Are accounts payable (AP) an asset or a liability? And why is this important for small business owners to understand? Both of these are great questions and a lot more common than you might think. 👍

Accounts payable, commonly referred to as AP, represent a company's obligation to pay off short-term debts to its creditors or suppliers.

In this article, we’ll answer the burning accounts payable questions you may have as a business owner including:

What are assets vs. liabilities?

Before we dive into the question of whether accounts payable (AP) are assets or liabilities, it's important to understand what these two terms mean. Let’s take a closer look.

What are assets? 📈

To put it simply, an asset is anything a business owns that holds value—from cash in the bank to real estate and intellectual property. Accounts receivable (like outstanding invoices you’ve sent to clients) are considered assets, too.

Managing your assets effectively is critical for your company’s long-term success. Assets help you pay your bills, invest in new equipment or technology, and become more profitable.

What are liabilities? 📉

A liability is an obligation or debt that a company owes to vendors, suppliers, or service providers. They represent claims on a company's assets and come from past transactions or events. 🛍️

Liabilities can be classified into two main categories.

Current liabilities are obligations that are expected to be settled within one year or one operating cycle, whichever is longer.

Long-term liabilities are obligations that are not expected to be settled within the next year. They include items with a longer maturity or payment period.

Liabilities are an important part of your company's balance sheet because they help you get a clear picture of your company's financial health. 📸

If you have more liabilities than assets, you may need to re-evaluate your business operations and financial management. On the other hand, if you have more assets than liabilities, this indicates that your company is in a stable financial position.

Are accounts payable an asset or a liability?

Here’s the short answer: Accounts payable (AP) are considered a liability.

Accounts payable are how much money your business owes to its suppliers or vendors for goods/services that have been received but not paid for. Accounts payable is sort of like a credit card—you received the goods or services already, but you'll need to pay your bill later. 💳

For instance, imagine your business orders office supplies from a vendor. You receive the supplies along with an invoice stating the payment is due in 30 days. At this point, these supplies become an account payable, a liability, because you owe money to your supplier.

What makes accounts payable a liability?

Because accounts payable represents a debt owed to another party, accounts payable are considered liabilities. Specifically, accounts payable are short-term debts your business owes to another company.

On a balance sheet, accounts payable are typically classified as a current liability. Basically, these liabilities are expected to be settled, or paid, within a short period of time. As the company pays off its accounts payable, the debt, or liability, is reduced. 📉

How do I find accounts payable on a balance sheet? 🔍

Accounts payable is typically listed as a current liability on your company's balance sheet.

The balance sheet is an important financial statement that provides a snapshot of your company's assets, liabilities, and equity at a specific point in time. It helps you understand your company's financial health and make informed decisions about managing your finances.

Here's how you can find accounts payable on your company’s balance sheet. 👀

1️⃣ Locate the current liabilities section: A balance sheet is divided into three main sections: assets, liabilities, and equity. Accounts payable fall under the liabilities section. Look for the heading titled just “Liabilities” or "Current Liabilities." 🔍

2️⃣ Find the accounts payable line item: Within the current liabilities section, you will find different entries that represent short-term obligations. Look for the specific line item labeled "Accounts Payable." 📝

3️⃣ Check the amount: The amount of accounts payable outstanding will be shown next to the line item. This figure represents the total amount of money that the company owes to its suppliers or vendors for goods and services that have been received but not paid for yet.

4️⃣ Review additional details: Some balance sheets provide additional details about your accounts payable. This could include information about the payment terms, any accrued liabilities, or other relevant details. 👓

If you have questions about your accounts payable, it’s never a bad idea to ask your accountant for help. They’ll walk you through each item on your balance sheet and other important financial statements.

Stay on top of accounts payable 💻

Whether you’re managing inventory or a team of freelancers, accounts payable can be tough to handle. However, staying on top of your AP is crucial for maintaining good relationships with suppliers and keeping your business financially healthy.

If you’re looking for a way to simplify your accounts payable processes, you can learn all about AP automation for small businesses here. 🚀

Looking for more small business money advice?

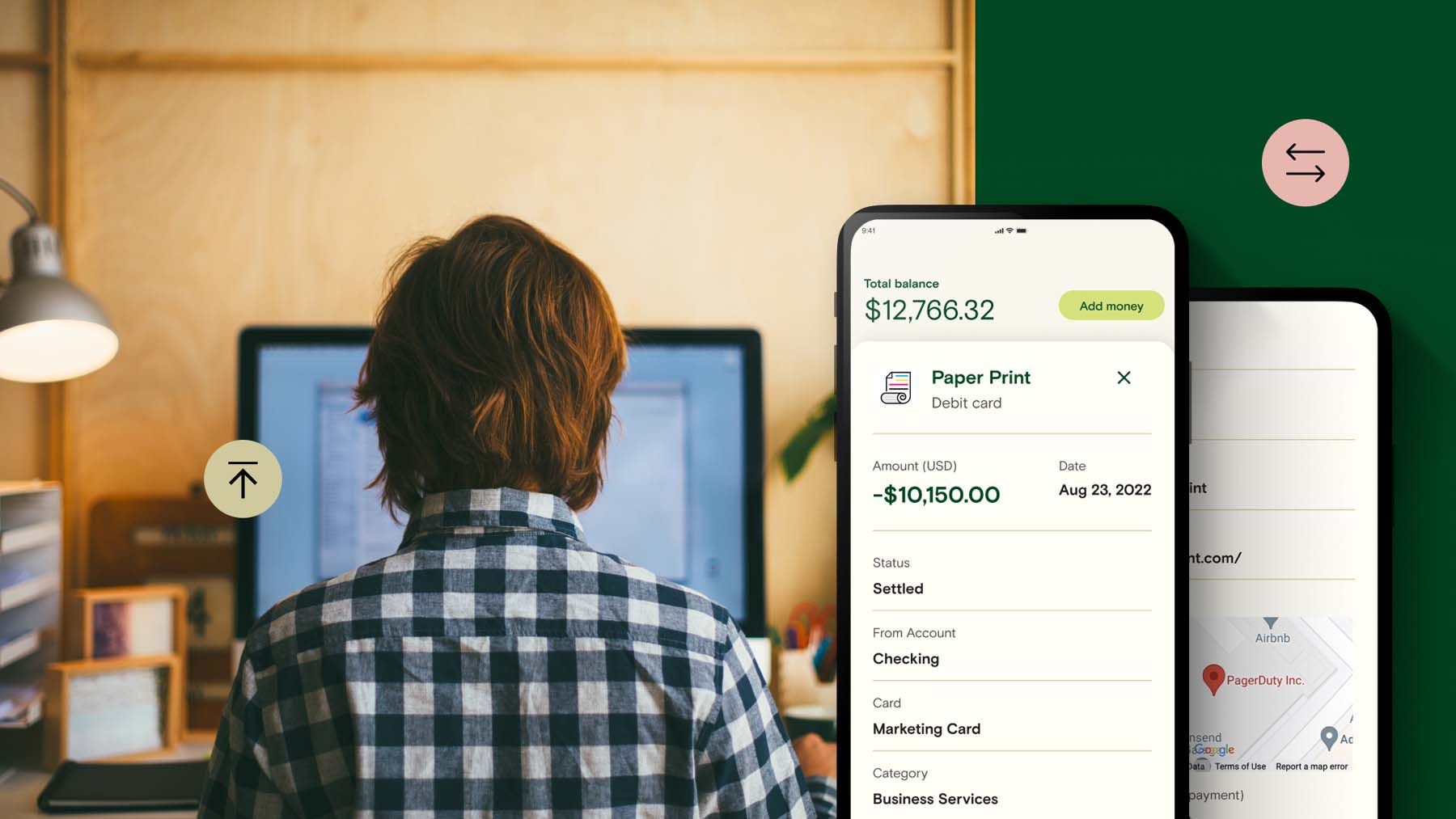

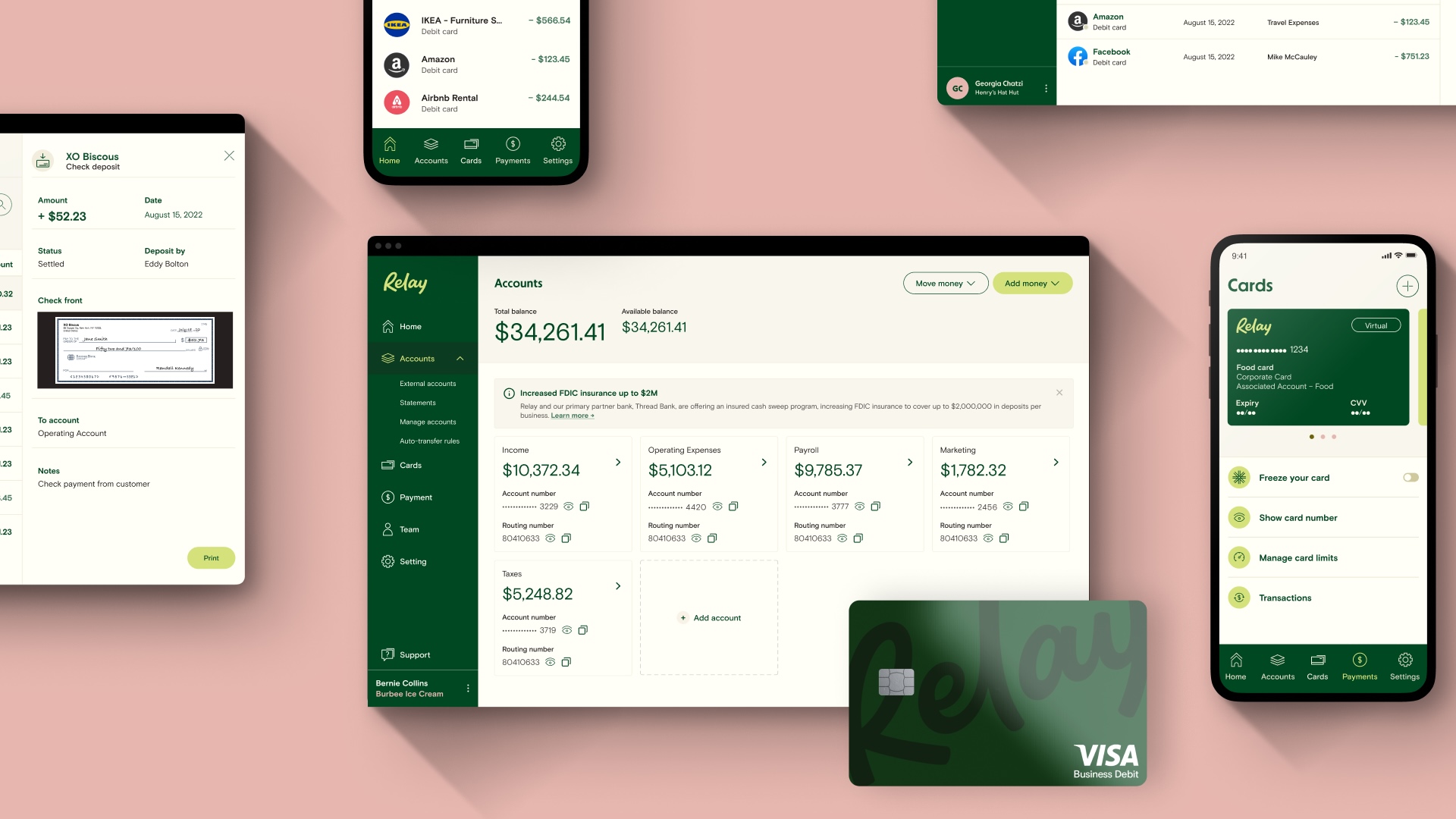

Relay is an online banking and money management platform that lets small business owners open multiple no-fee business checking and savings accounts—and we created a newsletter to help entrepreneurs like you thrive.

At the start of each month, our On the Money newsletter answers questions like…

How close are AI robots to doing your corporate tax filings? 🤖

What's the US central bank doing to make payments lightning-fast? ⚡️

And is Taylor Swift's Eras Tour saving the economy? 🪩

Subscribe now to find out about all these topics and more!