Historically, large corporations with greater financial resources have driven accounts payable (AP) automation, but today, companies of all sizes are incorporating automation into their back-office — why wouldn’t they when the benefits are obvious? 💭With the right AP software in place, you can reduce costs, minimize errors, speed up bill pay, and create stronger internal controls.

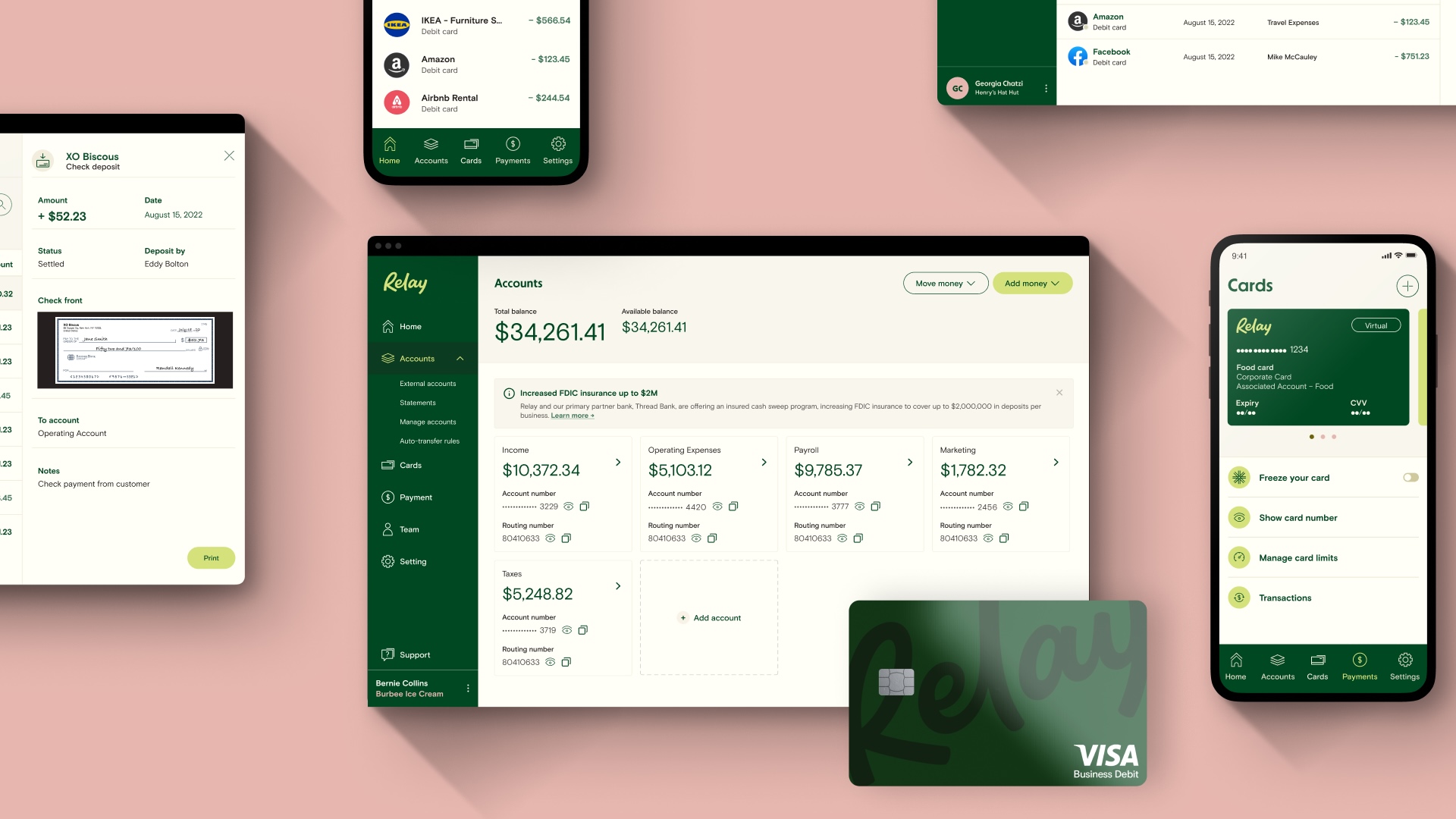

At Relay, we simplify online bill payment for small businesses by integrating AP directly into online banking. 🏦 We see first-hand how an automated AP process greatly improves financial visibility for small business owners. So we put together this list to outline the biggest AP automation benefits in detail.

8 accounts payable automation benefits

Automating accounts payable benefits your business in the following eight ways:

Let’s get started!

1. AP automation is faster than doing it manually 🏃💨

The average time to process an invoice manually is 45 days. In a manual AP process, an invoice has to be received, processed, approved by the right stakeholder, and then paid with a paper check (if you’re one of the 80% of small businesses that still use paper checks).

Each step takes a lot of time, and any additional delays can negatively impact your vendor relationships. That’s not great. 😖

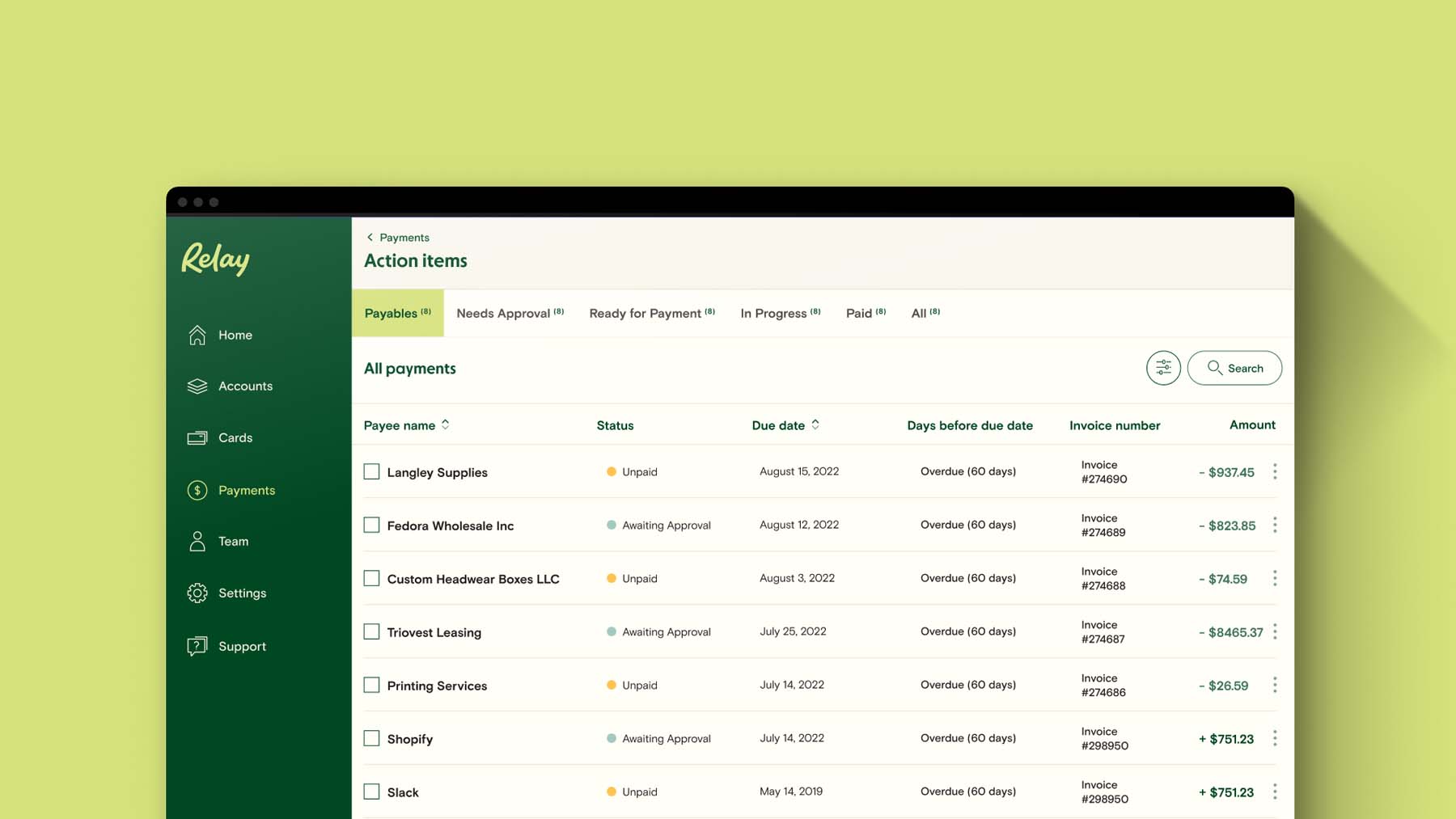

AP automation speeds things up by as much as 6x. An AP platform automates the receipt and storage of your vendor invoices, centralizes invoice reviews and approvals, helps you keep track of payments and stores your vendor information. Collectively, these automated processes save you a ton of time on invoicing.

Automated bill pay example

To illustrate the benefits of AP automation, here's an example of how Relay Pro streamlines bill management. All unpaid invoices are imported from the accounting software (QuickBooks Online or Xero) and then get automatically organized into a central dashboard. Now, all bills can be tracked and managed in one place, giving you clearer visibility into your company’s cash flow.

2. AP automation lowers the average cost of invoices 💰

Processing an invoice manually can cost up to $15 per invoice. That means every time you add a vendor to your network, you have to account for an additional $180 per year — and that’s only if they invoice you once a month — on top of their fees.

Meanwhile, an automated process can reduce the cost of an invoice to just $1.77. How? You save on the labor costs associated with data entry and dealing with discrepancies and the hard costs of document storage, printing checks, and postage.

3. AP automation makes your other software more impactful 🔄

A common concern with onboarding new software is that it won’t talk to the tools you’re already using. You can imagine just how much of a headache it would be if you had to input the same data multiple times. 😓 Likely, today’s AP automation solutions have been designed to easily share information with accounting software like QuickBooks and Xero, connecting the dots across your financial tech stack.

4. AP automation minimizes risk by improving accuracy 📈

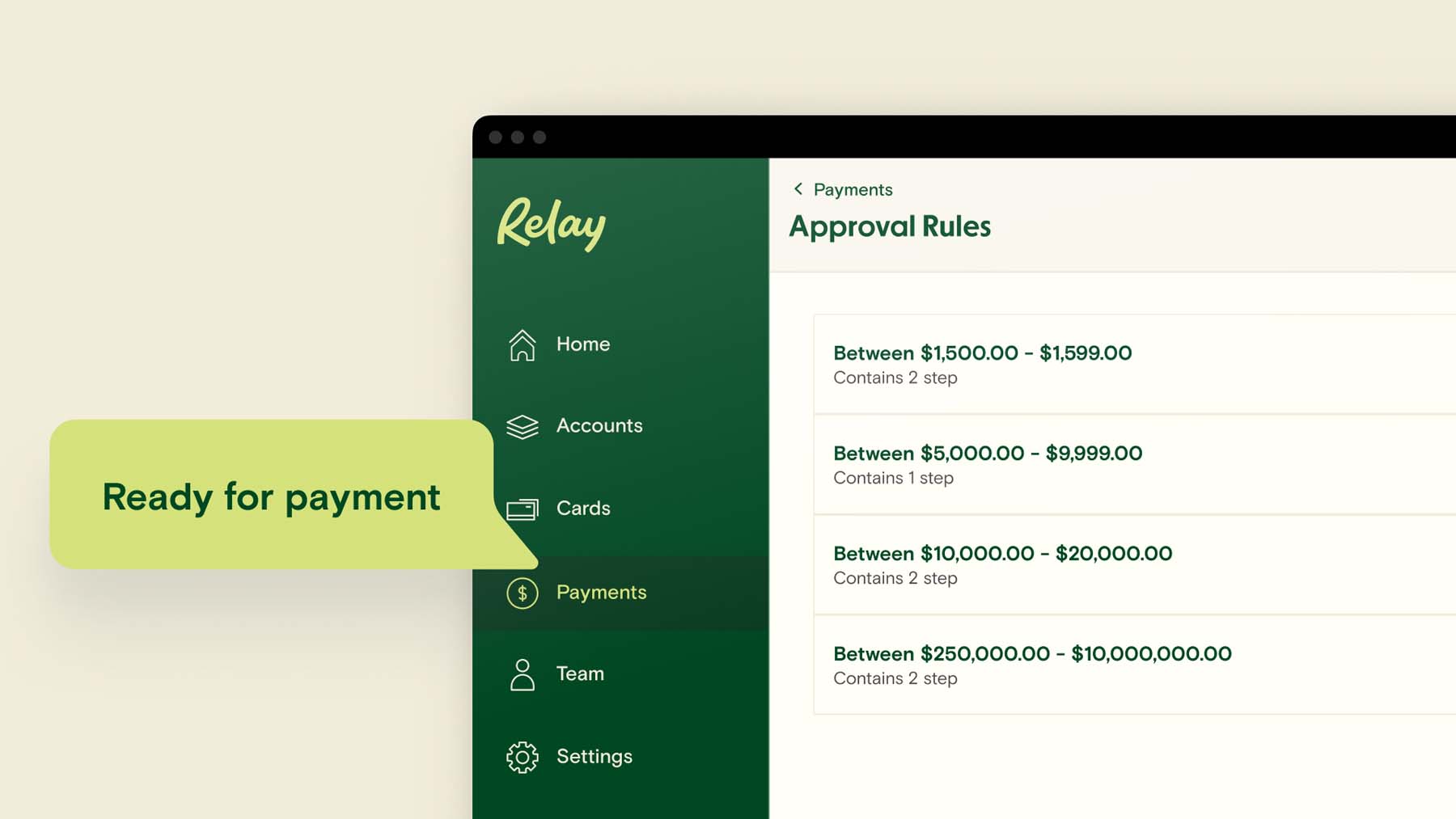

With the right accounts payable internal controls in place, automated AP reduces the risk of errors and fraud. Every AP process should have well-defined internal controls: how invoices get processed, who approves them, who is allowed to initiate payments and how vendor information is stored. 🕵️

When these processes are clearly laid out and controlled by AP software, there is less room for human error and better protection against fraud. Achieving an equivalent level of internal controls with no software is near impossible.

Automated internal controls example

Relay Pro, for example, lets you create single-step or multi-step approval workflows and completely customize them based on your needs. Every time an invoice is submitted for approval, notifications are kicked off to anyone involved in the approval process.

5. Automated AP streamlines audits 📑

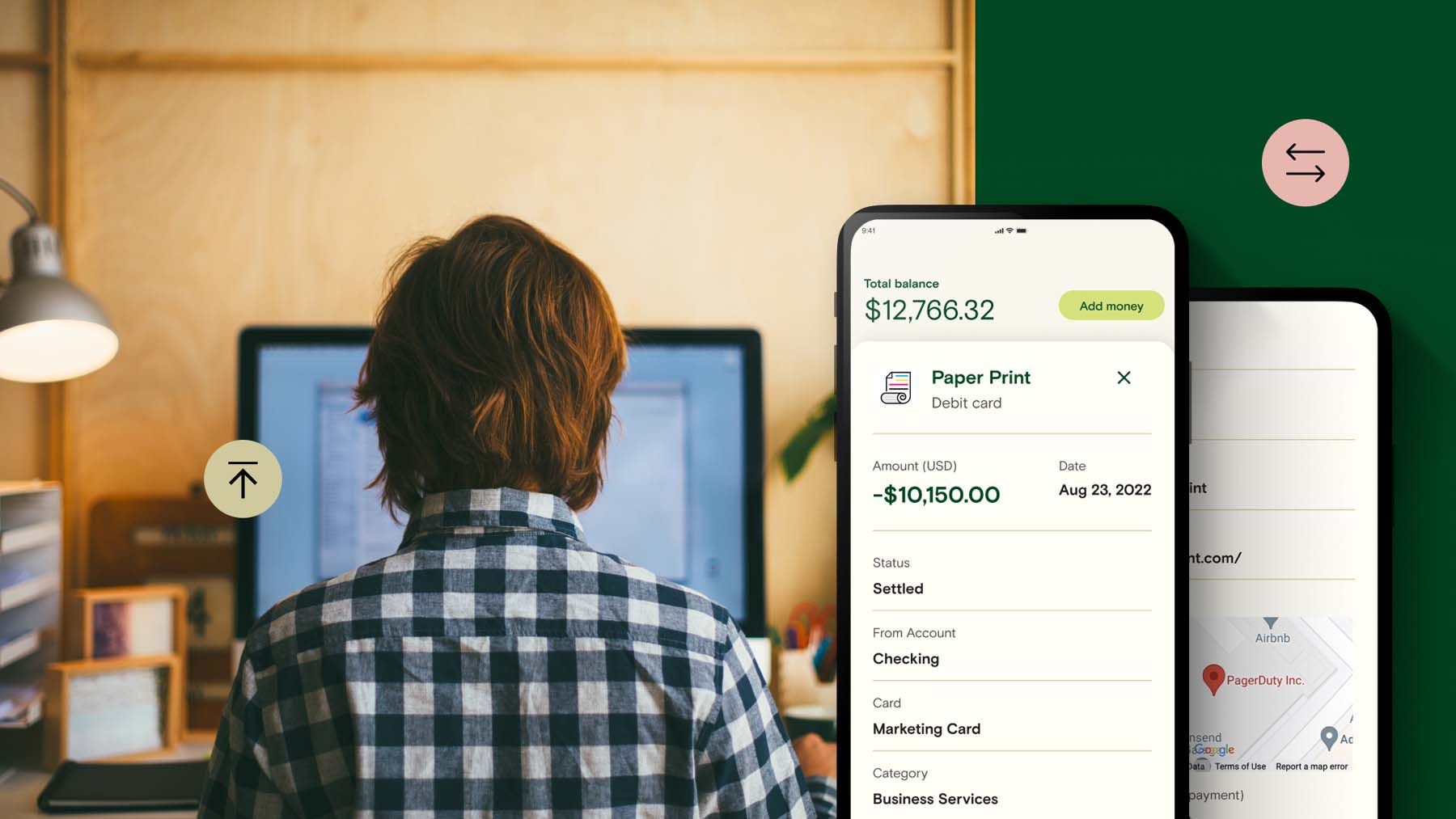

One of the biggest benefits of AP automation is a better auditing process. With detailed data accompanying every transaction, an auditor can easily follow the trail from invoice receipt to payment.

When your AP process is manual, audits can drag on for months — especially when paper invoices, receipts, or checks are involved. 📆 This difference can have huge implications for businesses. In one case study concerning employee fraud, Relay's automated payment solution was shown to dramatically speed up the audit and security response.

With AP software, you don’t have to worry about keeping boxes full of papers for an auditor to sort through — and you can save yourself from an agonizing wait while the audit is completed.

6. AP automation tools give you clearer visibility into cash flow 📊

With a digitized AP workflow, you get a birds-eye view of all processed and outstanding bills — as well as what you need to do to get remaining payments out the door. 🔍

Some AP platforms will also give you data about your accounts payable KPIs. This can give you greater insight into how much you’re spending on your vendors, whether there are any redundancies in your spending (e.g. if you have two vendors doing the same thing), and if there are any significant variations in your spending from month over month.

This information gives you deeper insight into what impacts your cash flow and can help you make better business decisions.

7. AP automation helps you avoid payment fraud 🔔

According to the 2020 AFP Payments Fraud and Control Survey, approximately 81% of companies were targets of payments fraud in 2019. When using a manual AP process, it can be difficult to spot fake invoices or fraudulent email payment requests.

Automated systems can help here by identifying and flagging suspicious requests before you approve payments. As your team grows, you can also limit who has the ability to approve payments by setting customized permissions, thereby reducing risk and the chance of fraud.

8. Automating your AP function gives you a competitive advantage 👊

Most importantly, AP automation empowers small business owners to grow their firms. Introducing a more efficient, speedy, and error-free way to manage accounts payable ultimately saves your business time (and time is money💰).

Say goodbye to the piles of paper, filing cabinets and the possibility of human error associated with manual AP. By automating your AP and using a transparent money management platform like Relay, you can track your invoices and records every step of the way. That means a better handle on your cash and, and that’s a win in our books.

Is AP automation the right call for your business? Get started with Relay Pro

If the above accounts payable automation advantages resonate with you, then it may be time to invest in an AP platform. 👋 A great place to start is Relay Pro — an accounts payable platform integrated directly into business banking.

Unlike enterprise AP solutions, Relay Pro is designed specifically with small businesses in mind, is easy to set up, and integrates directly with Xero and Quickbooks Online. So if you’re considering AP automation, make sure to check out Relay. We host a biweekly webinar that takes you through the ins and outs of the platform — you can sign up here.