Are you a therapist looking to manage your cash flow better? As a private practice owner, managing your client roster, tracking insurance payments, and covering payroll can feel overwhelming. If staying on top of your finances is a struggle, it might be time to implement the Profit First method. 💸

This revolutionary cash flow management system helps small business owners—like therapists—take control of their finances and achieve lasting success.

But what exactly is Profit First for Therapists, and how does it work? Keep reading to find out how to implement Profit First for your therapy practice.

In this article:

What is the Profit First method?

The Profit First method helps small business owners rethink how they manage cash flow. Entrepreneur Mike Michalowicz developed the Profit First method after noticing that many businesses struggle to succeed with the traditional Sales - Expenses = Profit accounting formula.

Mike shifted his money mindset and developed a new formula: Sales - Profit = Expenses. This simple yet powerful shift helped Mike gain control over his cash flow and grow his businesses. He now helps other small business owners overcome their financial struggles and become more profitable. 💰

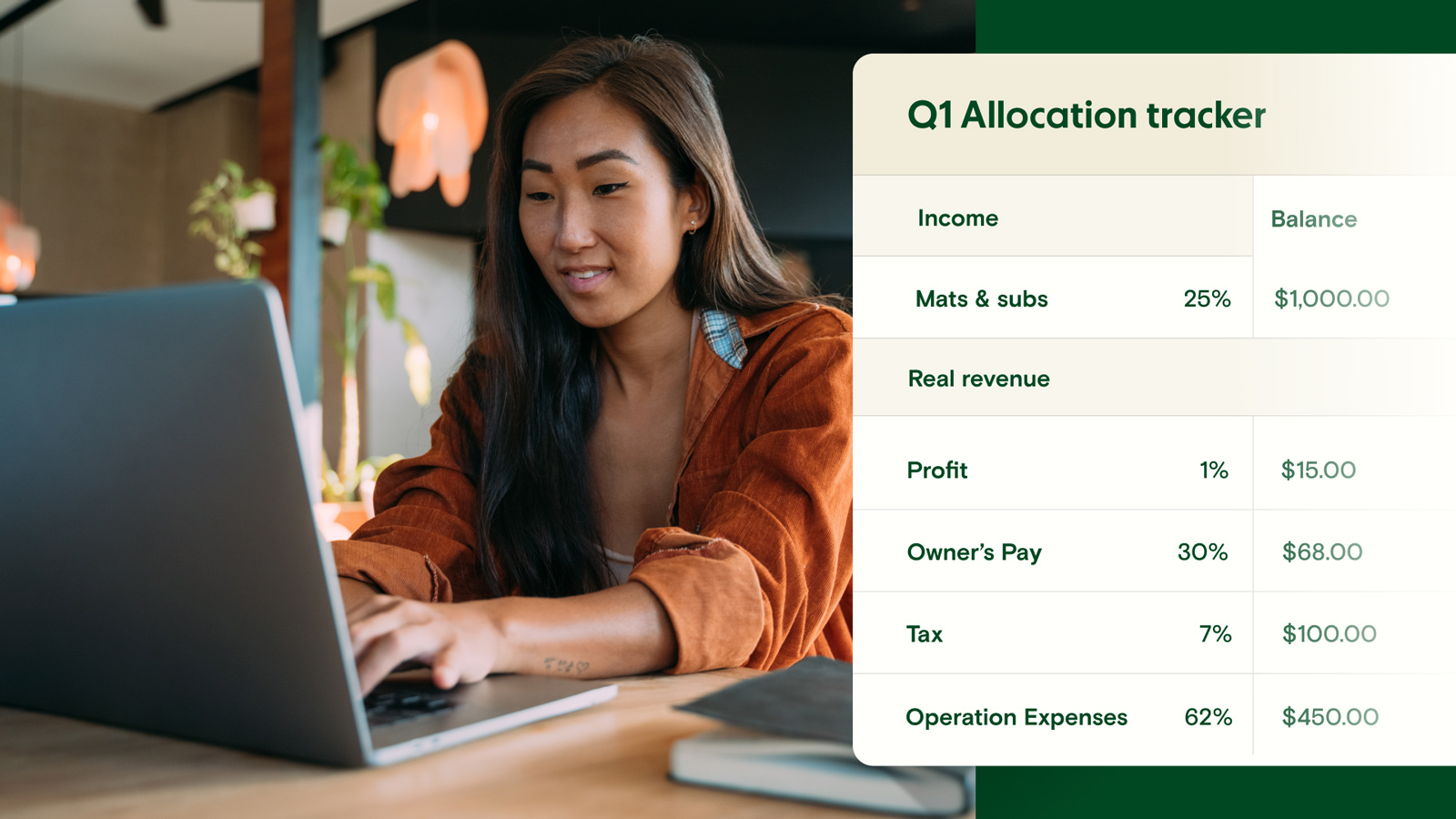

The Profit First method involves dividing your income across multiple bank accounts, including one dedicated to profit. This allows them to get a clearer view of cash flow and avoid overspending.

Here’s a quick overview of how business owners implement Profit First:

You receive all payments and business revenue to your Income account.

Then, you set aside a percentage of revenue in your Profit account before paying any expenses.

Finally, you divide the rest of your revenue across your other bank accounts, based on different expense categories. Typically, that means you’ll transfer your remaining income to individual accounts for Taxes, Operating Expenses, and Owner’s Pay.

Instead of allowing expenses to eat into your profit margin each month, Profit First helps you keep your spending in check and make profit a priority. ⭐️

If you’re wondering where to open multiple bank accounts for Profit First, Relay can help. Relay is an online banking and money management platform designed for small businesses—and we’re also the official banking platform for Profit First.

With Relay, you can open 20 no-fee business checking accounts. Then, you can make percentage-based transfers from your Income account to your other accounts—and when you’re ready, you can even automate your transfers. 🤩

Official banking platform for Profit First

Together, Profit First and Relay ensure that every dollar is allocated according to plan — be it paying down debt, reinvesting in your business, or taking a profit.

Learn MoreWho wrote Profit First for Therapists?

In the book Profit First for Therapists: A Simple Framework for Financial Freedom, Julie Herres adapts Profit First to the unique needs of private practice owners. In the book, Julie provides an easy-to-follow framework for creating a perpetually profitable private practice. ↗️

As the founder of GreenOak Accounting and host of the Therapy for Your Money podcast, Julie and her team have helped hundreds of clinicians build thriving private practices. She also provides tax, accounting, and Profit First consulting services to therapists.

You can purchase Profit First for Therapists at Amazon.com. 📖

The benefits of Profit First for Therapists

In the mental health industry, profit can seem like a dirty word. But the truth is: Your clients need your practice to be profitable! ❣️

Julie says it best, “Your business must serve you.” Remember the saying, “You can’t pour from an empty cup”? Well, the same can be said about your business. You can’t effectively serve your clients or community if you’re burned out and broke. 💔

One of the biggest benefits of Profit First for therapists is that it allows you to build a truly profitable practice. This cash management method can also help you:

👓 Gain financial clarity: Separating revenue into multiple bank accounts gives you a better idea of the money flowing in and out of your business each month.

💸 Manage your money more effectively: Setting allocations for each Profit First account gives each dollar you earn a clear purpose.

💰 Prepare for large expenses: Saving a percentage of revenue for taxes or operating expenses can help you avoid taking on credit card debt.

🌳 Sustainably grow your business: Prioritizing profit will help you achieve your short-term and long-term financial goals.

🙂 Have work/life balance: Putting profit first breaks the cycle of paying yesterday's bills with tomorrow's payments. The Profit First system allows you to build in paid time off for yourself and plan for seasonal lulls in business. With Profit First, you won't be left scrounging for cash to pay bills!

How Profit First works for therapists

Profit First for Therapists follows a framework similar to the original Profit First method. But, Julie made a few modifications to suit the needs of practice owners better.

The Profit First method creates cash flow clarity with multiple bank account budgeting. There are 5 core Profit First accounts that private practice or group practice owners need:

Income account: All of your revenue and client payments will go to this account.

Profit account: Pay your business first by saving a percentage of your revenue here.

Owner’s compensation: Use this account to pay yourself a salary.

Taxes: Set a portion of revenue aside throughout the year to make tax season less stressful.

Operating expenses: Keep funds for business expenses—like rent, utilities, and marketing software—in this account.

Keep in mind that group practice owners may want to separate payroll from operating expenses. Payroll is often a group practice’s largest expense, so having a payroll bank account can make it easier to manage clinician compensation. 🙌

When you open your Profit First bank accounts, you’ll need to determine your target allocation percentages (TAPs). Simply put, TAPs are the amount of money you hope to move to each account. 🎯

TAPs can vary from one small business owner to the next. For example, TAPs for someone’s solo practice will differ from TAPs for your group practice.

For example, you may have a 15% TAP for your Profit account. However, a group practice owner may set a 10% Profit TAP. If you’re just starting out, these goals can seem extreme.

The good news is that it’s okay to start small! You could put 1% toward Profit and increase your contribution over time. 🥳

Making your Profit First transfers

Once your bank accounts are open and you set your TAPs, it’s time to make allocations. You’ll need to establish a frequency for your Profit First transfers. Some Profit First business owners follow the 10/25 Rule. This rule just means they make transfers on the 10th and 25th of each month. 🗓️

But there’s more than one way to establish a transfer rhythm. 🥁 Based on your practice’s cash flow, you could make weekly, bi-weekly, or monthly transfers. The key is to choose transfer dates that align with your payment and payroll schedules.

Lastly, the Profit First method encourages business owners to take profit distributions. These distributions are typically made every quarter. Let’s say you, the practice owner, take 50% of the profits and reward yourself. You could reserve the remaining half for business investments and future growth opportunities.

If you aren’t sure where to start, you can schedule a consultation with GreenOak Accounting. Julie’s team offers step-by-step guidance tailored to your therapy practice.

You can also listen to Julie’s Therapy for Your Money podcast for more financial tips. 🏦

Official banking platform for Profit First

Together, Profit First and Relay ensure that every dollar is allocated according to plan — be it paying down debt, reinvesting in your business, or taking a profit.

Learn MoreAdvice from author Julie Herres

“Profit happens on purpose, with every session and every clinician in your practice.” - Julie Herres 💙

We asked Julie if she had any advice for therapists who want to implement Profit First, and she shared two insightful tips to help you get started. ⬇️✨

First, Julie told us that for therapists, changing where insurance payments are deposited can be a real pain. She suggests using your current checking account as your income account, not your operating expenses account. Then, you can open a new, separate operating expenses account for all your spending. 🏦

Julie also said that if you have a group practice, payroll is likely your largest expense. That’s why she recommends group practices have a dedicated payroll bank account. You can use your payroll account to cover employee benefits, payroll taxes, and wages for administrative staff and contracted clinicians.

What is the best bank for Profit First for Therapists? 🏆

The right online banking platform can make it easier to implement Profit First for therapists. Traditional banks don’t typically let you open multiple free business checking accounts. But Relay does business banking differently.

Our online banking platform 💻caters to the unique needs of small business owners, including private practice owners! Did we mention that Relay is the official banking platform for Profit First? 🙌

With Relay, you open 20 FREE business checking accounts. That means no overdraft fees, no minimum balance requirements, and no monthly maintenance fees.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreHere are a few more reasons why small business owners love using Relay for Profit First banking:

✅ Up to 20 free checking accounts: With no fees or minimum balances on any of your accounts, you have the ability to set up deposit-only accounts, as well as operating expense accounts. This gives you greater clarity into cash flow.

✅ Earn 1% to 3% APY on your savings: Open two savings accounts with Relay and watch your money grow. Plus, our auto-transfer rules help you consistently move excess cash out of operating accounts and into savings.

✅ Percentage-based transfers: Make your Profit First transfers easily thanks to Relay’s percentage-based transfer feature. Plus, you can automate your percentage-based transfers when you’re ready.

✅ Streamline bookkeeping with accounting integrations: No more tax season headaches. Relay’s integrations with QuickBooks Online and Xero help you waste less time deciphering transactions, and more time growing your business.

✅ 50 physical or virtual debit cards: Relay offers up to 50 debit cards that can be assigned spending limits, so you can get a clear picture of where your money is going.

Ready to take control of your cash flow? Sign up for Relay here. 😎