According to the Small Business Association, running out of capital is one of the main causes of small business failure. That’s one of the reasons Mike Michalowicz created the Profit First method. 🙌

Mike’s revolutionary accounting system helps entrepreneurs and business owners manage expenses and become permanently profitable. The Profit First method involves separating your income across five different business bank accounts, including a profit account. Then, you allocate a percentage of your income to each account—putting profit first.

If you’re ready to implement the Profit First method and want an easy way to track your allocations and account balances, look no further! 🥳 Relay is here to help with an official Profit First spreadsheet.

In this article, we’ll cover:

What is the Profit First spreadsheet for?

When you have multiple bank accounts, it’s important to stay on top of all your cash inflows and outflows. A Profit First spreadsheet can help keep your business finances organized.

The Profit First spreadsheet we're sharing today was developed by Profit First Professionals LLC. This group helps small business owners successfully implement the Profit First system.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreThe Profit First spreadsheet lists a business owner’s Profit First percentages–including target allocation percentages (TAPs) and current allocation percentages (CAPs)–for each of the five core Profit First accounts:

Income account

Profit account

Owner’s pay account

Operating expenses (OpEx) account

Tax account

Profit First businesses track CAPs and TAPs on a weekly, monthly, quarterly, and yearly basis. Having all this information in one place—in your Profit First spreadsheet—will give you an instant assessment of your business’s progress.

Download your Profit First spreadsheet

Ready to start using the Profit First spreadsheet? Just click the link below to access the spreadsheet template in Google Sheets. Then, you'll need to make a copy to start customizing the spreadsheet with your business's information.

💻 📊 Click here to get your Profit First spreadsheet!

Note: This resource is for individual business use only. To connect with a Certified Profit First Professional for assistance, or become a Profit First Professional yourself, click here.

How to use your Profit First spreadsheet

Before you use the Profit First spreadsheet, you’ll need to:

Confirm the number of Profit First accounts you need. Some industries may use more than the five core Profit First accounts.

Set your distribution dates. Many businesses use the 15th and 30th of each month but find the dates that work best for your cash flow.

Set your TAPs and CAPs. It’s okay to start small and work your way up to a larger goal. Even a 1% profit margin is a step in the right direction!

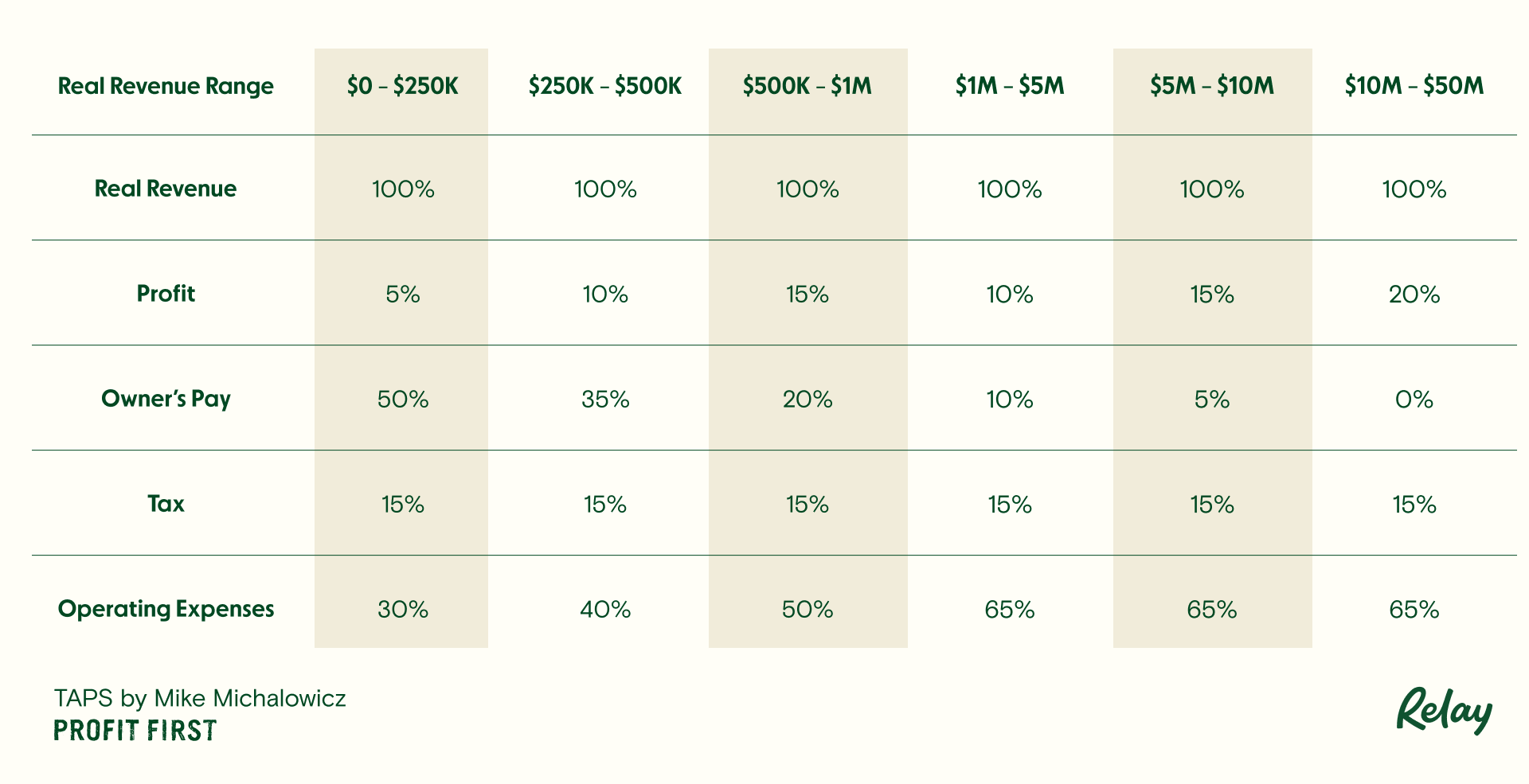

Need a refresher on your Profit First TAPs? Check out this helpful chart with the Profit First recommended allocation percentages:

Once you have the above details worked out, it’s time to fill out your Profit First spreadsheet. Follow this step-by-step guide to get started:

✅ Step 1: Open the Profit First spreadsheet and create a copy. Remember, you can download a Google Sheet as an Excel spreadsheet if you prefer (after making a copy of the linked template).

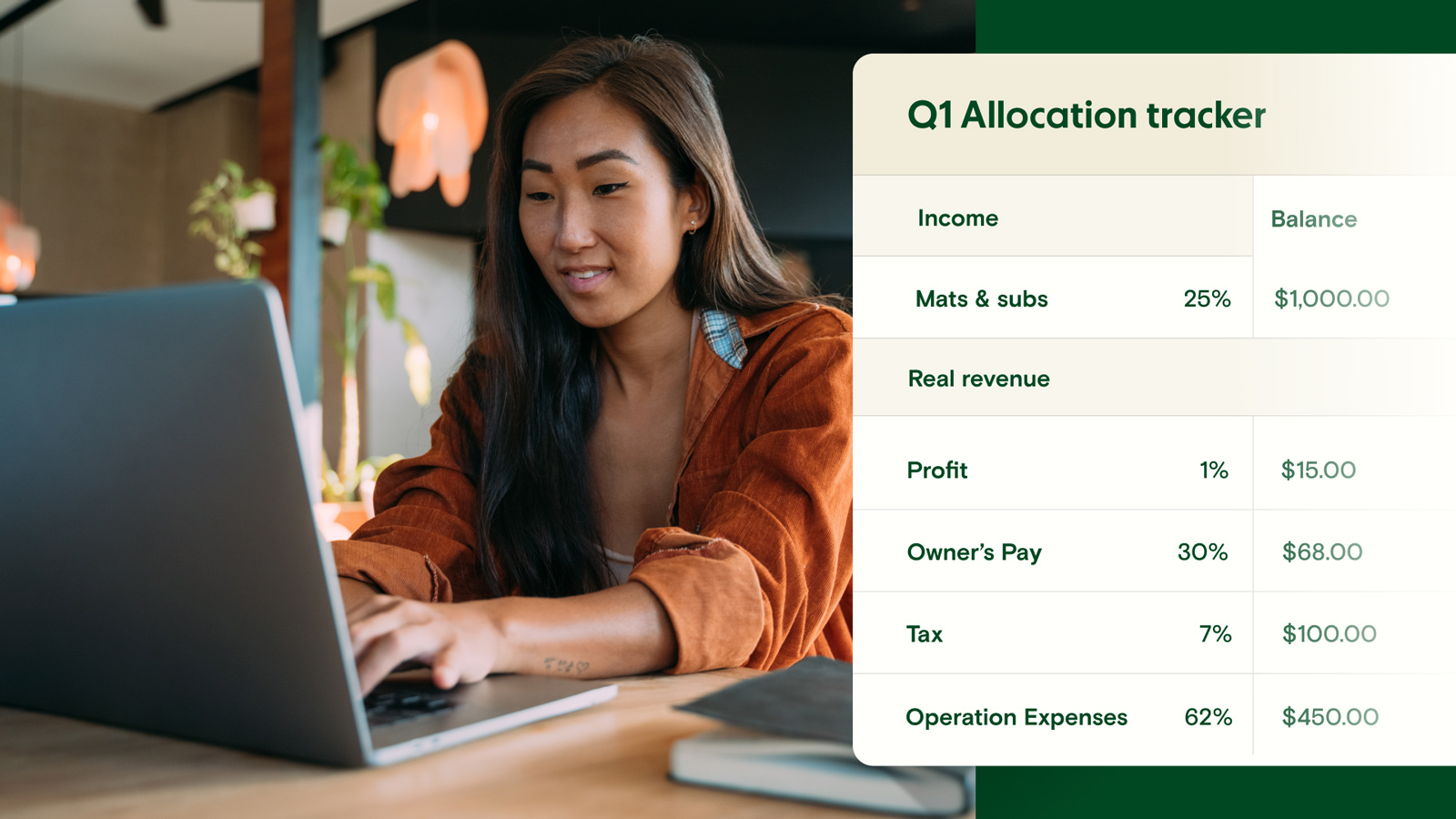

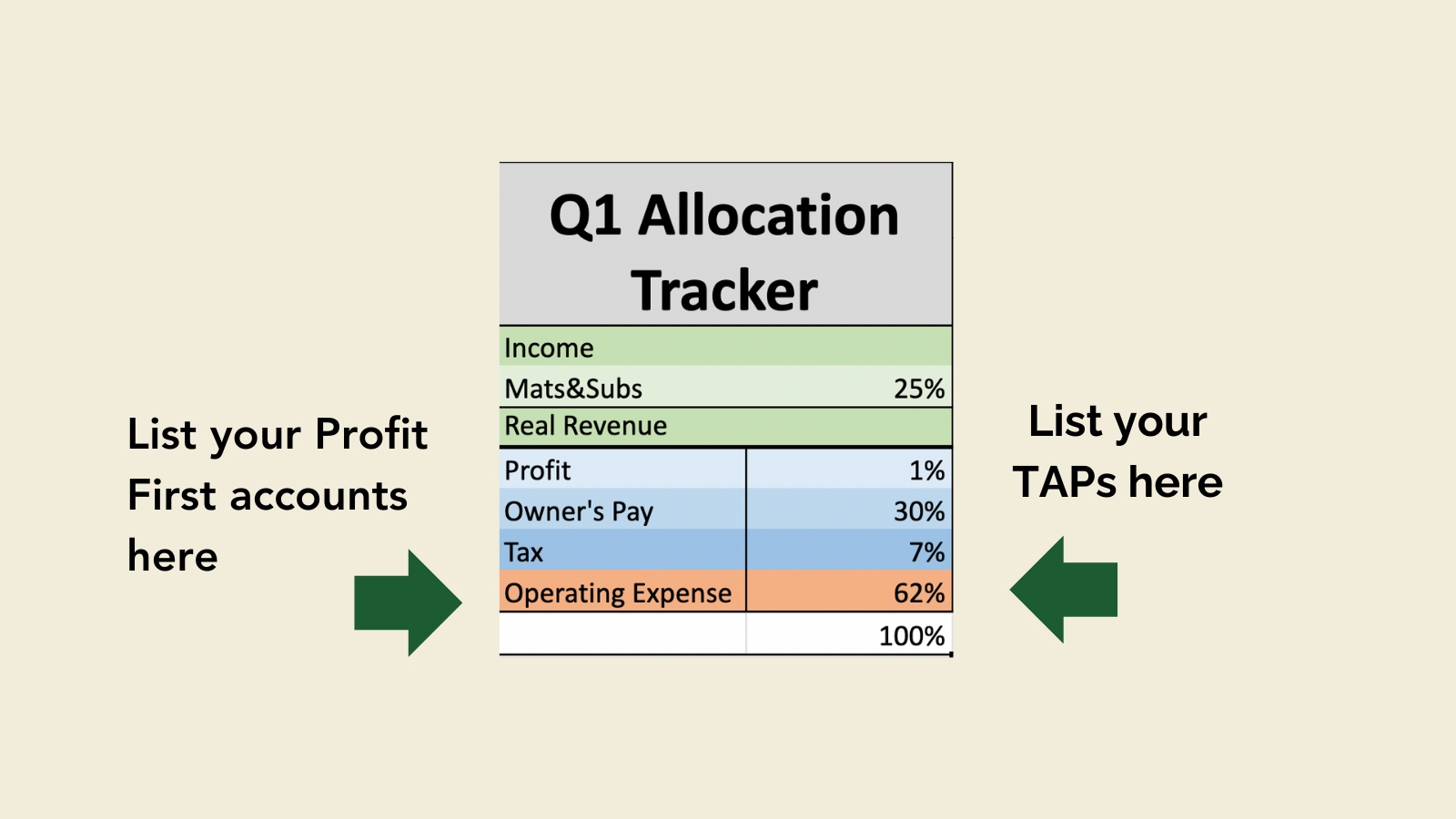

✅ Step 2: Within each quarter section, list your Profit First account names: Materials & Subcontractors, Real Revenue, Profit, Owner’s Pay, Taxes, and Operating Expenses (OpEx). Include any other accounts unique to your business, like inventory if you're practicing Profit First for e-commerce businesses.

✅ Step 3: Within each Profit First account row, write your TAP next to the corresponding account. Repeat this step for each of the four quarters of the year.

✅ Step 4: There are columns in the spreadsheet corresponding to each month of the year. Twice per month, you should use these columns to record the account balance and CAP for each of your Profit First accounts. 📆

✅ Step 5: Then, compare each account’s CAP to its TAP. Make a note of any account balances that fall short of your savings target. 🎯

✅ Step 6: Review your Profit First spreadsheet weekly, monthly, quarterly, and yearly to check your progress!

Stay on track with your Profit First spreadsheet

The Profit First method makes budgeting easy—since your funds are separated into dedicated accounts for specific types of expenses, you never have to wonder if you have enough cash to pay your bills.

This Profit First spreadsheet is a great way to take Profit First a step further, though. By recording your allocations each month, you'll be able to see your progress over time and keep profit top of mind.

And if you're having trouble with your Profit First allocations, don't forget that you can always reach out to a Profit First Professional for help. They're experts on all things Profit First— including this spreadsheet! 📊

Transform your business with Profit First

If you need help implementing Profit First, find a certified Profit First Professional today.

Find a Profit First ProfessionalImplement Profit First with Relay 💸

Did you know that Relay is the official banking platform for Profit First? With Relay, small business owners can open 20 FREE checking accounts for Income, Profit, and other spending categories. Then, you can set up percentage-based transfers for your TAPs and when you’re ready, automate your allocations.

Official banking platform for Profit First

Together, Profit First and Relay ensure that every dollar is allocated according to plan — be it paying down debt, reinvesting in your business, or taking a profit.

Learn MoreHere are a few reasons why small business owners love using Relay for Profit First banking:

✅ Up to 20 free checking accounts: With no fees or minimum balances on any of your accounts, you have the ability to set up deposit-only accounts, as well as operating expense accounts. This gives you greater clarity into cash flow.

✅ Percentage-based transfers: Make your Profit First transfers easily thanks to Relay’s percentage-based transfer feature. Plus, you can automate your percentage-based transfers.

✅ 50 physical or virtual debit cards: Relay offers up to 50 debit cards that can be assigned spending limits, so you can get a clear picture of where your money is going.

✅ Earn 1% to 3% APY1 on your savings: Open two savings accounts with Relay and watch your money grow. Plus, our auto-transfer rules help you consistently move excess cash out of operating accounts and into savings.

✅ Streamline bookkeeping with accounting integrations: No more tax season headaches. Relay’s integrations with QuickBooks Online and Xero help you waste less time deciphering transactions, and more time growing your business.

Ready to implement Profit First with Relay? Sign up completely online here. 😎