What actually counts as an operating expense? How much should you compensate yourself? And do you need any additional Profit First accounts for your specific industry? Fear not, we have you covered with answers to all your Profit First account questions (and the solution to make them easy to stand up… more on that later.)

The cornerstone of a successful Profit First setup for your business is setting up the right accounts. These accounts allow you to separate your money for different purposes. and see at a glance how much you have on hand to run each area of your business (and which areas may need a little more money contributed towards them).

But what are the accounts? And does your business need more than these five? We’re glad you asked!

The five main Profit First Accounts

There are typically five main accounts you want to leverage as a business choosing the Profit First method. Having the five accounts makes it easier to prioritize profit by giving you a clear picture of what you have available for each area of your business.

But why do you need so many accounts?

The five Profit First accounts make it easier to approach accounting in a new way. Think of it this way; your typical accounting method usually looks like this:

Sales - expenses = profit

In other words, whatever you have left over after covering all of your expenses is what you keep as profit. But using the Profit First method and Profit First accounts means you’re flipping the script, and tackling accounting like this:

Sales - profit = expenses

Your profit goes directly into your profit account first, and whatever is left over is what you have to run every other aspect of your business.

So what five accounts are you starting with? Let’s break down the five accounts, how much goes into each, and what they should be used for.

(Pro tip: These aren’t in any particular order. Each of these five accounts have a very important role, and work together to make Profit First such a powerful system. Teamwork!).

How do you determine how much money you should put into each Profit First account?

Determining the exact percentages can be tricky. Every business is different and has unique needs, but there are ranges you can look to as a starting point for what to put into each account. The table below will give you an idea of how to allocate your Profit First percentages, based on the amount of revenue you’re bringing in.

Let’s look at each account in depth.

1. Income account

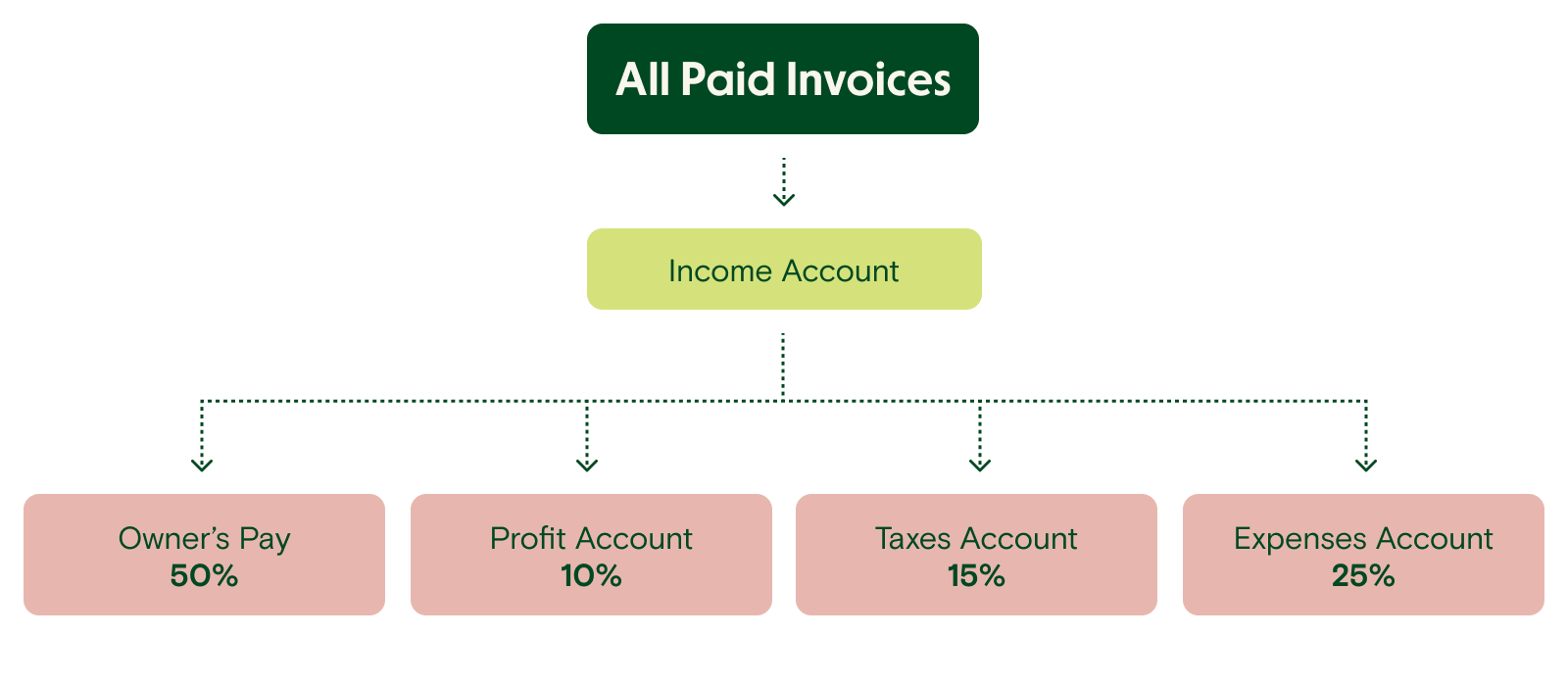

Think of your income account as a holding tank where all of your money will initially start. Everything in your business will go into the income account—sales, wire transfers, check deposits, and any other way money comes in.

It’s from here that you will start to divide up your money into the other accounts, based on the percentages you establish.

If you’re more of a visual learner, check out the visual below that shows you how your income account works (and remember, the percentages shown here are just an example—your ideal allocations may be different!).

2. Profit Account

5-20% of your income

The name may be a giveaway, but this account is where you are going to put your profit.

The money you put into this account has to go here before any other expense is paid out, and should be set aside completely and not touched (unless you’re reinvesting in the business or participating in profit distribution with your team).

3. Owner Pay

5-50% of your income

It can be hard to fairly compensate yourself as a business owner. There are so many other areas that pull money in your business, and you may be tempted to give yourself less of a salary to keep the business running and growing.

With Profit First, say goodbye to the “going with less salary” mindset and hello to an account dedicated to owners' pay. Allocate a percentage of your income for your salary, and that salary automatically goes into an owner's pay account.

If you’re struggling with what to pay yourself, ask yourself this: What would somebody doing your role somewhere else make? That gives you a great and objective idea of what you need to be putting aside into your owners pay account.

If you aren’t paying yourself fairly, enough, or at all, you’re going to grow resentful of your business. And that’s going to make it hard to want to put the work in.

4. Tax Account

15% of your income

Ah, tax season. The least stressful time of year, right? Getting your bill at the end of the year and spending a few weeks scrambling to get together a large chunk of money for the taxes you owe. It’s every business owner’s dream!

Okay, we can hear you rolling your eyes (rightfully so). Tax season can be an absolute nightmare. Searching through pockets for receipts, countless hours with your accountant or bookkeeper, trying to find a large chunk of money to settle up—it’s a headache. But your Profit First tax account ensures you’ll at least have enough to cover the bill when the time comes.

This account is where you safely put aside money for your taxes. Allocate roughly 15% of your income to this account. When tax season comes around, you’ll be ready to face it head-on—no Advil required.

5. Operating Expenses

30-65% of your income

You’re probably reading through these accounts and wondering about the money it takes to actually run your business. Cue your operating expenses, or OpEx, account.

Anything that’s leftover after your other allocations are deposited into the above accounts go towards your OpEx. This is the money you have left to run your business—rent, supplies, payroll, and everything in between.

We’ll be honest: it’s going to be uncomfortable to operate this way at first. Many businesses wait to see what’s left over after their operating expenses, and use that to deal with everything else outlined above. But when you distribute your money into accounts like this, you become more disciplined with your spending and shift into a profit-focused mindset.

It's also important to note that the percentage ranges for the Profit First accounts above don't add up to 100% if you use the maximum of each range. To increase the percentage you put into operating expenses, for example, you need to decrease the percentage going into owner's pay. You need your percentage allocations to add up to 100%.

Are there any additional Profit First accounts?

The key to Profit First is using these five Profit First accounts, but the fun of Profit First—outside the fun of seeing your profit begin to grow—is that you can tailor it to your specific business needs.

Here are some examples of additional Profit First accounts that you may want to add.

Materials/Inventory: This account is great for businesses that spend a large part of their operating expenses on inventory or materials. Think construction, where you can spend literally tens of thousands of dollars a month on raw supplies. In these cases, it may be helpful to have a separate account.

Marketing: So many agencies are using Profit First. Separate accounts that pull money for marketing spend for clients can be hugely helpful for keeping the money clients send you organized, especially if you’re trying to deal with numerous clients.

Payroll: Payroll is typically a large chunk of any business’ operating expenses. Depending on your setup or workforce, having a separate payroll account can help you stay organized.

COGS: E-commerce or other product-based businesses need to have cash set aside to manufacture or purchase get their goods that they sell. Without it, there’s no business! As e-commerce and product-based businesses scale, having an account dedicated to COGS can help you see exactly how much is going towards this area of your business.

Remember, the additional accounts aren’t mandatory. It’s meant to be what works for you! If having additional accounts and division helps you, great. If keeping it simple with the initial five accounts is best for you, that’s great too.

How do you set up Profit First accounts?

Setting up doesn’t have to be tricky. Here are the steps for setting up your Profit First accounts.

1. Work with your bank or banking platform to set up your Profit First accounts. You’ll need at least five accounts set up to use this method effectively.

Pro tip: Traditional banks may tie up your cash flow in these accounts by making you hold a minimum balance to avoid fees. Work with low-fee or no-fee banking platforms, like Relay, for the easiest way to set up multiple accounts that won’t cost you an arm and a leg.

2. Determine your Profit First percentages. This will determine what percentage of your cash that lands in the Income account goes to each of the other accounts.

3. Set an allocation schedule. This can be every payday, the first and last day of each month, or whatever works for you. This date is when you will allocate the money to each of your separate Profit First accounts.

4. Now, run your business based on the funds in your OpEx account. By using your expense account only, you know your business is running at a profit. Even if it’s just a dollar, having that money in your profit account is a huge win!

Easily implement Profit First with Relay

There are tons of reasons small business owners are using Relay to implement Profit First, but here are some of our favorites:

✅ Up to 20 checking accounts1: With no hidden fees or minimum account balances, you have the ability to set up deposit-only accounts, as well as operating expense accounts. This gives you greater clarity into cash flow.

✅ Percentage-based transfers: Make your Profit First transfers easily thanks to Relay’s percentage-based transfer feature. Plus, you can automate your percentage-based transfers when you’re ready.

✅ Streamline bookkeeping with accounting integrations: No more tax season headaches. Relay’s integrations with QuickBooks Online and Xero help you waste less time deciphering transactions, and more time growing your business.

✅ 50 physical or virtual debit cards2: Relay offers up to 50 debit cards that can be assigned spending limits, so you can get a clear picture of where your money is going.

1 Relay is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. FDIC deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. 2The Relay Visa® Debit Card is issued by Thread Bank, member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted.