As a business owner, it’s your job to make financially-savvy divisions. And with digital banks becoming the new norm, it’s a good idea to look into the pros and cons of banking with a traditional bank like Bank of America vs. a neobank like Brex — especially if you're exploring different Brex alternatives.

Considering the fact that traditional banks are so different from digital banks, the question becomes: How does BoA stack up to the (digital) competition? Let’s find out.

IN THIS ARTICLE

We put together a comparison guide to weigh ⚖️the main differences between Brex vs. Bank of America. Read on to learn which is better for taking control of your business finances.

🏦 What is Brex?

Brex is a financial management and banking platform that helps large venture-backed tech startups spend smart and grow fast. Brex offers banking services, charge cards, capital and spend management features with no monthly transaction fees.

Brex previously served businesses of all sizes, but starting August 15, 2022, the company will no longer serve small business customers with less than 50 employees. This means Brex is best for large businesses that offer a tech or software-based product.

If you qualify, Brex’s credit and cash back rewards can help you better manage capital. But if you’re a small business and don’t qualify, now’s a great time to consider the financial services your business needs most and whether an alternative bank can meet those needs.

🏦 What is Bank of America?

Unlike digital banks, traditional banks have physical branches. Bank of America offers business bank accounts that are designed to move your business forward with financial tools, services and dedicated support.

Bank of America offers two primary business checking accounts: Business Advantage Fundamentals Banking and Business Advantage Relationship Banking. The biggest aspect to call out here is that both account types have monthly fees associated with them. While you might be able to avoid these fees by meeting certain requirements, this is one of the biggest drawbacks of banking with BoA.

In addition to these core options, Bank of America offers simple digital tools, including basic cash flow monitoring, virtual cards and profile linking between personal and business accounts.

⚖️ Brex vs. Bank of America: What’s the difference?

The main difference between Brex and Bank of America is that Brex is a digtal-only banking and spend management platform that serves venture-backed tech startups, whereas Bank of America offers traditional brick-and-mortal business banking aimed at small businesses with simpler finances.

📋 Brex vs. BoA comparison chart

When looking at the differences between Brex vs. BoA, one of the main aspects to call out is account fees. One of the biggest disadvantages of banking with BoA, and likely a contributor to their low rating, is the fees and minimum balance requirements you’ll run into. For SMBs, every dollar counts when you’re trying to scale and these fees can stack up.

To get a clear picture, here’s a detailed comparison chart that looks at the differences and similarities between Brex and Bank of America:

FEATURE | BREX | BOA |

Businesses of any size can open an account | ❌ | ✅ |

No monthly account fees | ✅ | ❌ |

No minimum balance requirements | ✅ | ✅ |

No overdraft fees | ✅ | ❌ |

Free ACH payments | ✅ | ✅ |

Free check payments | ✅ | ✅ |

No fees on deposits | ✅ | ✅ |

Cash withdrawals at ATMs | ❌ | ✅ |

Currency exchange for international wires | ❌ | ❌ |

Domestic wire transfers | Free | Fees vary

|

International wire transfers | Free | Fees vary

|

Free checking accounts | 8 | ❌ |

Savings accounts | ❌ | ✅ |

Debit Cards | ❌ | ✅ |

Credit cards | ✅ | ✅ |

Cashback and rewards on card spend | ✅ | ✅ |

QuickBooks Online integration | ✅ | ✅ |

Xero integration | ✅ | ❌ |

Gusto integration | ✅ | ❌ |

Startup Funding | ✅ | ❌ |

Investment account | ❌ | ❌ |

Financial modeling tools | ✅ | ❌ |

FDIC insured | ✅ | ✅ |

Bank from | Web, iOS, or Android | Web, iOS, or Android |

Trustpilot rating | 3.8 (Source) | 1.4 (Source) |

Struggling to find perfect banking for your small business? Try Relay — rated 4.5 on Trustpilot! See how Relay vs Brex compare here.

🔐 Qualifying for an account

Qualifying for an account is very different between Brex and Bank of America.

According to Brex, here are the qualifications to be eligible to use their banking services:

You have received an equity investment of any amount (accelerator, angel, VC or web3 token)

You have more than $1 million a year in revenue

You have more than 50 employees

You have more than $500k in cash

You’re a tech startup on a path to meeting the criteria above and are referred by an existing customer or partner

With Bank of America, most businesses qualify. So opening a checking or savings account is fairly simple and can be done by filling out an online application form, calling or visiting a branch location.

🏦 Business bank accounts

With a Brex Cash account, you get up to 8 checking accounts per venture-backed startup, each with unique account and routing numbers. In addition to checking accounts, Brex also offers corporate cards and startup capital.

Bank of America offers one checking account and one savings account per business. While the savings account is a great perk, the lack of checking accounts and envelopes can hinder your ability to effectively categorize cash flow using the digital envelope method.

💰Cashback and rewards

Both Brex and Bank of America offer rewards, but they differ quite significantly.

Brex’s rewards program includes discounts on business apps and supplies, as well as cash back and travel points on corporate credit cards. To get the best rewards with the Brex card, businesses need to prove card exclusivity, otherwise, cash back rewards are diminished.

With BoA, members have access to a wide range of rewards. Eligible business credit cards get 25%-75% in Rewards Bonus and Business Advantage Savings account holders receive a 5%-20% interest rate booster. For example, if the interest rate on your account is 1.00%, a 5% rate booster would increase the interest rate to 1.05%.

🗄 Accounting features

With Brex, startups can create expense policies for employees, and employees can request the ability to make purchases using API access, increase limits or get vendor-specific cards. While Brex does not directly pull unpaid invoices from your accounting system, like Xero or QuickBooks Online, businesses can send their unpaid invoices to Brex by email.

Bank of America offers cash flow projections, transaction monitoring and balance categorization. You can also customize employee account access and integrate bookkeeping with QuickBooks®. These features are pretty basic compared to Brex and other digital banks.

🧑💼 Is it the right fit for your business?

Brex is designed for large fintech startups with large teams and complicated finances. And since their account qualifications are so strict, most SMBs won’t qualify for a Brex account.

On the other hand, BoA is a better experience for small businesses that have simple finance needs and prefer in-person support. And while Bank of America’s mobile app allows you to carry out simple transactions like check deposits, payments, transfers and wires — it’s not as robust as some of the other available digital business banking options.

🆚 Which is better, Brex or BoA?

So, which is the best bank: Brex or Bank of America? The answer largely depends on the size, location and complexity of your business.

If you’re a large venture-backed tech startup with multiple different teams and business expenses, Brex might be the right option for you. On the other hand, if you’re a small business that needs basic banking services and wants the option to visit a physical location, Bank of America might be a better fit. But you’ll want to make sure that you have a branch nearby to avoid driving out of your way.

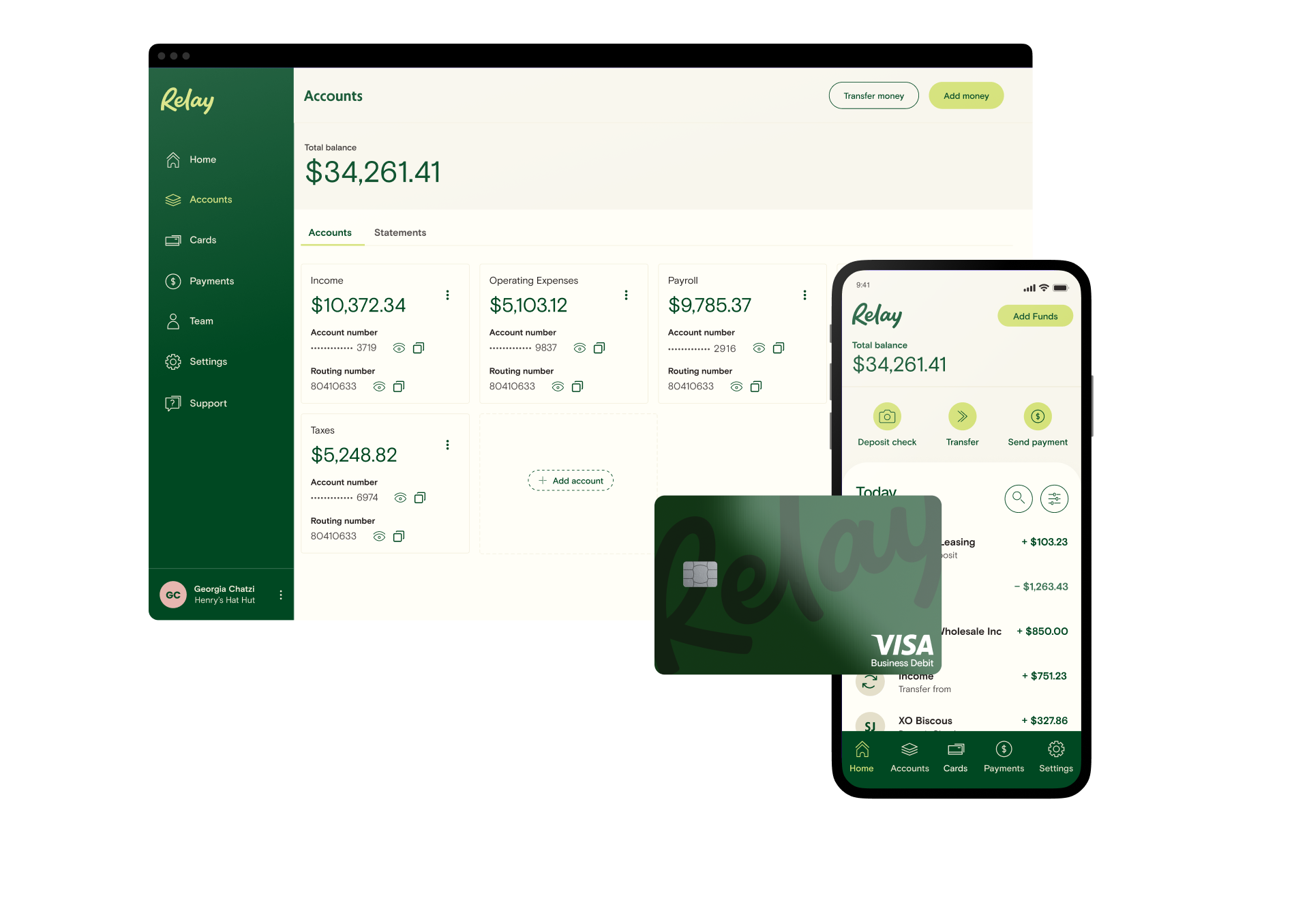

If neither of these options seem like the perfect fit, you may need a different solution. An online banking and money management platform like Relay might just be your answer. With Relay, you can control your cash flow and understand precisely what you’re earning, spending and saving so you can make the smartest decisions for your business. Relay serves all SMBs and gives you complete control of your finances.

📊 Control your cash with Relay

Take control of your finances by collecting income in one place, using up to 20 checking accounts to organize expenses and categorizing payments for a crystal-clear picture of your cash flow.

Relay goes above and beyond banking basics:

✅ No account fees, overdraft fees or minimum balances

✅ Up to 20 individual checking accounts

✅ 50 virtual or physical Mastercard® debit cards

✅ Payments and deposits via ACH, wire and check

✅ Deposits from payment processing providers like PayPal, Stripe and Square

✅ Direct integrations with accounting software like QuickBooks Online and Xero

If you’re looking for an online banking solution that puts you in control of your cash flow, check out Relay—you can sign up here!