 if filed on or after August 1, which is the same penalty if you do not file a 1099 at all

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowHow to automatically collect W-9s with Relay

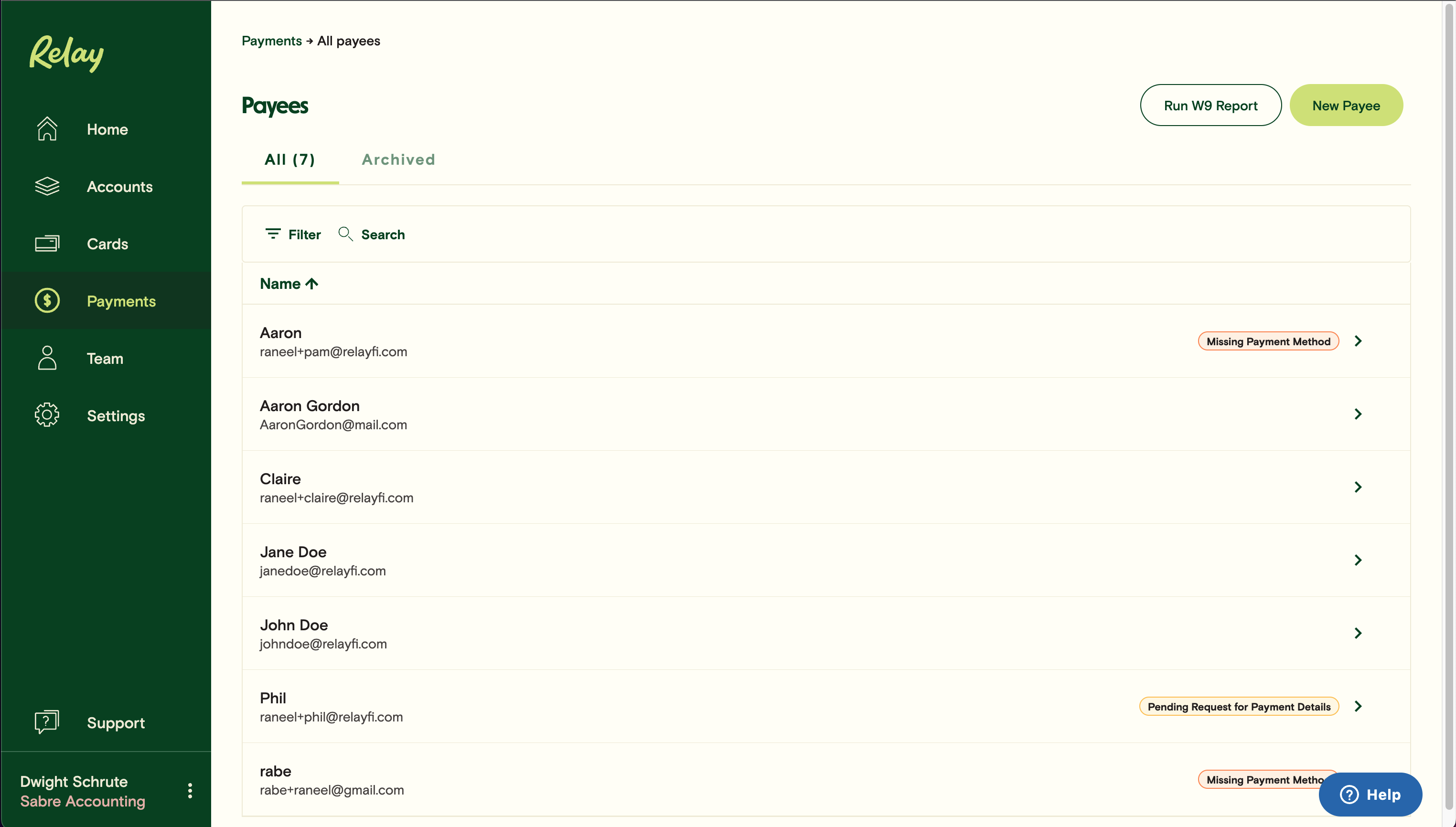

Having a W-9 on file for everyone you pay non-employment income to is important. With Relay, you can easily collect W-9 information from contractors with just one click.

When’s the best time to collect W-9 forms from your contractors? When you’re paying them.

Think about it: you’ve just started the relationship, and they’re already eager and excited to get paid, so having to fill out a form alongside getting their pay seems like an easy task. Compare that to sending your contractor a frantic email at the end of the year asking for a W-9 — it’s much more likely to be ignored or get a delayed, last-minute response.

You completely avoid this tax season stress when you bank with Relay.

Relay lets you automatically request W-9 forms from your contractors at the time of payment. Best of all — they’ll need to upload their W-9 before they can get paid, making sure that you will actually get those forms back.

And when it comes time for tax season, you can export all of your collected W-9s as a CSV and upload them into Xero or QuickBooks Online to generate 1099s for each of your payees. That’s hours of manual data entry work saved and avoided stress.

Get organized for tax season with Relay

If you’re looking for a way to simplify contractor payments — both while you’re making them and at year-end, consider opening a free Relay account.

Relay is business banking built to keep you on the money, so you can understand exactly what you’re earning, spending and saving and make the smartest decisions for your business. If you want better business banking, apply for a Relay account online (it takes 10 minutes).