Keeping business funds in one checking account can make it hard to stay on top of cash flow. Having separate accounts, like a dedicated payroll bank account, can help. 🙌

Businesses can use multiple bank accounts to organize and track income and expenses. Specifically, a payroll checking account can give you a clear picture of your payroll expenses and make the payroll process easier to manage. But what exactly is a payroll bank account?

To keep it simple, a payroll bank account is solely used to pay freelancers, employees, and contractors their paychecks. 💵 In this article, we’ll take a closer look at payroll bank accounts and how to use them. We’ll also cover:

What is a payroll bank account?

A payroll bank account is a business checking account only used to pay team members their payroll checks. Businesses can use this bank account to issue employees, contractors, and freelancers paper checks or send direct deposits.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreIf you want to more clear visibility into your business’s cash flow, having a dedicated payroll checking account can help. At a glance, you’ll be able to see if you have enough funds available to cover payroll expenses and payroll taxes. 😎

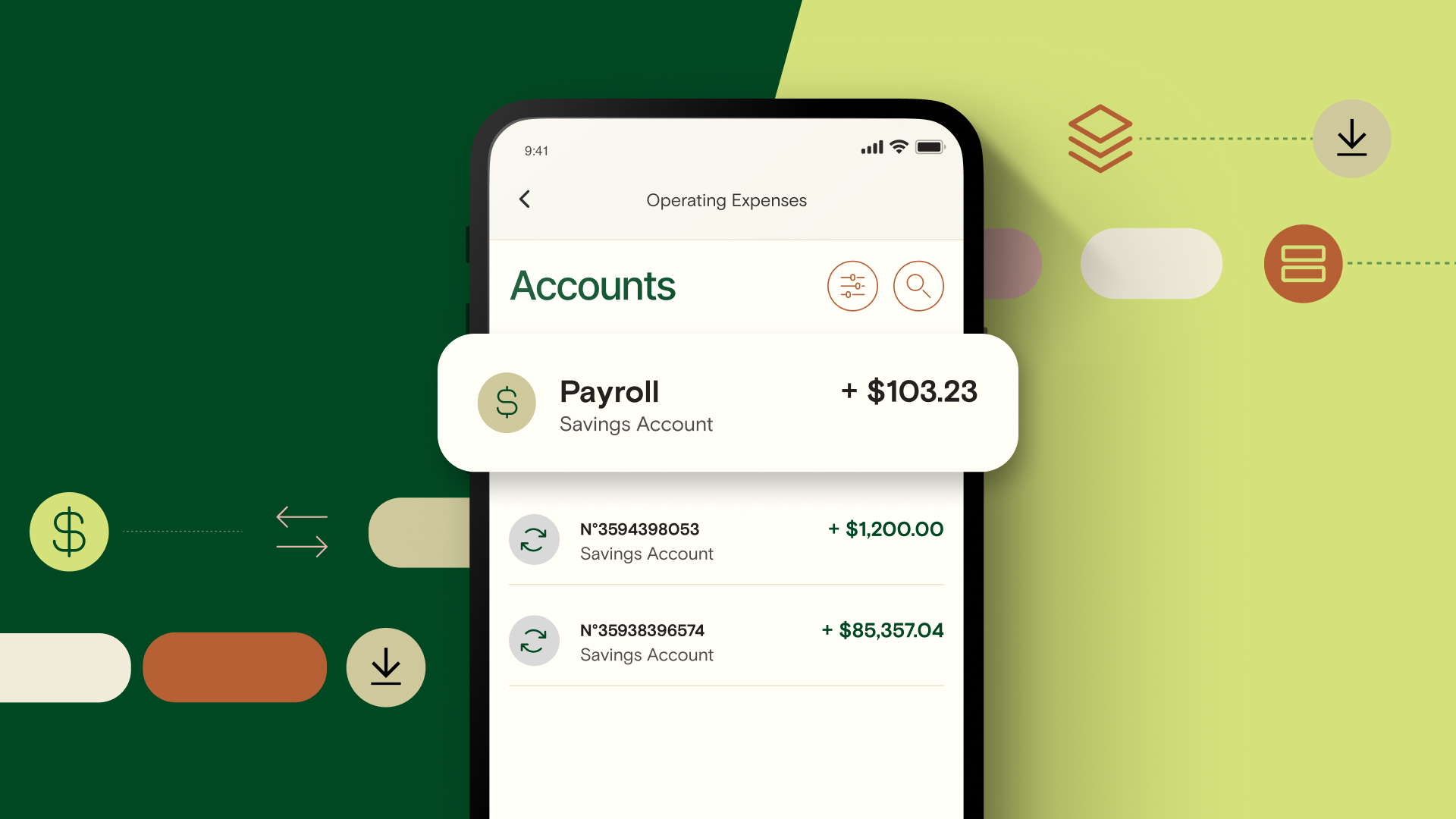

Relay (that’s us!👋) is a banking and money management platform that helps business owners manage cash flow by opening multiple business checking accounts. The best part? You won’t have to navigate minimum balance requirements or pay unnecessary bank fees, like monthly maintenance fees.

🏦 Learn more about Relay’s no-fee business checking accounts here.

Reasons to open a payroll bank account

Optimizing cash flow is vital for growing any small business. That’s why you need a clear idea of the money flowing in and out of your business each month—and opening a dedicated payroll bank account is one of the best ways to get full visibility into your spending. 🔎

Here are some more reasons why small business owners may want to open a payroll bank account:

1. A payroll checking account can improve cash flow management.

Managing payroll expenses can be a hassle if you don’t have a dedicated payroll account. If you only have one bank account, you’ll have to sift through expenses to understand your available funds. Doing this every pay period can be extremely time-consuming and make it harder to stick to your business budget. 😕

A separate payroll bank account can streamline bookkeeping, save time, and give you a better idea of your labor costs. Plus, a payroll account ensures you can pay your employees the right amount on time, every time. 🥳

2. Having multiple bank accounts makes budgeting easier.

Are you wondering, “How many business checking accounts should I have?” The correct answer will depend on your unique situation. However, having dedicated checking accounts for different funds can make budgeting for small business expenses much easier. 💰

For example, you could have a dedicated checking account for tax payments, one for employee wages, and one for your operating costs. Plus, separating your business expenses into different categories or buckets can majorly simplify bookkeeping.

3. You can put Profit First.

Businesses that use the Profit First approach set aside a percentage of revenue for profit before anything else. Then, they divide their remaining income across multiple bank accounts for different expenses—including, if you have employees, a payroll bank account.

With the Profit First method, business owners subtract their profit from their sales to determine their expense budget. Once you know how much you have leftover after profit, you can determine if you need to change the pricing for your services or adjust your budget for labor costs.

Relay is the official banking platform for Profit First. With Relay and Profit First, small business owners can get complete visibility into their cash flow and grow their profits. 📈

4. You can better plan for payroll taxes.

The type of business you run may influence the type of business taxes you pay. However, if you’re paying employees, you can almost definitely plan on paying payroll taxes. ☑️

As a small business owner, you may have to pay federal, state, and local payroll taxes. Since most small businesses don’t have human resource departments, the responsibility of managing payroll taxes typically falls to the business owner.

It can be tough to manage tax payments by yourself. That’s why having a dedicated payroll account and payroll service provider is so important—and when those platforms work together, it’s even better. 🙌

For example, Relay’s online banking platform integrates with the payroll software Gusto. Relay will help you stay on top of labor costs by showing you detailed payroll transaction data for every payroll cycle and debit type (like net salary and tax deductions). Plus, we’ll send you a notification if your account is low on funds, two weeks before a scheduled payroll cycle.

How to open a payroll bank account

Opening a payroll bank account can make it easier to plan for payday and send electronic payments, like payroll ACH. Keep in mind, though, that a dedicated payroll bank account shouldn’t be a sub-account of your main account.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreA sub-account isn’t a truly individual bank account, which means your funds are still technically sharing one account. This can make managing your cash confusing—sub-accounts don’t have their own checking and routing numbers, so they usually aren’t that different from having just one bank account.

When you open a payroll checking account with Relay, however, the account will have its own account number. Relay lets you open up to 20 free business bank accounts with no fees or minimum balance requirements. 😄

5 steps to open a payroll bank account

Are you thinking about opening a payroll account for your business? Here are some steps you’ll probably need to take:

💸 Step 1: Open a business checking account with a bank or financial institution. (You can get started with Relay here!)

🏦 Step 2: If you plan on using direct deposit, collect your employees’ banking details. This includes their bank name, account number, and routing number. Make sure they specify whether the payment is going to a checking account or savings account.

📆 Step 3: Choose a payroll schedule, like net 15 or net 30. Review your cash flow trends to see which pay date works best for your revenue stream. Once you have a schedule set, sync the payroll schedule to your payroll bank account.

💰 Step 4: Allocate payroll expenses to your payroll account ahead of each pay cycle. Having the proper amount of funds in your account can help you avoid overdraft fees and payment delays. Payroll automation services can help the payroll process run smoothly.

💻 Step 5: Connect your payroll software to your payroll account so you can track expenses and plan for tax season.

Do I need a payroll account and a payroll service provider?

A payroll account can help you manage your payroll cash flow and track labor costs. A payroll service provider can help with various additional payroll tasks, such as:

Paying taxes: A payroll service can ensure your business adheres to federal, state, and local payroll tax requirements. ✅ They can also file and pay your taxes automatically.

Tracking time: A payroll service can help you review time sheets to ensure employees accurately enter their hours.

Calculating payment: Keeping track of time cards or salary agreements can be time-consuming. A payroll service can help determine how much to pay employees, contractors, and freelancers each pay cycle.

Bookkeeping: A payroll service provider can help you organize bank statements and track expenses and tax records. 💰

Payroll expenses are a major factor in any small business’s operating costs. Partnering with a payroll service provider can help your business avoid costly mistakes, adhere to tax laws, improve cash flow, and boost your bottom line.

🏦 Open a payroll bank account with Relay today

Relay can help you stay on top of cash flow and never miss a payroll cycle. With Relay, small business owners can open multiple business checking and savings accounts—with no minimum balance requirements, no overdraft fees, and no monthly maintenance fees.

Then, you can use our Gusto payroll integration to get notifications when your balance is too low to process payroll. Plus, you’ll get detailed transaction data for every payroll run—so you’ll never have to waste time decoding your bank statements again. With Relay and Gusto, you can spend less time on payroll tasks, and more time on running your business and growing your revenue. 📈 Ready to open a payroll bank account with Relay? Sign up here.