Are you a building contractor struggling with profitability? Do you find it challenging to stay on top of cash flow and understand your business's financial health? If so, the Profit First method can help.

Profit First is a revolutionary approach to cash flow management that helps contractors become immediately and permanently profitable. It involves setting aside a percentage of revenue for profit first—instead of looking for extra funds after all your expenses are paid.

In this article, we’ll outline exactly how construction business owners can use the Profit First approach to turn their companies into money-making machines. 🙌

We’ll also cover:

What is the Profit First method?

The Profit First method was developed by entrepreneur and best-selling author Mike Michalowicz. As a successful business owner, Mike saw first-hand how hard it is to build a sustainable business using traditional accounting methods.

After building and selling multi-million dollar businesses, Mike decided it was time to share an alternative approach with his fellow business owners. In 2014, he published the book, Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine. 📖

The Profit First method involves setting aside a percentage of revenue for profit in a separate bank account, before paying any expenses. Then, you split your remaining funds across multiple bank accounts for different types of expenses—like owner’s pay, taxes, and day-to-day operating expenses.

This gives business owners a clear view of cash inflows and outflows. 💵 It also simplifies budgeting. Instead of making spending decisions based on a single bank account balance, you'll be able to see how much money you have set aside for each expense, at a glance

Plus, when you set aside profit first, it’s easier to avoid unnecessary spending. When extra funds aren’t sitting in your bank account, you’re less likely to find a reason to spend them. As the common saying goes, “Out of sight, out of mind.”

Keep reading to see how the Profit First approach applies to building contractors and construction business owners. 🏗️

Who wrote Profit First for Contractors?

Shawn Van Dyke is a construction business coach and author of Profit First for Contractors. He’s a successful construction business owner who shares profit-boosting insights on podcasts and in his coaching programs.

Shawn takes the core concepts of Mike Michalowicz's Profit First approach and tailors them to the needs of construction business owners and contractors. You can find Shawn’s book, Profit First for Contractors: Transform Your Construction Business from a Cash-Eating Monster to a Money-Making Machine on Amazon.com.

The Profit First for Contractors method outlines steps contractors can take to overcome common cash flow struggles within the construction industry. Shawn helps contractors break out of what he calls “The Craftsman Cycle,” boost profits, make more money, and get their lives back. 🙌

Why Profit First works for contractors

According to Shawn, many contractors fall into “The Craftsman Cycle” which leaves them tired, uninspired, and broke. The Profit First for Contractors system helps you break free from the vicious cycle of never-ending daily tasks so you can focus on the big picture.

If you’re always working and always broke, prioritizing profit can put you back in control. Profit First works for contractors because it details easy steps any construction business owner can take to break the cycle and become profitable.

How Profit First helps with contractor cash flow challenges

Managing money is a skill most business owners learn over time—however, it can be especially tricky in the construction industry. As a contractor, operating expenses like raw materials and labor costs can add up quickly.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreIf you aren’t effectively managing your business’s money, it’s easy to fall into debt and rely on credit to finance operations. This can put your company into a tricky financial situation, especially when interest costs and other fees add up. 👎

Let’s say a client pays their invoice late. If you’re counting on that money to pay your credit card statement, you may have to pay a late fee. These death-by-a-thousand paper-cut situations can seriously affect your cash flow and eat into your profitability.

Sure, you can just pick up a few jobs to make up those extra costs. But this leaves you spinning your wheels, exhausted and broke. 😩

By contrast, Profit First helps construction businesses grow their profit margins and avoid cash flow crises. When your business is profitable, you can save for the future, expand your team, and respond faster when things do (inevitably) go wrong.

So if your clients ever do pay late, you won’t have to rely on debt or work longer hours—you’ll have the extra cash you need to keep the business running until your invoices are paid. 💸

The 5 must-have Profit First accounts for contractors

As we discussed above, the Profit First for Contractors approach recommends that you have separate bank accounts for different types of expenses. You’ll also need one account to receive payments from clients and customers.

Here are the five Profit First accounts recommended for contractors:

Income: For all sources of revenue, like customer payments.

Profit: You’ll allocate a percentage of funds to this account every month. Shawn recommends you start small and dedicate 1% of revenue to profit. You can gradually increase contributions by 1% each quarter until you reach your target.

Owner’s Compensation: Use this account to pay yourself.

Taxes: Put money in this account for tax payments. It’s a good idea to work with a tax adviser or CPA to find your tax savings target.

Operating costs: The funds in this account keep your business running. You may put money here to pay for raw materials, a new truck, labor costs, and other expenses.

Dividing your cash between these five accounts will give you a clear picture of your business’s financial health. For example, if you don’t have enough funds to pay your operating costs and your taxes, you’ll be able to see the deficit right away—instead of struggling to find the cash at the end of the month or year.

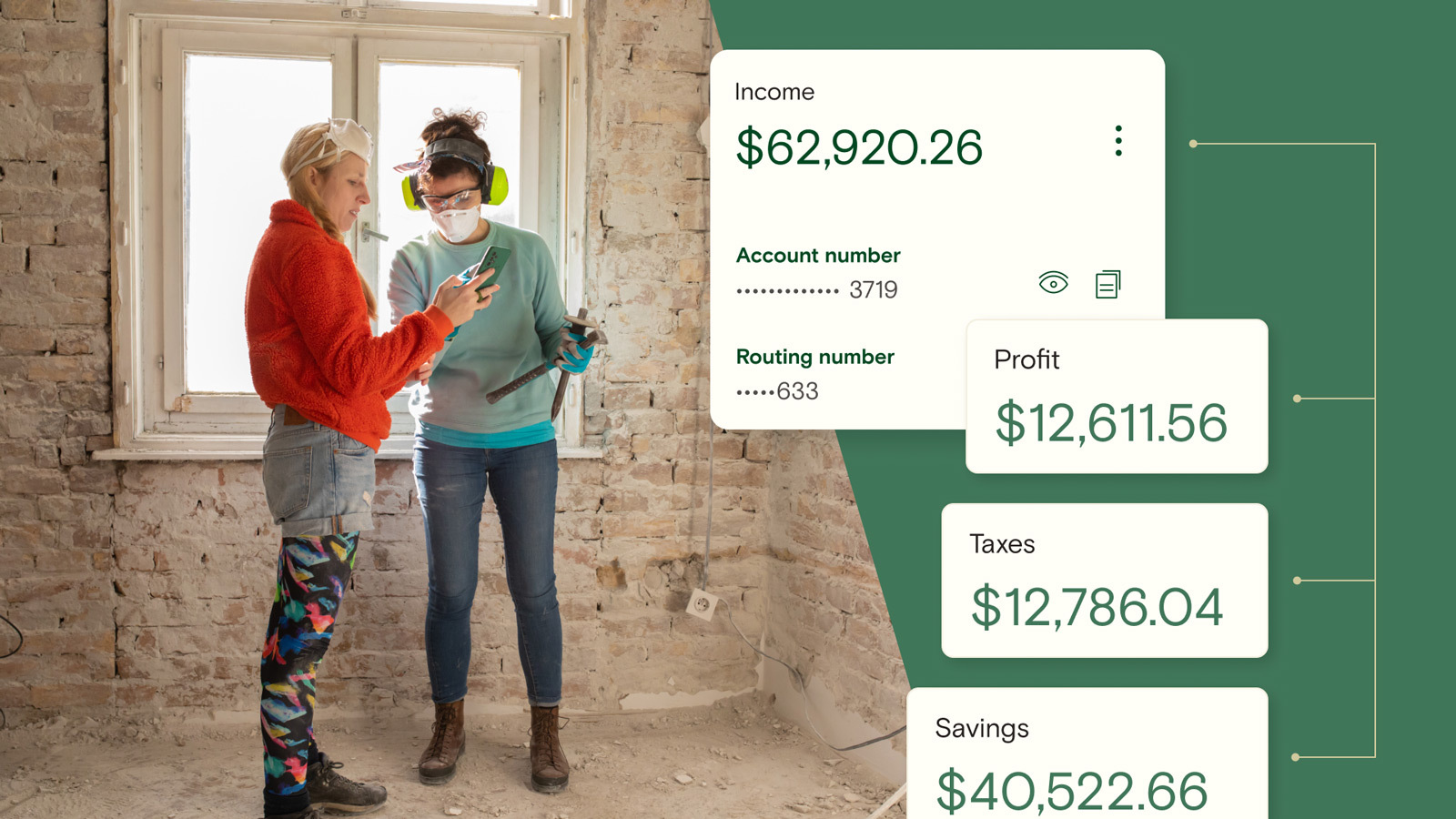

You might be wondering how to open multiple business checking accounts, especially if your current bank only allows you to have one. Relay (that’s us! 👋) is an online banking and money management platform that lets business owners open 20 no-fee checking accounts—and we’re the official banking platform for Profit First.

With Relay, you can open your Profit First bank accounts completely online, with no fees and no minimum balance required. 😎 Learn more about Relay + Profit First here.

Official banking platform for Profit First

Together, Profit First and Relay ensure that every dollar is allocated according to plan — be it paying down debt, reinvesting in your business, or taking a profit.

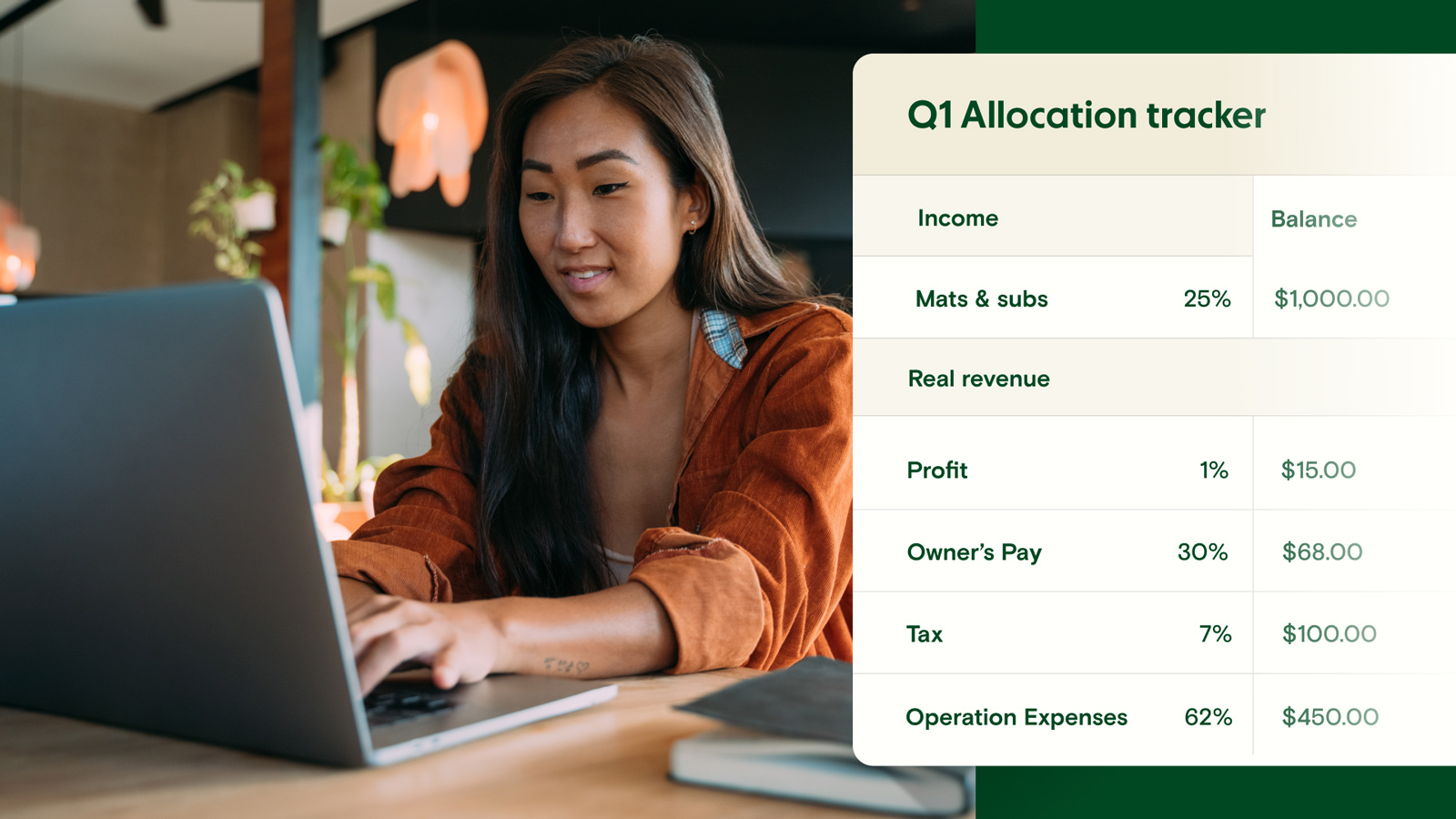

Learn MoreProfit First percentages for contractors

To implement Profit First, you’ll need to allocate a percentage of revenue for each of your accounts. For example, if you receive a $1,000 payment to your income account, you could allocate 1% ($10) to the profit account, 50% to the owner’s pay account ($500), and so on, until you allocate 100% of your income.

Choosing the right allocation percentages is key to successfully implementing the Profit First approach. But how do you know what your percentages should be?

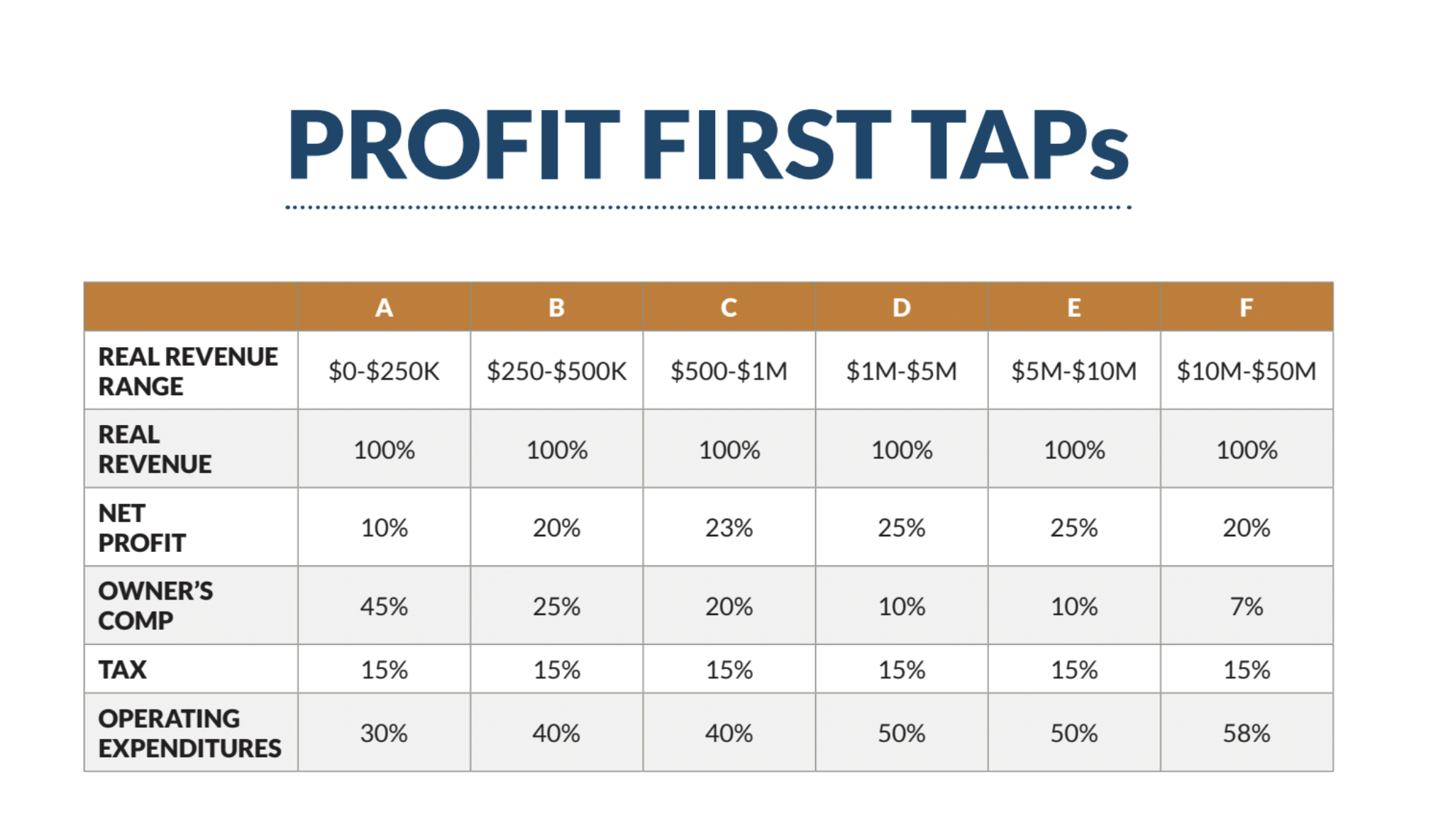

Profit First recommends the following target allocation percentages (TAPS) for most business owners:

Source: Profit First for Contractors

However, the exact percentages may vary from one contractor to the next. That’s because a general contractor may only need a 10% pre-tax profit target. But a plumbing contractor or HVAC specialist may need to aim for a 20% profit margin. ✅

If your construction business profits fall below those targets, it’s time to ask yourself why. For contractors, it’s always a good idea to start by reviewing your cost of goods and services (COGS).

Shawn says that COGS should be somewhere between 65% to 70% of your total revenue. If your COGS are above 70%, it could mean you’re pricing your services too low. ✅

Next, look at your expenses. Ideally, you should allocate 15% to 25% of revenue to operating expenses. If your expenses are higher than this range, you may need to increase prices or cut costs to make up the difference. ✅

If you’re struggling to figure out the right Profit First percentages for your business, consider working with a certified Profit First Professional. These accountants, bookkeepers, and financial experts have a deep understanding of the Profit First method and can help you get started.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more3 steps to implement Profit First for contractors

If you feel like you’re constantly walking the “cash flow tightrope” and ready to make a change, the Profit First for Contractors method can help get on the right track.

To get started, you might want to check out Shawn’s free Profit First for Contractors webinar—just visit the Build Academy website to reserve your spot. You could also invest in one of his coaching programs for a deep dive into Profit First for Contractors.

When you’re ready to put Profit First into action, follow these three simple steps:

Step 1: Open your 5 Profit First bank accounts. As outlined above, these accounts will be for Income, Profit, Owner’s Compensation, Taxes, and Operating Expenses. It just takes 10 minutes to get started with Relay—sign up here. 💻

Step 2: Determine your Profit First percentages. Gather your profit and loss statements, tax returns, and balance sheets from the previous year. Review this information and determine percentages for net profit (after-tax), taxes, owner’s compensation, and operating expenses. 💰

Step 3: Make your Profit First transfers twice per month. With Relay, you can easily make percentage-based transfers from your income account to your other Profit First accounts. When you’re ready, you can even automate your transfers! ⚡️

What is the best bank for Profit First for contractors? 👷

If you’re ready to start using the Profit First method in your business, you’ll need the right banking partner. So how do you choose the best bank for Profit First?

Well, it’s crucial to find a business banking solution that will allow you to conveniently open multiple checking accounts. If you can do it for free, that’s even better. 🙌

That’s why so many contractors love using Relay for Profit First banking: we make it easy to open multiple, no-fee checking accounts completely online.

Plus, Relay is the official banking platform for Profit First—and we offer small business owners a wide range of helpful features like:

✅ 20 free checking accounts: Relay doesn’t charge overdraft fees, maintenance fees, or require a minimum account balance.

✅ Earn 1% to 3% APY on your savings*: Open two savings accounts with Relay and watch your money grow. Plus, our auto-transfer rules help you consistently move excess cash out of operating accounts and into savings.

✅ Percentage-based transfers: Save time with our pre-built Profit First template, designed to help you implement your Profit First allocations in seconds. Plus, when you’re ready, you can automate your transfers.

✅ 50 physical or virtual debit cards: Relay’s debit cards give you total visibility into spending with ultra-rich transaction data. You can use your cards to organize spending by category, team member, and beyond.

✅ Streamline bookkeeping with accounting integrations: No more tax season headaches. Relay’s integrations with QuickBooks Online and Xero help you waste less time deciphering transactions, and more time growing your business.

If you’re ready to give Profit First a try, sign up for a free Relay account today!