Have you ever wondered why your business's revenue is growing...but your profits aren't? You're not alone—but there's a better way to approach cash flow management. When you implement the right Profit First percentages for your business, you can put the focus back on profit and start thriving. 🌳

Profit First is a cash management methodology designed to help small business owners prioritize profit. To implement Profit First, you set aside a percentage of your business's revenue for profit before paying any expenses. Then you divide your remaining cash into individual accounts for different types of business expenses, like owner's pay and taxes.

To successfully implement Profit First, you'll need to identify how much cash should go into each of these accounts. 💸 In other words, you'll have to choose a target allocation percentage (TAP) for your Profit First accounts—and that percentage can vary depending on what kind of business you own.

In this article, we're breaking down Profit First percentages for 13 different types of small businesses. Whether you're a contractor, a therapist, or an e-commerce seller, this ultimate guide to Profit First percentages is for you. (And yes, it's in alphabetical order!) 🙌

In this article:

What are Profit First percentages?

Profit First percentages are also known as target allocation percentages (TAPs). Your TAPs define what percentage of revenue you'll transfer to each of your Profit First accounts (Profit, Owner's Pay, Taxes, and Operating Expenses).

For example, let's say a client pays you $1,000. You've decided to allocate 5% of your revenue to profit (5% being your TAP), so you transfer $50 to your Profit account. If another client pays you $10,000, you would still allocate 5% of your revenue to profit ($500). 💰

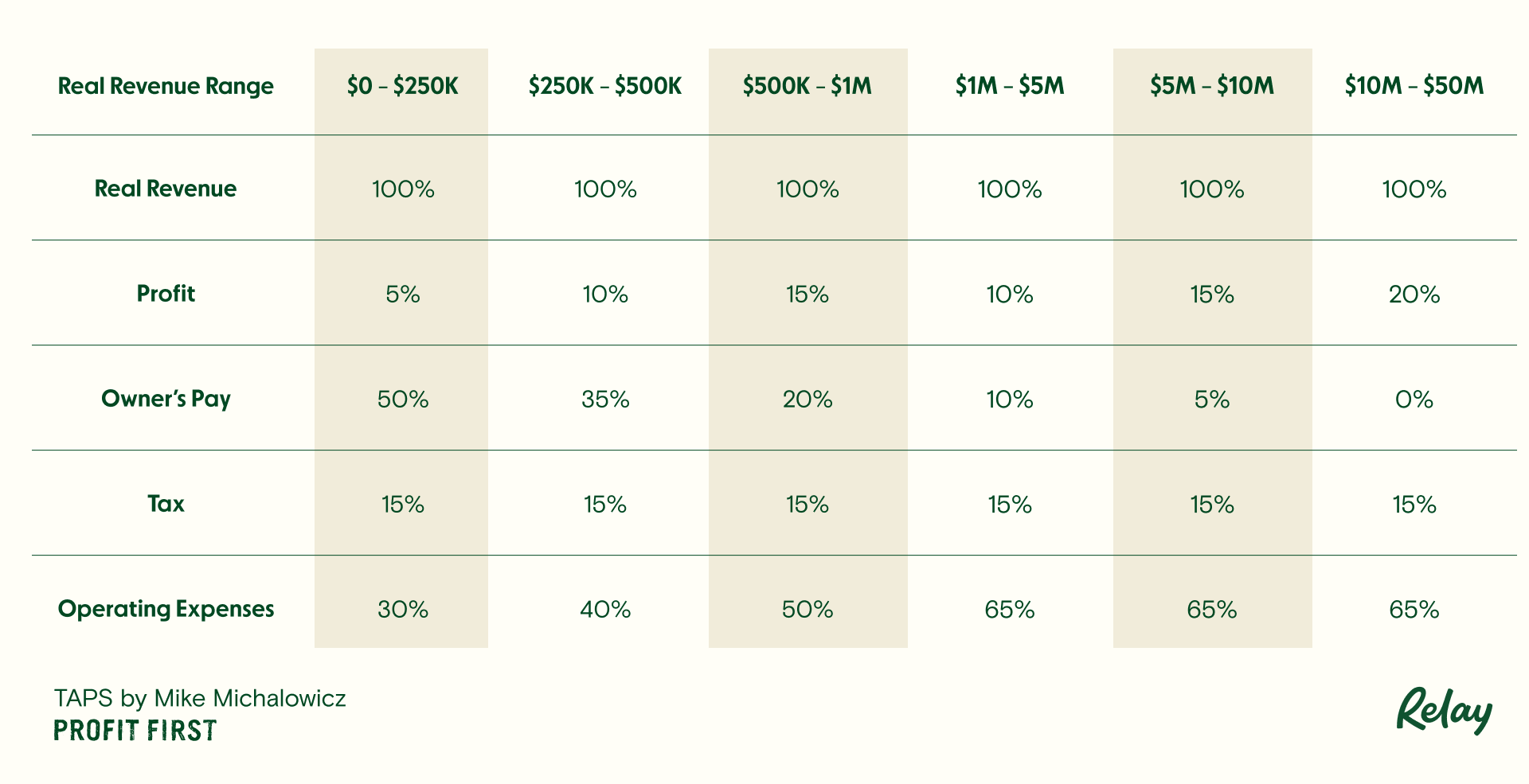

You'll need to choose a TAP for each of your Profit First accounts. These percentages will depend on your company's unique needs and business model, but Mike Michalowicz (the creator of Profit First) recommends the below TAPs as a starting point:

It's important to note that TAPs are based on real revenue, which is the total amount of money your business generates annually minus the cost of materials and subcontractors. Be sure to take this into account when reviewing the real revenue range in the chart above. ⬆️

If you're feeling overwhelmed by these Profit First percentages, don't worry. It might take some time to figure out the right TAPs for your business, but you can always start by allocating 1% of your income to profit.

How to implement Profit First percentages

The first step of implementing a Profit First approach is seeing where your business finances currently stand. You can use Profit First’s instant assessment to understand your company’s current revenue numbers. 💵

Then, you can use the same assessment to calculate your current allocation percentages (CAPs). AKA, the money you’re currently setting aside for each category (Operating Expenses, Taxes, Owner’s Pay, and Profit).

If your CAPs are pretty far off from the TAPs that Profit First recommends, you’ll want to set small goals to increase your allocations over time—or reduce them, if you’ve been overspending in one area. This will help you work your way up to the TAPs. 📈

If you still need to open your 5 Profit First accounts and implement your Profit First percentages, Relay can help. Relay is an online banking and money management platform—and we’re the official banking platform for Profit First. 🤩

With Relay, small business owners can open 20 no-fee business checking accounts. Then, you can set up percentage-based transfers for each of your TAPs. When you’re ready, you can even automate your Profit First transfers!

Official banking platform for Profit First

Together, Profit First and Relay ensure that every dollar is allocated according to plan — be it paying down debt, reinvesting in your business, or taking a profit.

Learn MoreProfit First percentages for different types of businesses

The TAPs recommended above are a fantastic starting point for anyone new to Profit First. However, every entrepreneur and every business is different. Your TAPs might need to be adjusted depending on your unique goals, financial situation, and business model.

The good news is that you're not alone: Profit First's certified Profit First Professionals can help. These accountants, bookkeepers, and financial experts are trained to help business owners improve their cash flow management with the Profit First method. 💸

Some of these certified professionals have even written books to help different types of small business owners implement Profit First. In this section, we'll be providing insights straight from these Profit First professionals and their books.

Ready to discover the right Profit First percentages for your business? Let's dive in!

Chiropractors 🧑⚕️

Profit First for Chiropractors was written by Debra Cassera and Sabrina Pelech, with a foreword by Mike Michalowicz. The founders of Profit First Chiro, Debra and Sabrina, help chiropractors optimize cash flow and become permanently profitable.

As a chiropractor, the desire to help people may seem at odds with profitability. But Debra and Sabrina have helped numerous chiropractors reframe their thinking and create thriving businesses.

With the Profit First approach, you can learn to balance your work as a healer with your duties as a practice owner. In fact, it’s your responsibility to be financially successful. That’s because profitability helps you better serve your community. 🙏

Setting up the five essential Profit First accounts is the first step toward creating a profitable chiropractic practice. Here are the TAPs allocations chiropractors should aim to reach with their revenue:

Owner’s pay: 50%

Taxes: 15%

OpEx (rent, staff, etc): 30%

Profit: 5%

It’s okay if you can’t reach these allocation targets at first. Use your current allocation percentages (CAPs) and work your way up to your TAPs. You can gradually increase your CAPs for Profit, Owner’s Compensation, and Tax accounts. Then, you can gradually decrease your OpEx allocations.

Contractors 🦺

Profit First for Contractors was written by Shawn Van Dyke, with a foreword by Mike Michalowicz. Shawn strives to get contractors out of what he calls “The Craftsmen Cycle,” where profit is an afterthought.

Shawn takes the core principles of Profit First and tailors them to the unique needs of contractors. The Profit First for Contractors approach can help your business become permanently profitable.

Contractors need work trucks, equipment, and overhead to complete jobs. That’s why Shawn recommends having a business account dedicated to the cost of goods and services, also called a COGS account.

Your TAP for the COGS account should be somewhere between 65% to 70% of your total revenue. If your COGS allocation exceeds that 70% target, you may need to increase your prices.

Also, look at your operating expenses (OpEx). Aim to allocate 15% to 25% of your revenue for your OpEx account. If your OpEx allocations exceed 25%, look for ways to cut your spending.

Keep in mind that your Profit TAP may vary by your specialty. For example, a general contractor may only need a 10% pre-tax profit margin. But an HVAC specialist or plumber may need a higher Profit TAP, like a 20% pre-tax profit margin.

If these numbers seem big, don’t worry! You can start small with a 1% Profit TAP and work your way up from there.

💡 Want to learn more? Check out Relay’s deep dive on Profit First for Contractors here!

Dentists 🪥

Profit First for Dentists is a book written by Barbara Stackhouse and Drew Hinrichs, with a foreword by Profit First founder, Mike Michalowicz.

Owning a dental practice can come with some high overhead costs. To make ends meet, some dentists fall into the trap of thinking they have to spend more time in the chair to make more money. This can lead to a lack of work-life balance and more than a few cash flow problems.

But here’s the good news: If you’re working more hours but not seeing more profit come into your practice, Profit First for Dentists can help. 🙌

According to the authors of Profit First for Dentists, if you want to make your dental practice thrive, you have to take a hard look at your operating expenses. Then, Barbara suggests starting small with your Profit TAP. If you’re barely breaking even, your profit CAP is probably 0%. If you want to work up to 10%, it’s going to take some time.

Breaking your TAPs into quarterly targets can help you scale. Let’s say you set a Profit TAP of 2% for the first quarter. If you increase the TAP by 2% each quarter, you’ll reach your Profit goal in about 14 months.

Here’s an example of what your dentist practice’s TAPs may look like:

Profit: 10%

Owner’s Compensation: 13%

Taxes: 10%

OpEx (including staff, rent, etc): 67%

For dental practice owners, decreasing operating expenses—NOT working more hours—is key to increasing profit margins.

E-commerce businesses 🛍

Cyndi Thomason is a certified Profit First Professional and founder of a company that provides bookkeeping services to e-commerce businesses. She also wrote the book Profit First for E-commerce Sellers, which breaks down exactly how to implement Profit First—and all the benefits for e-commerce businesses.

Cyndi recommends that e-commerce business owners open the five Profit First accounts, plus one dedicated to Inventory. Keep in mind that e-commerce Profit First percentages are determined by real revenue, which is the amount of revenue left over after inventory costs. 💰

That’s why it’s important to remember that your TAPs will change based on your revenue. Let’s say your e-commerce business does $250,000 in real revenue this year. You may aim for a 5% Profit TAP. But if you double your real revenue next year, you may aim for a 10% Profit TAP.

If these targets seem overwhelming, remember to start small. You can set aside 1% for Profit and slowly scale to your TAP. This approach allows you to stay on top of spending, cut unnecessary costs, and ultimately, create sustainable business growth. 🙌

💡 Keep reading: Check out Relay’s deep dive on Profit First for E-commerce Sellers here!

Lawncare businesses 🌷

Profit First for Lawn Care and Landscape Businesses was written by Christeen Era. Lawncare and landscape services have the potential to be one of the most profitable businesses out there. Christeen says it’s possible to have profit margins that range from 50% to 65%. Plus, net profit margins of 30% to 35% are totally attainable.

But most small businesses in the lawn care and landscape industry aren’t hitting these numbers. If your profit margin is less than 15%, it might be time to make a change and implement Profit First. 📝

To get started, Christeen says that you’ll need to find your break-even point. Add up your fixed and variable costs for a given month, then multiply that number by 12. If it costs $15,000 to run your business each month, you’ll need to make $180,000 per year to break even. But you don’t want to just break even—you want to be profitable!

Your allocation percentages will be based on your break-even point, which is the amount of money it takes to sustain your business.

Besides your main income account, there are five core Profit First accounts recommended for landscape and lawn care businesses. Here are the accounts and an example of the TAPs that could go with them:

Profit: 15%

Owner’s Compensation: 20%

Taxes: 15%

OpEx: 50%

Materials & Subcontractors: 15% of total revenue

If you’re thinking, “These numbers don’t add up to 100”, you’re right! Here’s why: Your Profit, Owner’s Compensation, Taxes, and OpEx TAPs will be based on your real revenue number—which is your income minus the costs of materials and subcontractors. 💸

If your accounts don’t match these target allocations at first, that’s okay! Once you have your TAPs and Profit First accounts set up, identify which accounts have a negative CAP.

Prioritize the negative accounts and bring them up to at least 1%. Then, adjust your other accounts to account for this 1% reallocation. Over time, these small adjustments will help you reach your larger allocation targets. 🎯

Lawyers 🏛

Profit First for Lawyers was written by Rjon Robins. This book builds on the core principles of the Profit First approach and tailors this cash flow management system to law firms.

Some law firms have profit margins as large as 35% to 45%. However, many lawyers face cash flow problems due to delayed client payments and variable operating expenses. With Profit First, they can build a financial safety net and learn to keep spending under control.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreYour law firm’s Profit First percentages will depend on your real revenue range. Then, you’ll need to find your CAPs and decide if your budget needs to change. Remember, if your operating expenses are too high or you don’t have enough money for profit, you may need to raise your prices and cut back on spending.

Minority-owned businesses 💼

Profit First for Minority Businesses, by Susanne Mariga, takes the core principles of the Profit First Approach and tailors the system to the unique needs of minority-owned businesses.

Susanne explains how the Profit First approach is a practical system for helping your business thrive. Six different bank accounts provide the framework for this cash management system:

Income

Profit

Owner’s Compensation

Taxes

OpEx

Materials and Subcontractors

Once you see where your money is going, you can define your TAPs. Allocate funds for materials and subcontractors based on your total revenue. Then, subtract material and subcontractor costs from your total revenue, which is your real revenue. All other TAPs should be based on your real revenue.

Let’s say you have a Profit target of 30%. If your current allocation for Profit is 10%, that’s okay! Susanne suggests starting small with weekly, incremental changes. Can you up your Profit allocation by 1% each month? If so, you’re headed in the right direction! 🗺️

Susanne’s approach will give you cash flow clarity and help put you in control of your company’s finances. As a result, you’ll be able to make spending decisions with ease and create sustainable business growth. 💸

Microgyms 🏋️♀️

Profit First for Microgyms was written by Jason Briggs. Building on the principles of the Profit First system, Jason gives small gym owners practical tools to improve their financial fitness.

Want to make profit gains for your micro gym? Start by creating these Profit First accounts:

Income

OpEx

Taxes

Profit

Equipment

Team Members

Owner’s Pay

Once you establish these accounts and determine your TAPs (based on your unique business goals), it’s time to get into a financial rhythm. You can use the 10/25 Rule to set up bi-weekly allocations.

Making your Profit transfers on the 10th and 25th of each month will give you more visibly into your cash flow. If the 10th and 25th don’t work for your cash flow, just make sure to find two other dates that fit your finances.

Real estate agents 🏡

Profit First for Real Estate Agents is a book written by Damon Yudichak. Building off the core Profit First principles, Damon helps real estate agents navigate the financial ups and downs of this ever-changing market. According to Damon, the key to financial clarity is separating revenue into different accounts.

In real estate, you often need to spend money to make money. By putting profit first, you limit unnecessary spending and put the focus squarely on profitability. That said, your TAPs will be based on real revenue, not total revenue.

This approach helps you see what you’re actually bringing into your business and what you’re actually spending. 💵

If you’re a solo agent, your real revenue is the amount you bring in after your brokerage split. But if you run a real estate team, your real revenue is the amount left after you subtract your brokerage split and your team members’ commissions from your gross commission income.

Real estate investors 🏢

Profit First for Real Estate Investing, by David Richter, breaks down the many moving parts of real estate investing and provides a road map for cash flow clarity. Juggling property taxes, income tax, home maintenance, renovations, and rent collection can feel overwhelming. But the Profit First method can give real estate investors a way to simplify their finances.

Profit First recommends setting up six separate accounts for real estate investing:

Income

Profit

Owner’s Compensation

Owner’s Tax

OpEx

Other People’s Money

Setting up separate accounts for each property can also help you stay in control of your cash flow. After you’ve set up all your accounts, you’ll need to calculate your TAPs and real revenue. 💸

To find your real revenue, there are 2 main formulas to consider depending on what kind of real estate investor you are:

For real estate investors that flip and sell properties: Real revenue = sale price - pass-through revenue (purchase price + rehab costs+ closing/holding costs)

For those who rent out properties: Real revenue = rental income + owner’s financing income - pass-through revenue

💡Ready to learn more? Check out Relay’s deep dive on Profit First for Real Estate Investing here!

Restaurants 👩🍳

Profit First for Restaurants is a book written by Kasey Anton. The book is designed to help restaurant owners optimize profits and grow their businesses. Kasey understands that restaurant owners face unique challenges, such as unpredictable sales spikes and slumps, supply chain shortages, and food price increases.

The Profit First approach gives you a cash flow management system from which you can make informed financial decisions. When you prioritize profit, you reframe how you think about expenses.

Restaurants typically have tight profit margins—around 2% to 6%. But implementing a Profit First approach can help restaurants scale their profitability to 7% and even 20%. Smart menu planning, inventory control, and strategic staffing decisions can help your business thrive! 📈

Start by figuring out your current revenue. This number is the amount of money left over after food costs. Your Profit TAP should be somewhere between 20% to 55%.

If you’re not there yet, that’s okay! Start small by reallocating funds from other allocation accounts. If you’re operating expenses are high, consider cutting back on staff for slow nights. You could also adjust your menu to accommodate higher food costs. These small changes can deliver a positive profit impact over time. 🙌

Salons 💇♀️

Profit First for Salons, by Ronit Enos, is a book designed to help beauty salon owners work smarter, not harder. This simple, effective money management system is scalable for beauty salons, spas, and barber shops of all sizes.

By prioritizing profit, you minimize excessive spending and ensure every dollar spent is working for your bottom line. In the book, Ronit provides a step-by-step approach to supercharging your profitability. 💰

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreYou can start by creating five individual bank accounts for your CAPs. Your TAPs will shift based on your total revenue. But here’s a basic breakdown. Let’s say you bring in $250,000 in real revenue. You may want to aim for breaking your revenue into the following buckets:

Profit: 5%

Owner’s Compensation: 50%

Taxes: 15%

Operating Expenses: 30%

If you aren’t there yet, don’t worry! Ronit says allocating just 1% of revenue for Profit is a step in the right direction.

Therapists 📝

Profit First for Therapists, by Julie Herres, is a book written for therapists’ unique financial situations. Julie wants therapists to know that profit isn’t a dirty word. Prioritizing profit isn’t selfish. In fact, it’s necessary for your practice’s survival. 💵

Here’s how Julie breaks down Profit First accounts for therapists:

Income

OpEx

Payroll (only if you have employees or contractors)

Owner’s Pay

Taxes

Profit

Your TAPs may vary by the type of practice you have, including:

Solo Practice

Small Practice

Large Group Practice

Once you’ve figured out your TAPs—based on your real revenue and type of practice—Julie also suggests setting a regular tempo for making your Profit First transfers. Based on your cash flow, you could make transfers weekly, bi-weekly, or monthly. 📅

💡 Want to keep reading? Check out Relay’s deep dive on Profit First for therapists here!

Implement your Profit First percentages with Relay 🙌

Profit First helps business owners stay on top of spending, get greater visibility into cash flow, and ultimately, grow their profits. 💸 By understanding how much money should go into each of your Profit First accounts, you can optimize your business's cash flow and avoid overspending.

But now that you know which TAPs to use for your business, what’s the best bank for implementing Profit First?

Well, the best banking platform should make it easy to implement Profit First with multiple no-fee bank accounts—and that’s exactly what we do here at Relay. In fact, Relay is the official banking platform for Profit First. 🏦

With Relay, small business owners can open 20 FREE checking accounts for Income, Profit, and other spending categories. Then, you can set up percentage-based transfers for your TAPs and when you’re ready, automate your allocations.

Here are a few more reasons why small business owners love using Relay for Profit First banking:

✅ Up to 20 free checking accounts: With no fees or minimum balances on any of your accounts, you have the ability to set up deposit-only accounts, as well as operating expense accounts. This gives you greater clarity into cash flow.

✅ Earn 1% to 3% APY1 on your savings: Open two savings accounts with Relay and watch your money grow. Plus, our auto-transfer rules help you consistently move excess cash out of operating accounts and into savings.

✅ Percentage-based transfers: Make your Profit First transfers easily thanks to Relay’s percentage-based transfer feature. Plus, you can automate your percentage-based transfers when you’re ready.

✅ Streamline bookkeeping with accounting integrations: No more tax season headaches. Relay’s integrations with QuickBooks Online and Xero help you waste less time deciphering transactions, and more time growing your business.

✅ 50 physical or virtual debit cards: Relay offers up to 50 debit cards that can be assigned spending limits, so you can get a clear picture of where your money is going.

Ready to implement your Profit First percentages with Relay? Sign up here. 😎